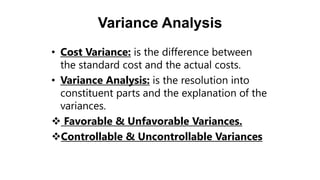

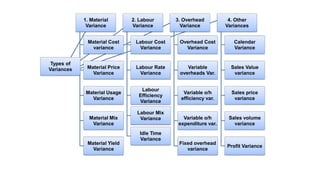

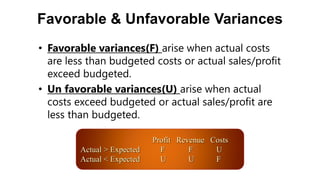

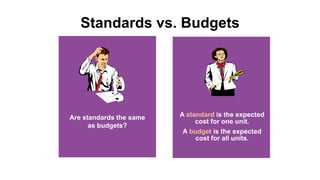

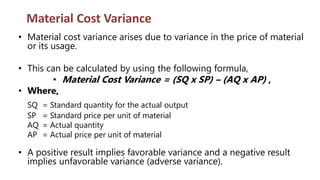

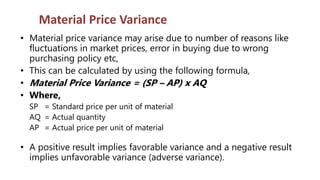

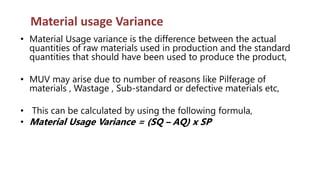

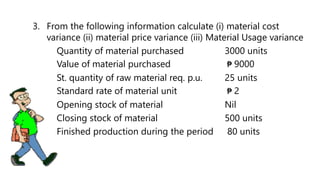

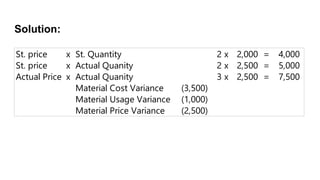

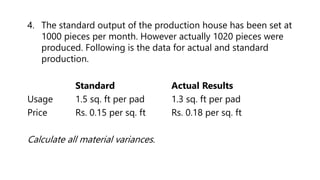

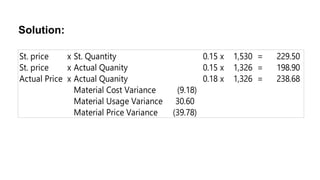

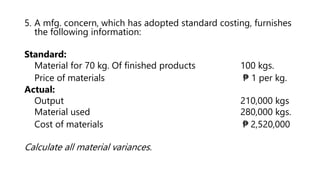

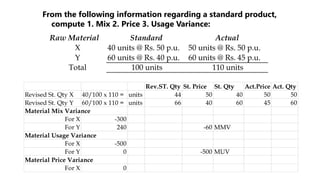

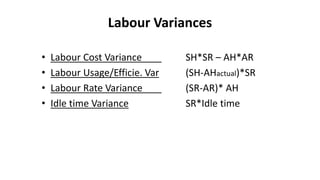

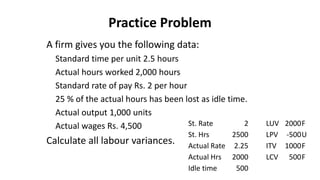

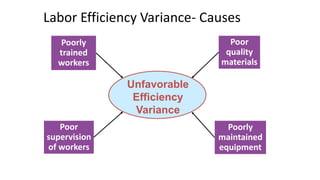

This document provides definitions and explanations of standard costing and variance analysis. It defines standard costs as predetermined costs based on estimates for materials, labor, and overhead. Standard costing involves establishing standard costs and measuring actual costs against standards to analyze variances and improve efficiency. Variance analysis involves separating total variances into constituent parts and explaining the reasons for variances. The document then discusses different types of variances, including material, labor, and overhead variances. It provides examples of how to calculate various variances using standard and actual data.

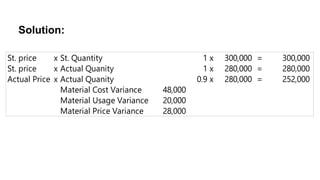

![Material Mix Variance

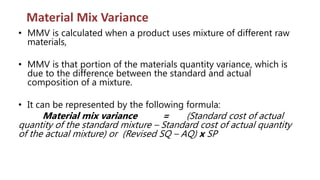

• Material Mix Variance

= [Revised St. Qty – Actual Qty] x St. Price

Rev. St. Qty = St. Qty of 1 Mat. x Actual Total

Standard Total](https://image.slidesharecdn.com/standard-costing-variance-analysis-230519124542-cb61e48c/85/Standard-Costing-Variance-Analysis-ppt-24-320.jpg)

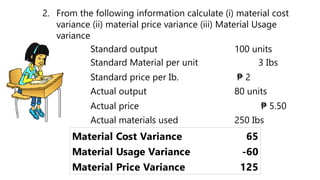

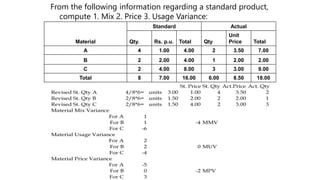

![Formulas

1. Variable overhead variances.

(Standard variable o/hfor actual prodn. – Actual variable o/h)

2. Variable overhead budget or expenditure variance,

(Budgeted variable overhead for actual hours – Actual

variable overhead) i.e. AH*BR – Actual Cost

3. Variable overhead efficiency variance.

Standard variable overhead rate per hour [Std. hours for

actual output – Actual hours] i.e. (SH-AH) *SR

4. Fixed Overhead Variance

Budgeted FO- AFO](https://image.slidesharecdn.com/standard-costing-variance-analysis-230519124542-cb61e48c/85/Standard-Costing-Variance-Analysis-ppt-33-320.jpg)