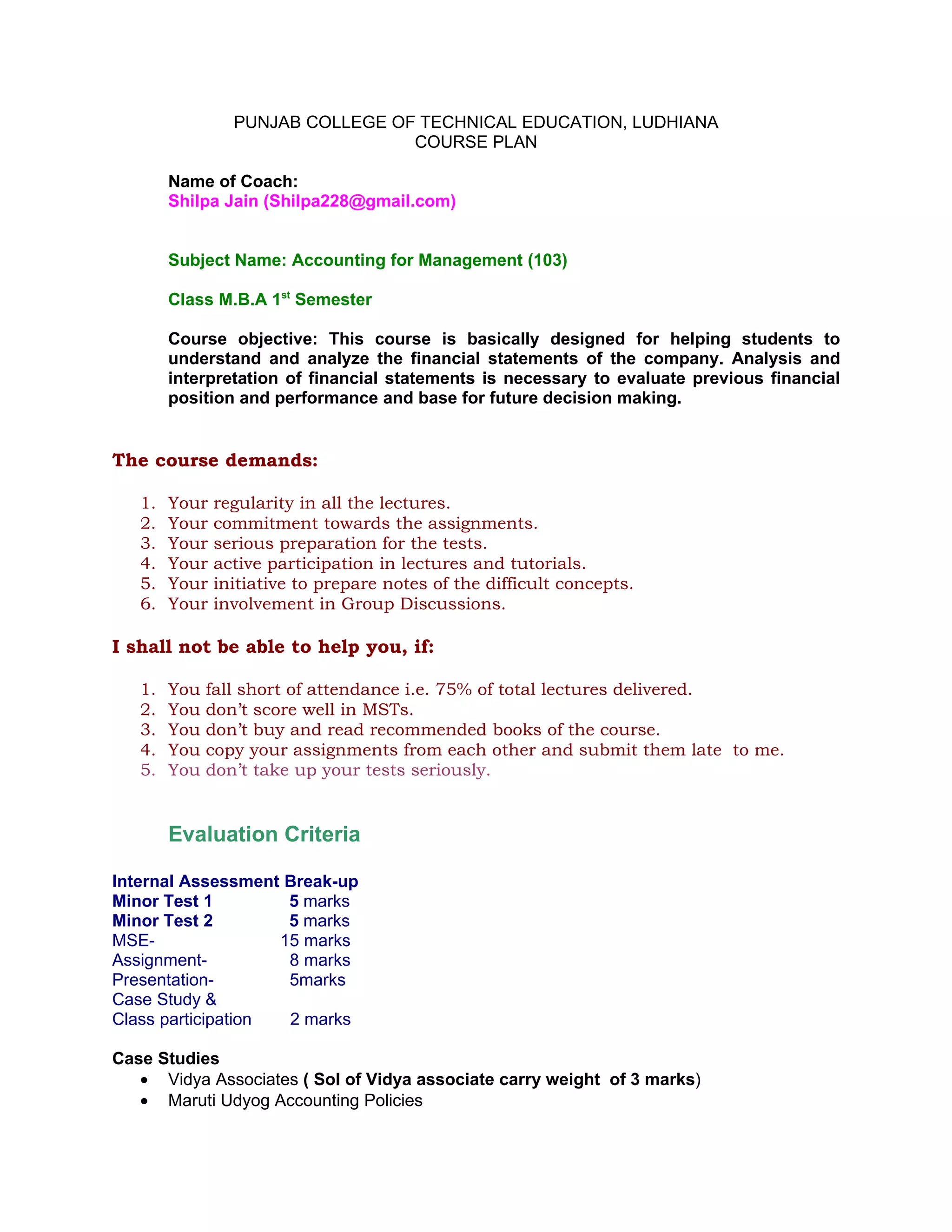

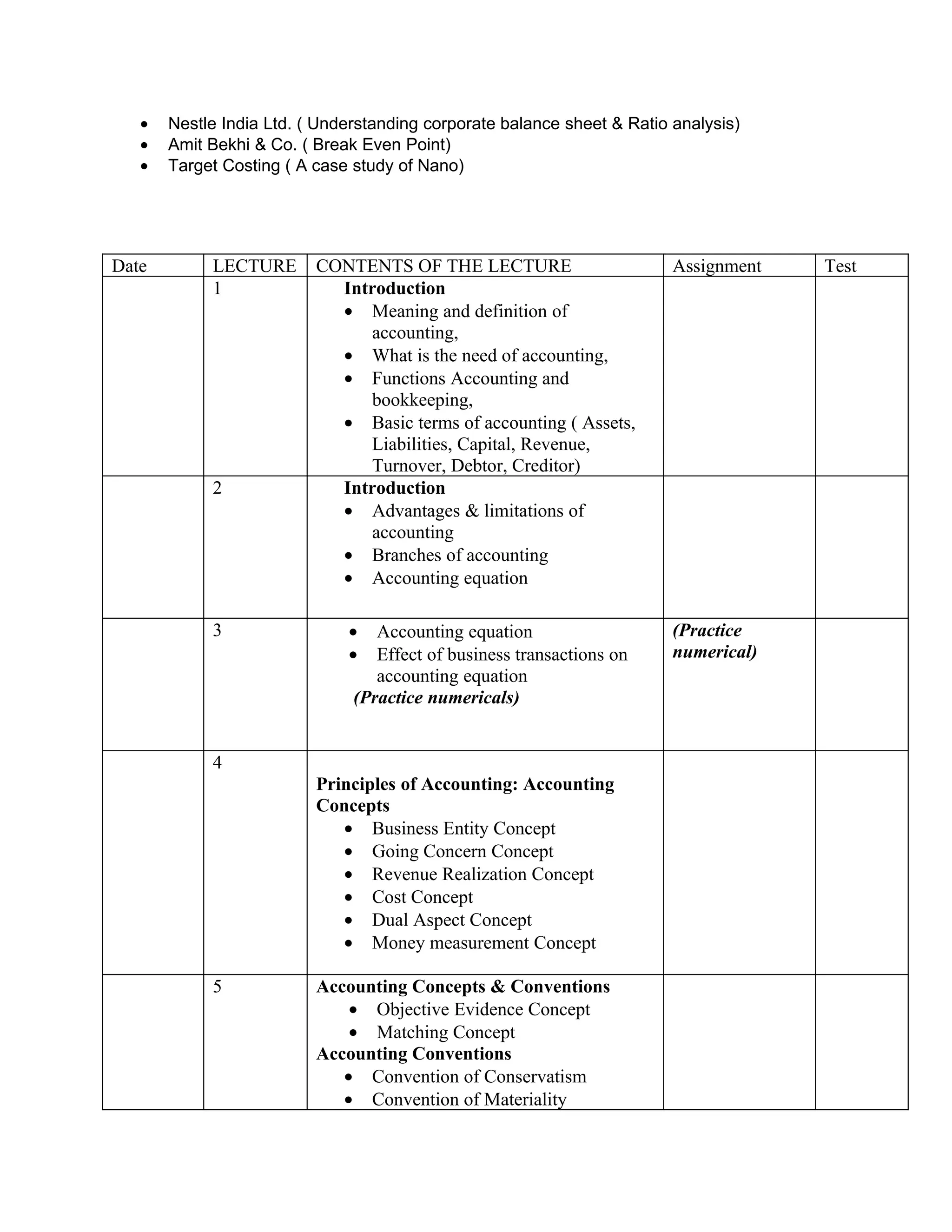

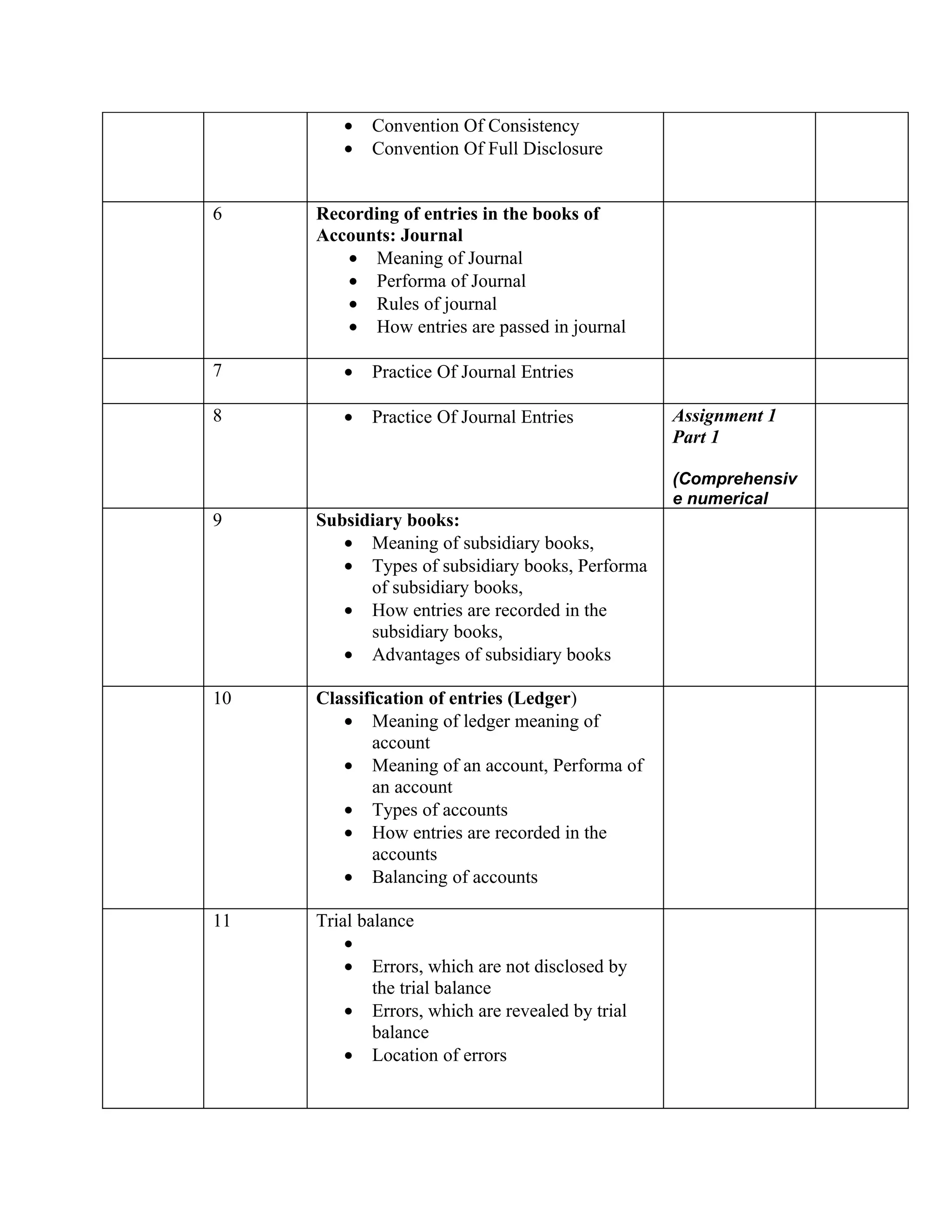

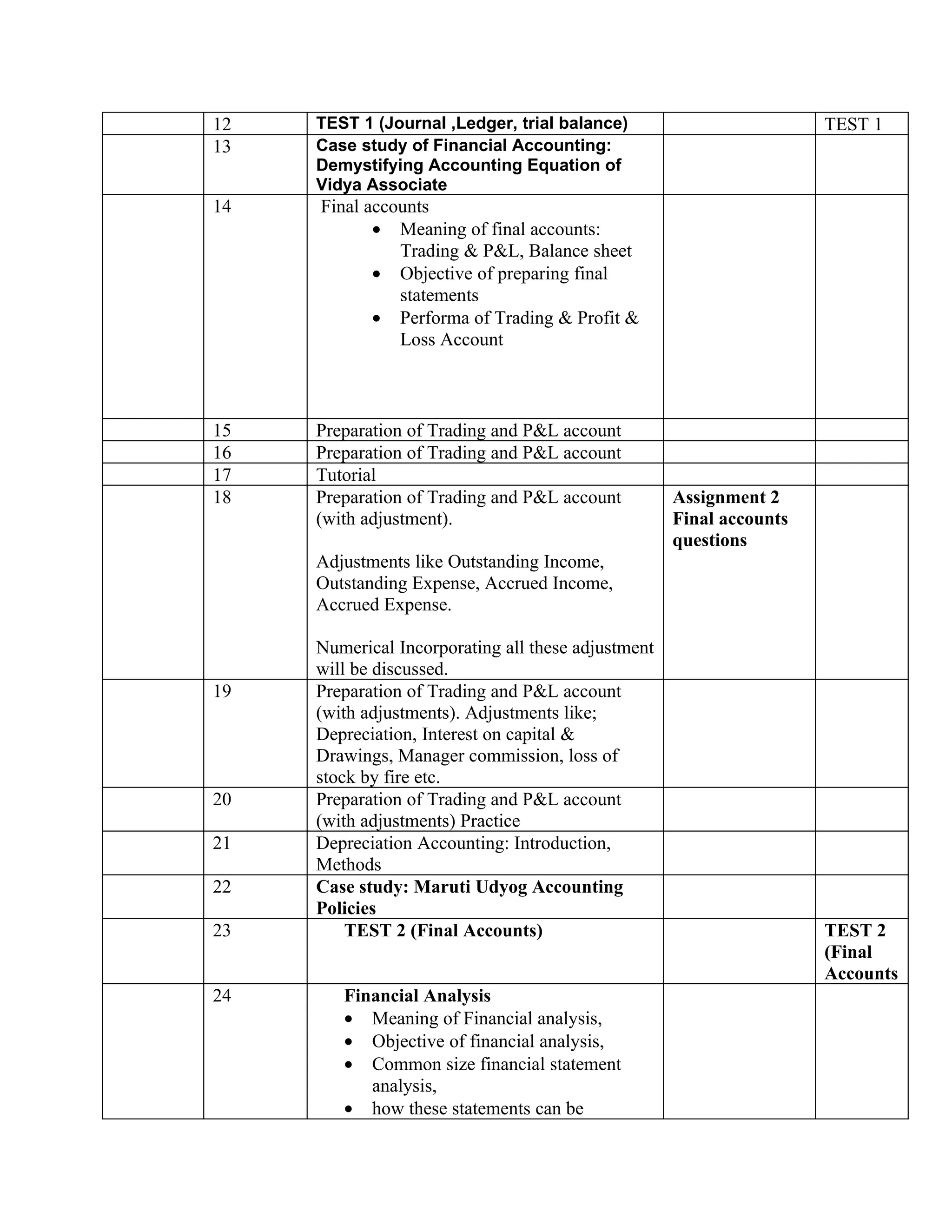

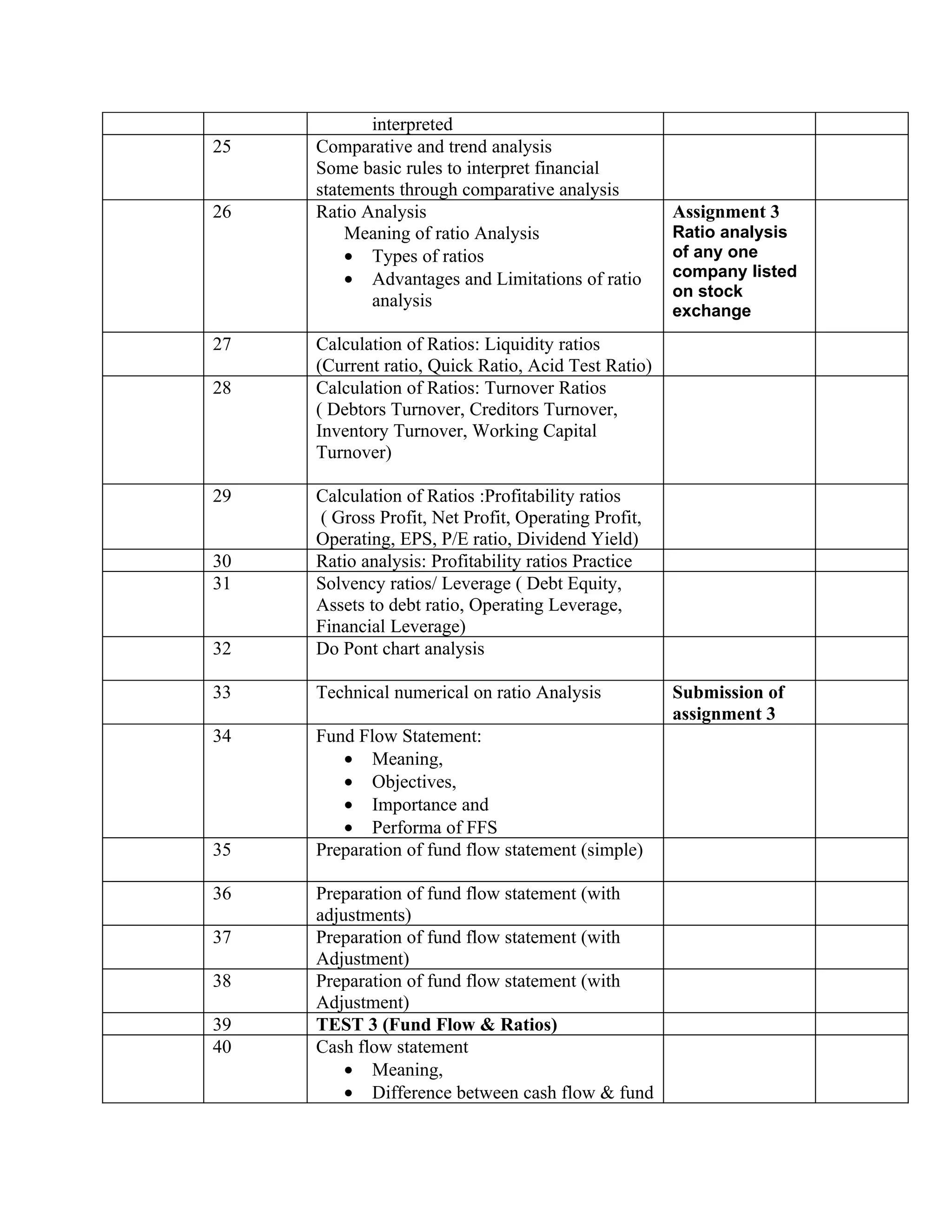

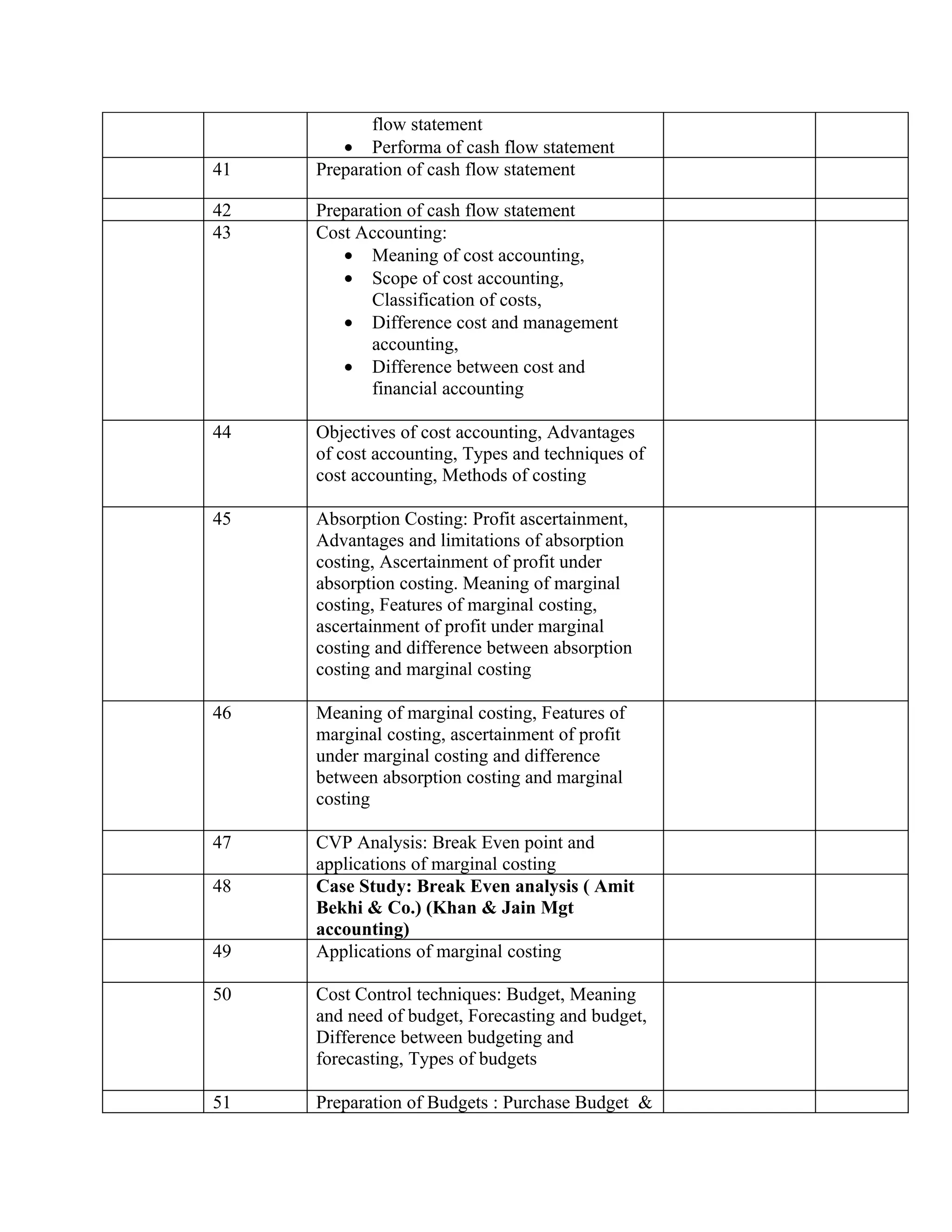

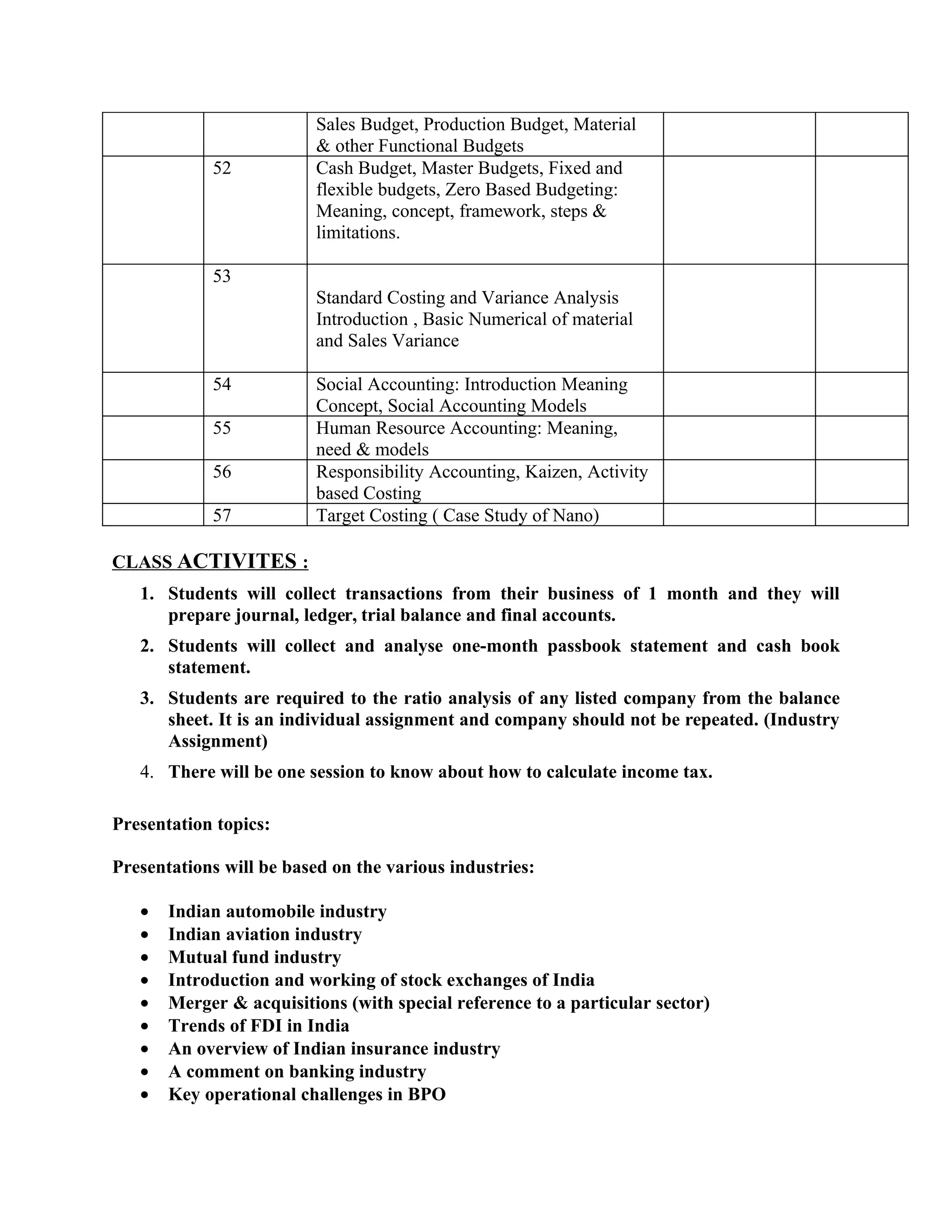

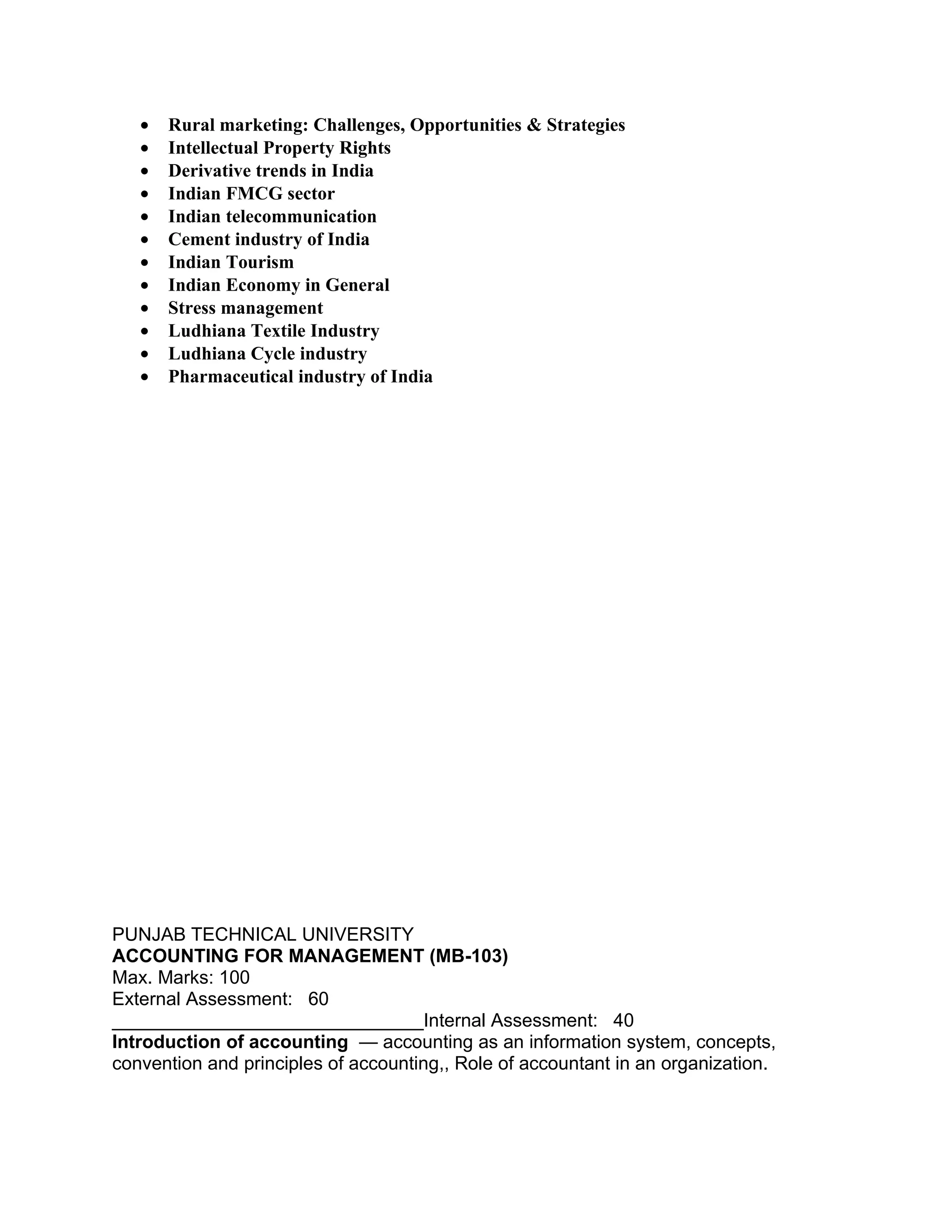

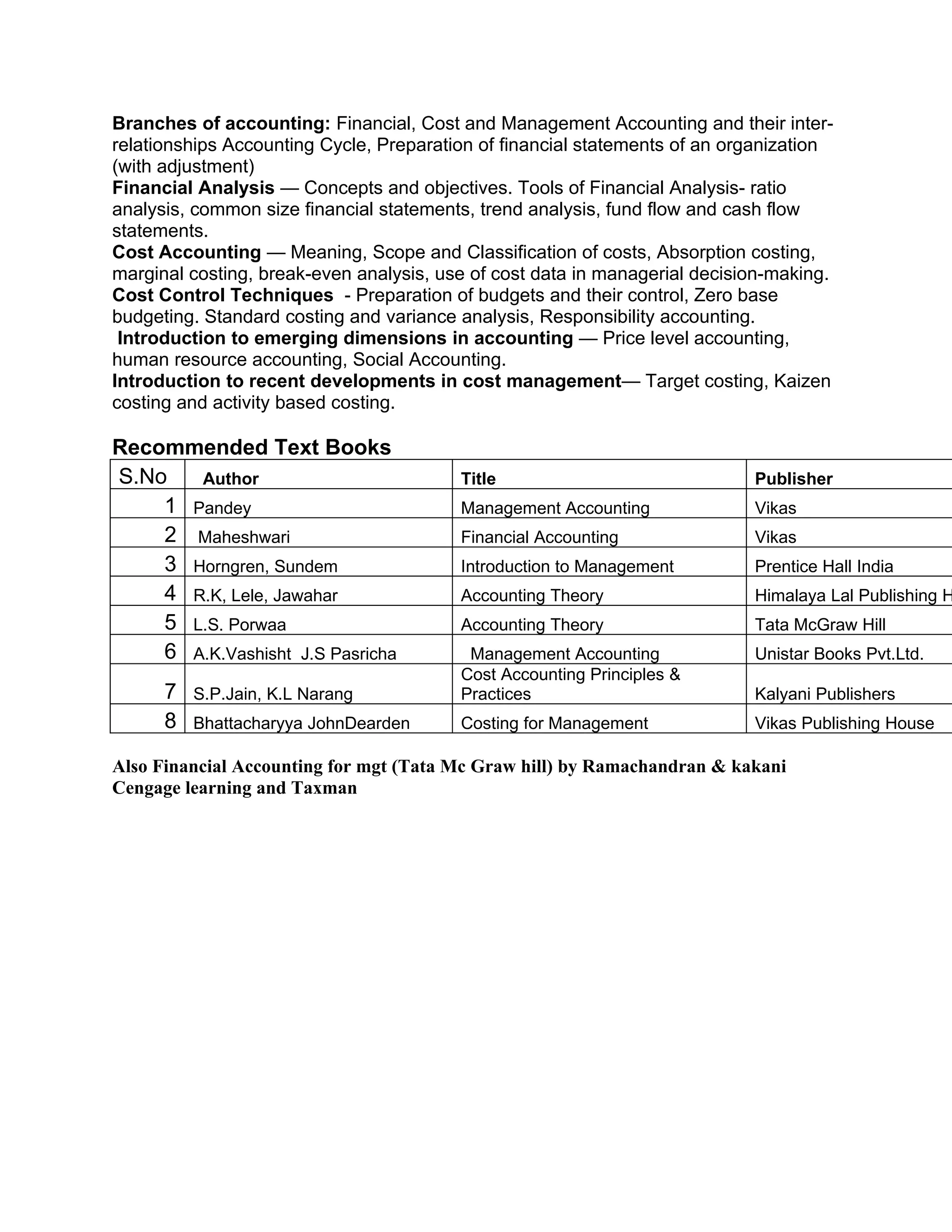

This document provides the course plan for Accounting for Management (103) at Punjab College of Technical Education, Ludhiana. The objective of the course is to help students understand and analyze financial statements to evaluate financial position and performance and aid future decision making. The course spans 57 lectures covering topics such as accounting principles, preparation of financial statements, ratio analysis, cost accounting, and recent developments. Student evaluation includes assignments, presentations, tests, and internal assessments.