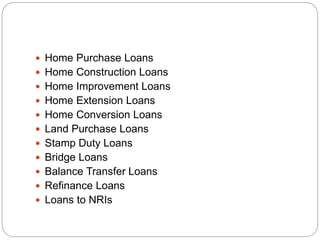

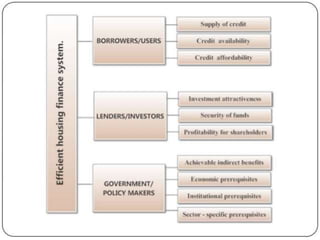

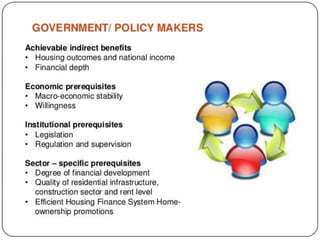

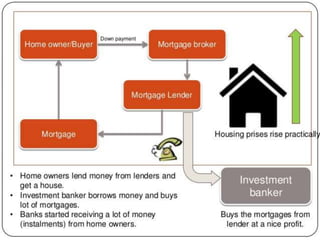

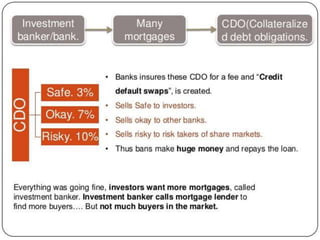

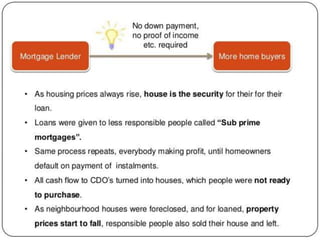

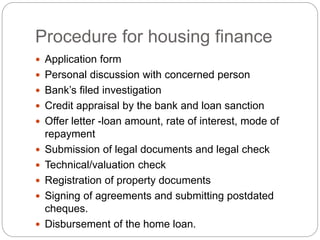

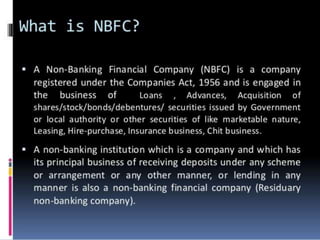

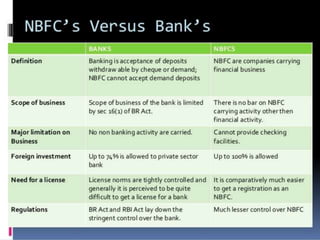

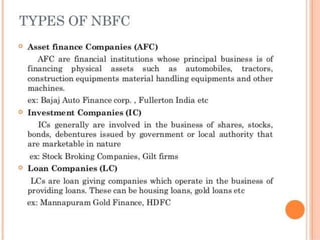

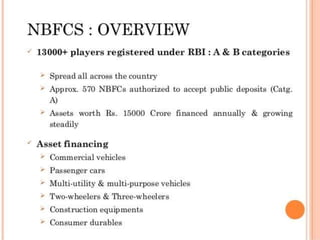

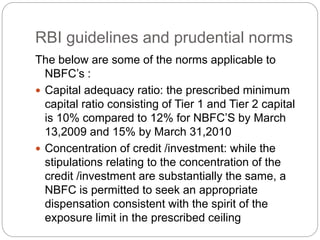

This document provides an overview of housing finance in India. It discusses the role and purpose of housing finance systems, different types of housing loans (such as conventional, FHA, VA, fixed rate, adjustable rate, and non-qualifying loans), institutions that offer housing finance (banks, HUDCO, LICHFL, etc.), the process for obtaining housing finance, income tax implications, reverse mortgages, and RBI guidelines and prudential norms for non-banking financial companies. The essential functions of any housing finance system are to channel funds from investors to home buyers.