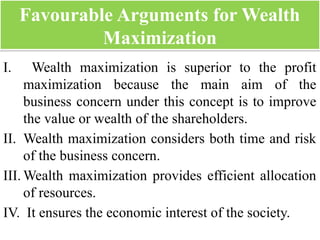

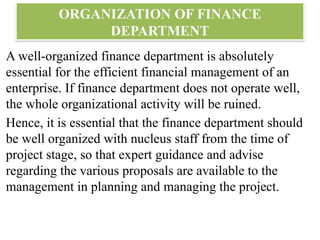

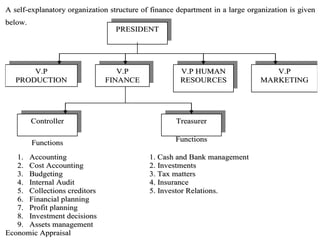

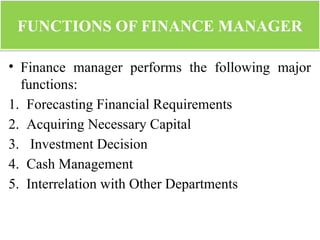

The document discusses the necessity and functions of financial management within business, emphasizing that finance is a scarce resource essential for effective business operations. It argues that wealth maximization is preferable to profit maximization as it focuses on increasing shareholder value and ensures optimal resource allocation. Additionally, it details the structure and key functions of a finance department and the roles of a finance manager.