1) The document outlines several theoretical relationships between spot exchange rates, forward rates, inflation rates, and interest rates including purchasing power parity (PPP), the Fisher effect (FE), the international Fisher effect (IFE), and interest rate parity (IRP).

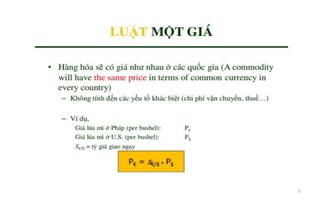

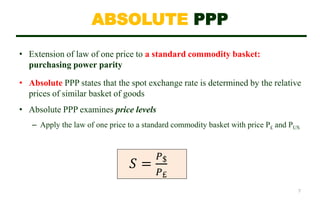

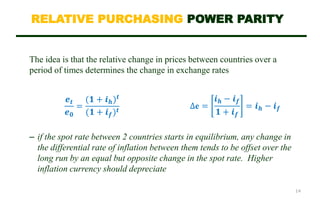

2) It discusses absolute and relative PPP, and that empirical tests show PPP holds better over the long-term than short-term and for countries with high inflation.

3) The Fisher effect and international Fisher effect state that the difference in interest rates between countries should equal the difference in expected inflation rates.

![FORECASTING EXCHANGE RATES: EFFICIENT MARKETS APPROACH

Financial markets are efficient if prices reflect all available and relevant

information.

− The efficient market hypothesis (Prof. Eugene Fama)

If this is true, exchange rates will only change when new information arrives,

thus:

St = E[St+1]

− The random walk hypothesis suggest that today’s ER is the best predictor of

tomorrow’s ER

Ft = E[St+1| It]

− Predicting exchange rates using the efficient markets approach is affordable and

is hard to beat.](https://image.slidesharecdn.com/ifm-chapter6-240116085213-2d0ff476/85/IFM-Chapter-6-pdf-23-320.jpg)