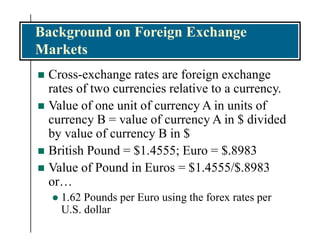

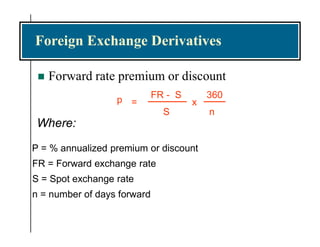

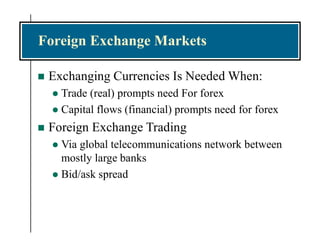

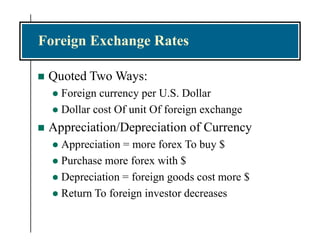

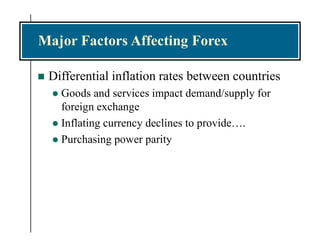

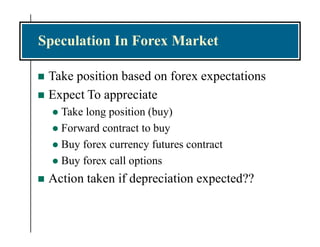

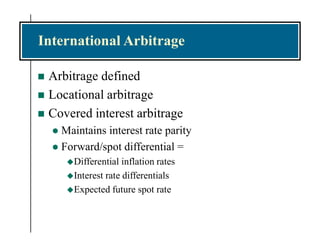

The document discusses foreign exchange markets and derivatives. It covers how exchange rates are quoted, factors that affect exchange rates like inflation and interest rates, techniques for forecasting exchange rates, and how derivatives like forwards, futures, and options can be used to hedge or speculate on currency movements. It also describes arbitrage opportunities between markets and how covered interest arbitrage equalizes forward rates and interest rate differentials.