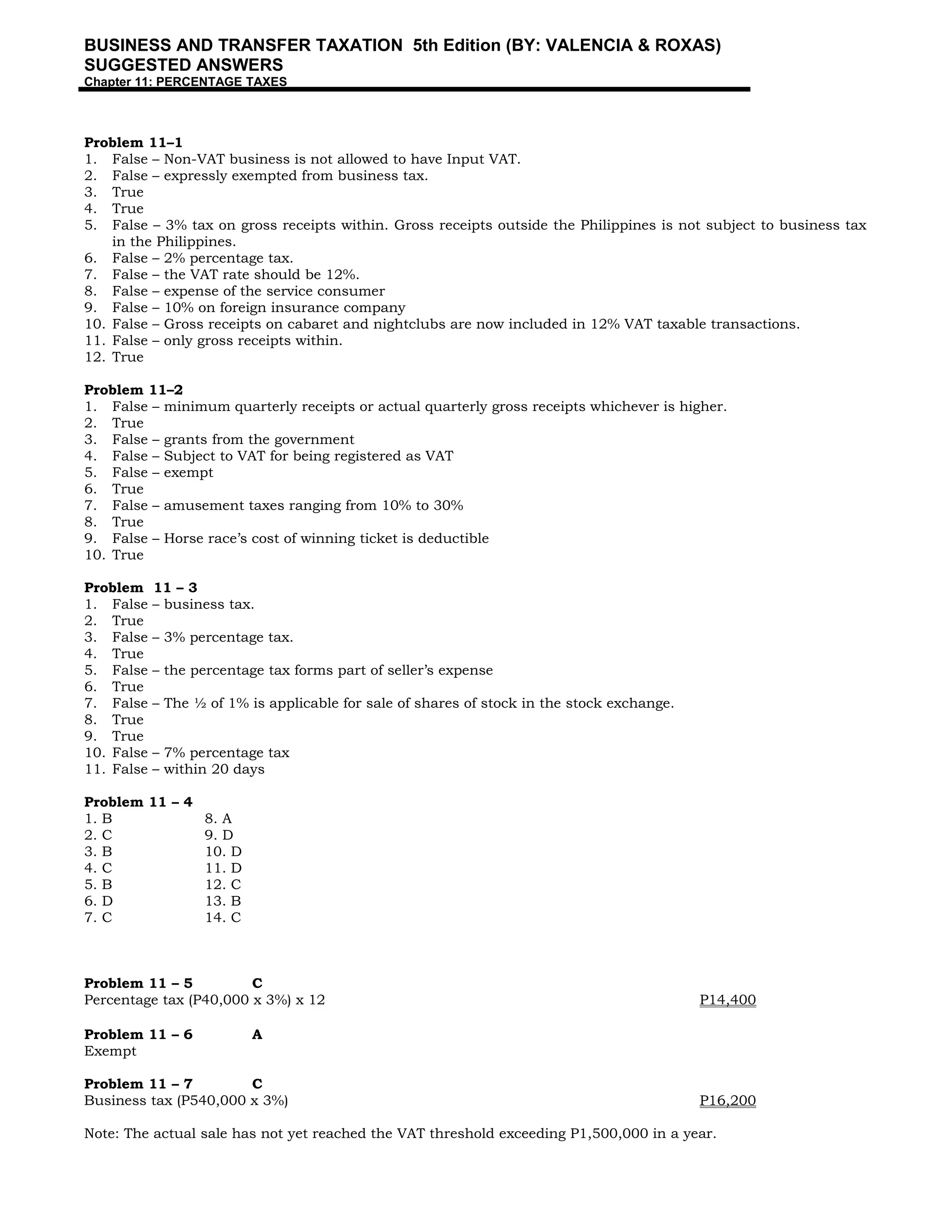

This document provides the suggested answers to problems in Chapter 11 on percentage taxes from the textbook "Business and Transfer Taxation 5th Edition" by Valencia & Roxas. It addresses 51 problems testing understanding of percentage tax concepts and calculations. The problems cover various percentage tax rates applied to different types of businesses, income, and transactions. The answers follow tax regulations and explain reasoning for right and wrong answers.

![BUSINESS AND TRANSFER TAXATION 5th Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 11: PERCENTAGE TAXES

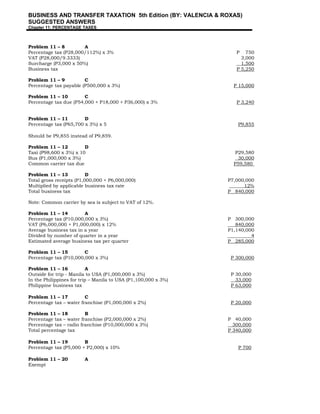

Problem 11 – 21 D

Service charge (P75,000/10%) P 750,000

Percentage tax (P750,000 x 10%) 75,000

Total collection P 825,000

Problem 11 – 22 D

P - 0 -

Problem 11 – 23 D

Percentage tax (P200,000 x 10%) P 20,000

Problem 11 – 24 D

Amusement tax (P500,000 + P200,000 + P100,000) x 18% P 144,000

Problem 11 – 25

1. A

Percentage tax (P2,000,000 + P1,000,000) x 10% P300,000

2. D

Exempt

Problem 11 – 26 B

Percentage tax [P1,000,000 - (P200,000/100)] x 10% P 99,800

Problem 11 – 27 A

Percentage tax (P100,000 – P1,000) x 10% P 9,900

Problem 11 – 28 B

Percentage tax [P1,000,000 x .005) P 5,000

Problem 11 – 29 D

P - 0 -. The sale is subject to capital gains tax because the shares of stock were sold directly to the buyer.

Problem 11 – 30 C

Percentage tax [400,000 x P12) x 1% P 48,000

400,000/1,150,000 = 34.5% more than 33 1/3% = 1% percentage tax.

Problem 11 – 31 D

Percentage tax [P600,000 x 4%) P 24,000

(600,000/20)/ (2,600,000/20) = 23% = 4% percentage tax.

Problem 11 – 32 B

Interest income with maturity more than 5 years (P400,000 x 1%) P 4,000

Leasehold income (P300,000 x 7%) 21,000

Total gross receipt tax P25,000

Note: The net trading loss is deductible only from trading gain of the same taxable year.

Problem 11 – 33 D

Interest income with maturity less than 5 years (P600,000 x 5%) P 30,000

Royalty income (P300,000 x 7%) 21,000

Gain from sale of derivatives (P200,000 x 7%) 14,000

Total gross receipt tax P 65,000

Note: The net trading loss for 2005 is not deductible from trading gain of 2006.](https://image.slidesharecdn.com/chapter11-percentagetaxes-150424065622-conversion-gate01/85/Chapter-11-percentage-taxes-Valencia-3-320.jpg)