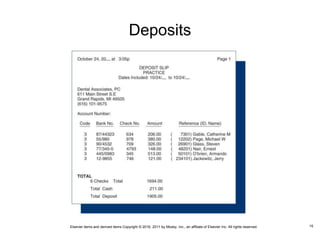

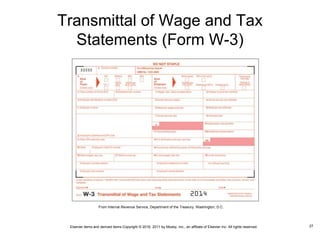

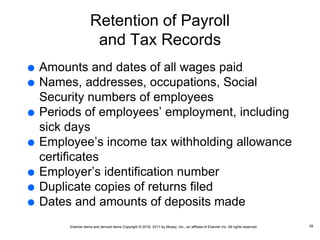

This document provides an overview of financial systems used in dental practices, including electronic banking, budgets, financial management software, payroll records, and tax responsibilities. It discusses establishing checking accounts and using online banking to pay bills and view balances. The document also covers reconciling bank statements, using petty cash, and maintaining accurate payroll records, withholding taxes correctly, and retaining records as required by law.