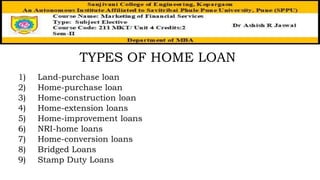

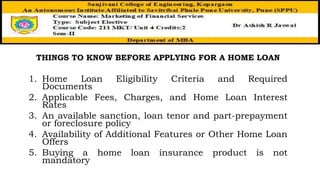

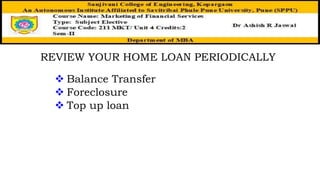

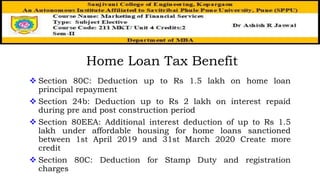

The document discusses housing finance and home loans. It defines housing finance as providing funds for home buyers to purchase homes. It notes there are various types of home loans, including for land purchase, home purchase, construction, extension, and improvement. The document outlines things for applicants to know before applying for a home loan, such as eligibility, fees/rates, loan terms, and additional features. It recommends periodically reviewing home loans for options like balance transfers and top-up loans. The document also outlines various tax benefits for home loans under sections 80C, 24b, and 80EEA of India's tax code.