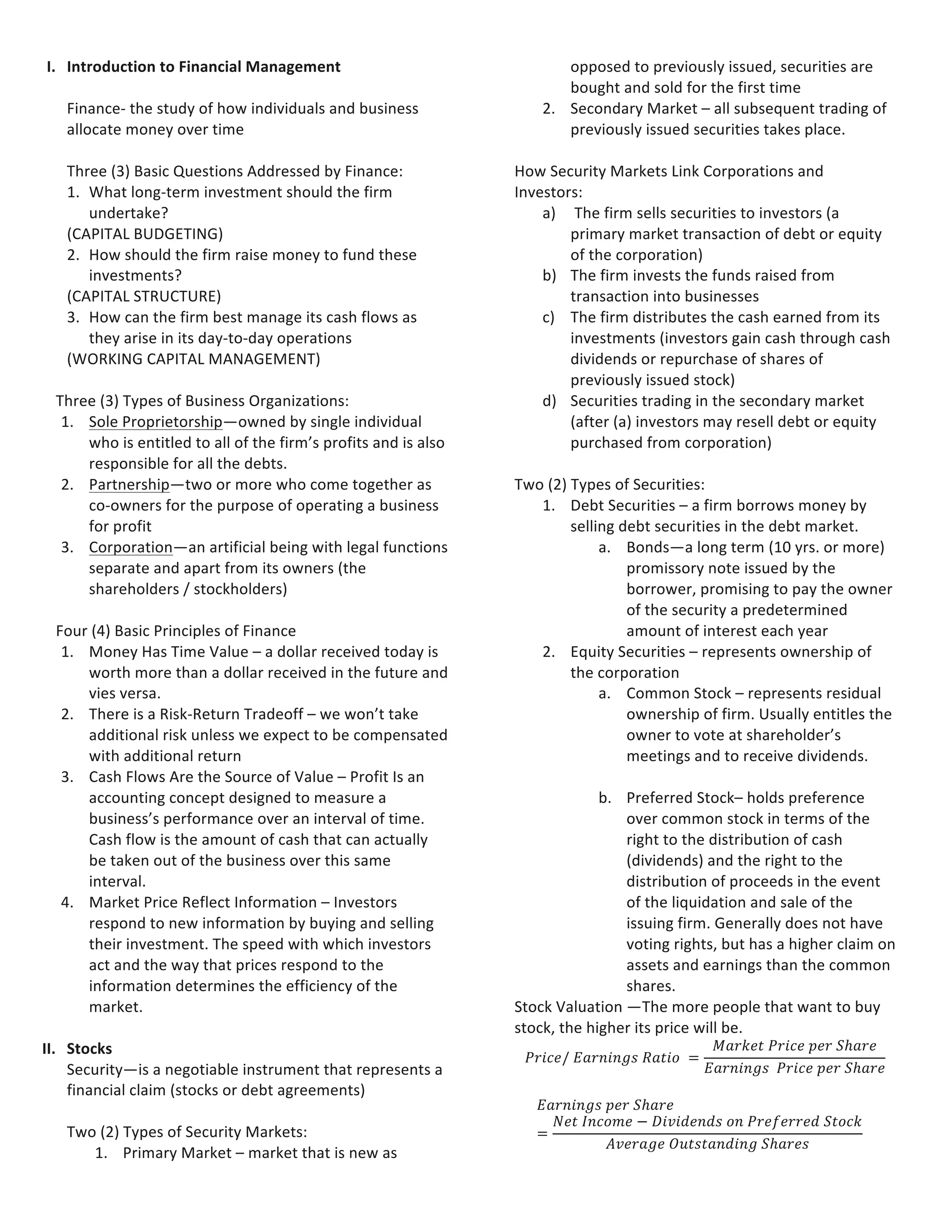

The document provides an overview of financial management, covering key concepts such as capital budgeting, capital structure, and working capital management. It details various types of business organizations, basic principles of finance, stock valuation, financial ratios, and the importance of financial statements. Additionally, it discusses the time value of money, bond features, investment analysis, cost of capital, and dividend policies.

![3. Par

or

Face

Value—an

amount

that

must

be

repaid

to

the

bondholder

at

maturity

4. Coupon

Interest

Rate—idicates

the

percentage

of

the

par

value

bond

that

will

be

paid

out

annually

in

the

form

of

interest

5. Maturity

and

Repayment

of

Principal—indicates

the

length

of

time

until

bond

issuer

returns

he

par

value

to

the

bondholder

and

terminates

or

redeems

the

bond

6. Call

Provision

and

Conversion

Features-‐-‐

is

most

valueable

when

the

bond

is

sold

during

a

period

of

abnormally

high

rate

of

interest,

such

that

there

is

reasonable

expectation

that

rates

will

fall

in

the

future

before

bond

matures.

a. Conversion

Features-‐-‐

allos

the

bondholders

to

convert

the

bond

into

a

prescribed

number

of

shares

of

the

firm’s

common

stock

TYPES

OF

BONDS

1. Secure

vs

Unsecured

a. Secured

bond

has

specific

assets

pledged

to

support

repayment

of

the

bond.

b. Unsecured

bond

applies

debenture

(any

form

of

unsecured

long-‐term

debt).

2. Priority

of

Claims

–

refers

to

the

place

in

line

where

the

bondholders

stand

in

securing

re-‐payment

out

of

the

dissolution

of

the

firm’s

assets.

3. Initial

offering

market

–

bonds

are

also

classified

by

where

they

were

originally

issued

(in

the

domestic

bond

market

or

elsewhere.

4. Abnormal

Risk

–

Junk,

or

high-‐yield,

bonds

have

a

below-‐investment

grade

bonding

rating

(facing

severe

financial

problems

and

suffering

from

poor

credit

ratings)

5. Coupon

level

–

bonds

with

a

zero

or

very

low

coupon

are

called

zero

coupon

bonds

6. Amortizing

or

Non-‐Amortizing

a. Amortizing

bonds,

like

a

home

mortgage

loan,

include

both

the

interest

and

a

portion

of

the

principal.

b. Non-‐amortizing

bond,

only

include

interest.

7. Convertibility

–

Convertible

bonds

are

debt

securities

that

can

be

converted

into

a

firm’s

stock

at

a

pre-‐specified

price

CURRENT

YIELD

Refers

to

the

ratio

of

the

annual

interest

payment

to

the

bond’s

current

market

price.

CY =

Annual Interest Payment

Current Market Price of Bond

XV. Bond's

yield

to

maturity

Bond Price =

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡!"#$ !

(1 + 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑟𝑎𝑡𝑒)!

+

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡!"#$ !

(1 + 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑟𝑎𝑡𝑒)!

+ ⋯

+

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡!"#$ !

1 + 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑟𝑎𝑡𝑒 !

+

𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙

(1 + 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑟𝑎𝑡𝑒)!

XVI. Book

value

per

share

Book Value per Share =

Common Shareholders!

Equity

Common Share Outstanding

XVII. Preferred

vs

Common

stock

Common

Stock—entitles

the

owner

to

vote

at

shareholder’s

meetings

and

to

receive

dividends.

a) Has

no

maturity

date

b) Life

is

limited

only

to

the

life

of

the

issuing

firm.

c) Common

dividends

have

no

maximum

or

minimums

d) Valuation

differs

from

the

the

valuation

of

preferred

stock

since

common

stock

has

no

promised

dividends.

Preferred

stock

–

generally

does

not

have

voting

rights,

but

has

a

higher

claim

on

assets

and

earnings

than

the

common

shares.

XVIII. Annual

Rate

of

Return

Rate

of

Return—Also

known

as

holding

period

return

is

simply

the

cash

return

divided

by

the

beginning

stock

price

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑅𝑒𝑡𝑢𝑟𝑛

= 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑅𝑒𝑡𝑢𝑟𝑛!×𝑝𝑟𝑜𝑏𝑎𝑏𝑜𝑙𝑖𝑡𝑦!

+ 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑅𝑒𝑡𝑢𝑟𝑛!×𝑝𝑟𝑜𝑏𝑎𝑏𝑜𝑙𝑖𝑡𝑦! + ⋯

+ 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑅𝑒𝑡𝑢𝑟𝑛!×𝑝𝑟𝑜𝑏𝑎𝑏𝑜𝑙𝑖𝑡𝑦!

XIX. Risk

&

Return

Cash

Return

–

The

gain

or

loss

on

an

investment

𝐶𝑎𝑠ℎ 𝑅𝑒𝑡𝑢𝑟𝑛 =

𝐸𝑛𝑑 𝑃𝑟𝑖𝑐𝑒 + 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 − 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒

Break

Even

Point

𝐵𝐸𝑃 𝑖𝑛 𝑢𝑛𝑖𝑡𝑠 =

𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡

1 − 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡 𝑝𝑒𝑟 𝑈𝑛𝑖𝑡

𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑈𝑛𝑖𝑡

Standard

Deviation

𝜎 = ([𝑟! − 𝐸 𝑟 ]!×𝑃𝑏!) + ⋯ + ([𝑟! − 𝐸 𝑟 ]!×𝑃𝑏!)

Variance

𝑉𝑎𝑟𝑖𝑎𝑛𝑐𝑒 = 𝜎!

XX. Payback

period](https://image.slidesharecdn.com/basfin1finalsreview-140411125112-phpapp02/85/BASFIN1-REVIEWER-FOR-FINALS-4-320.jpg)