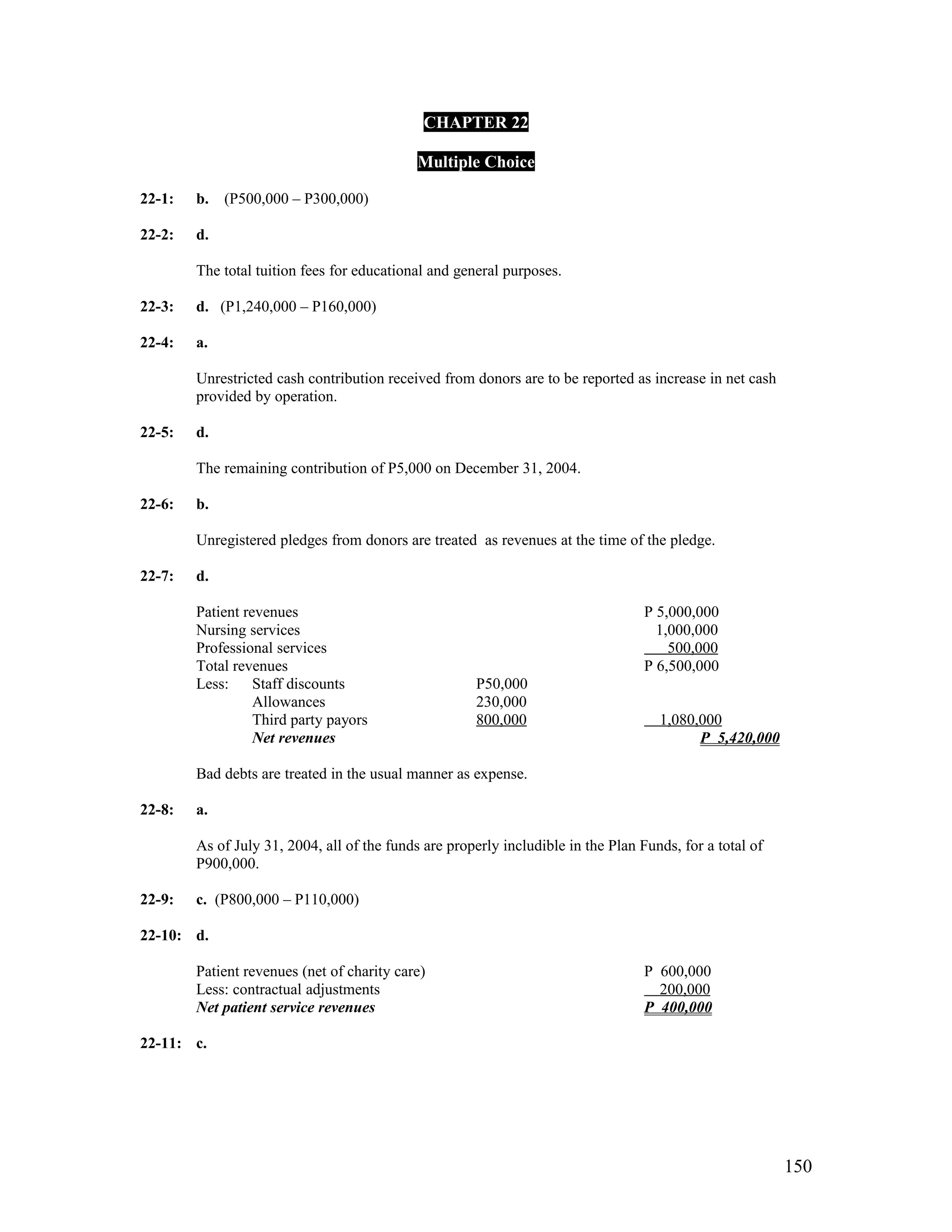

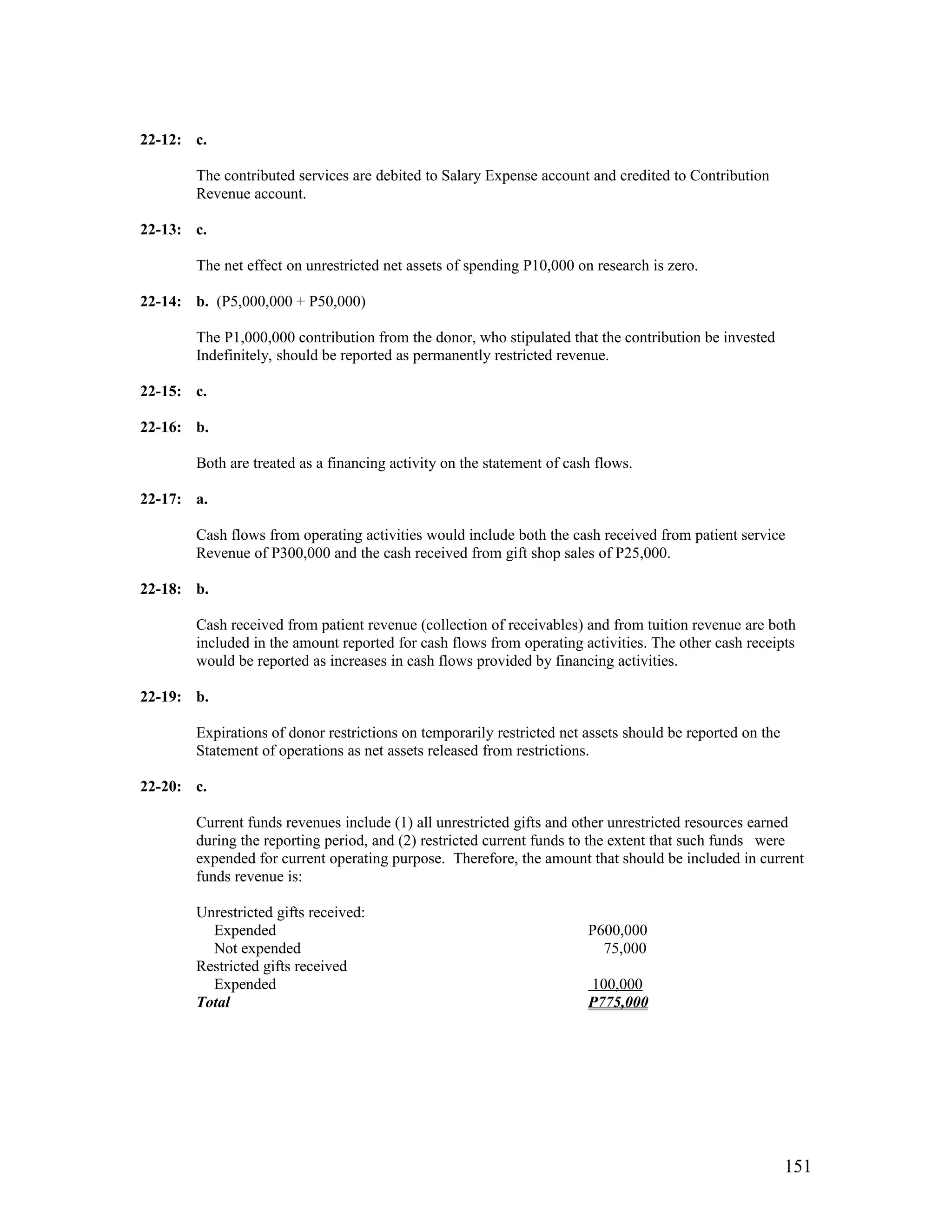

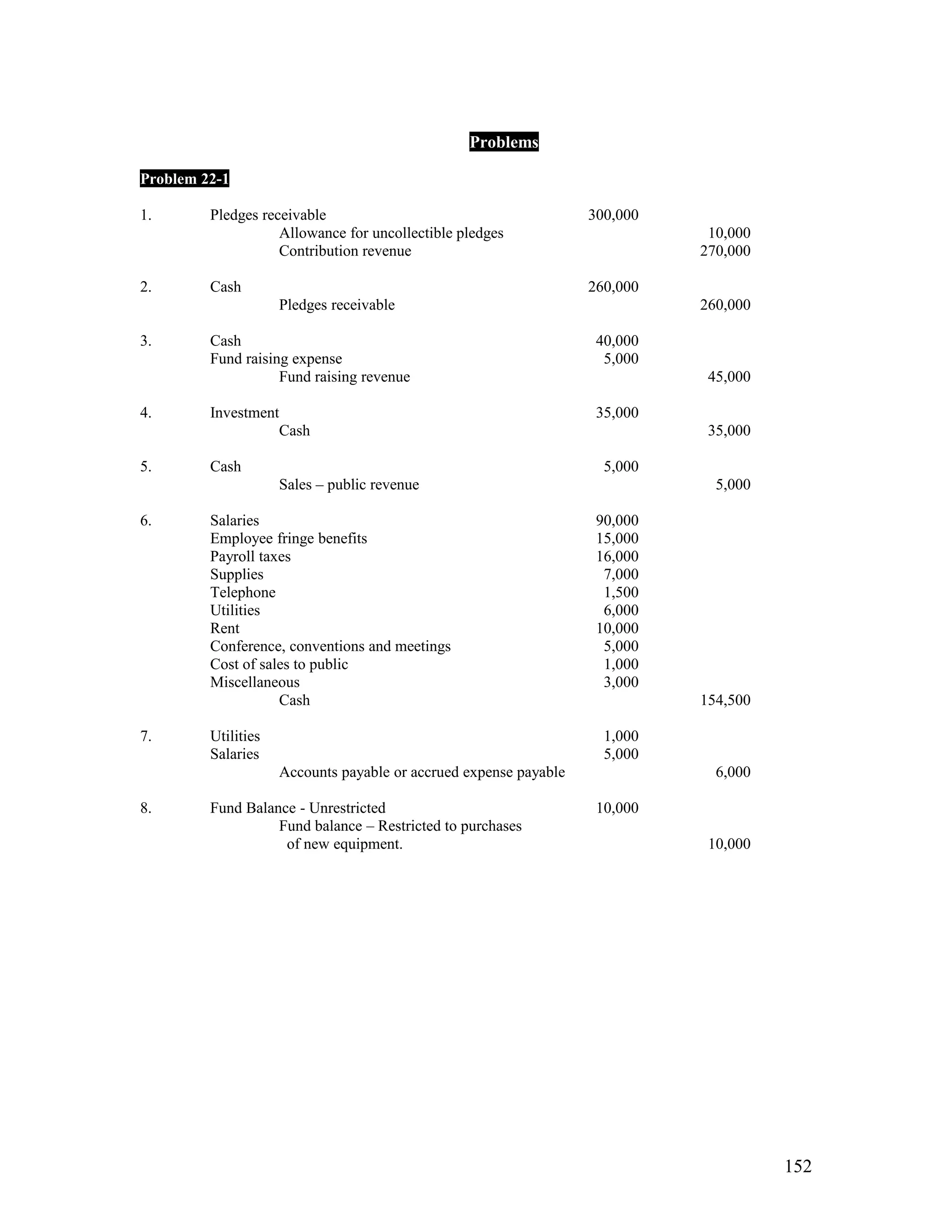

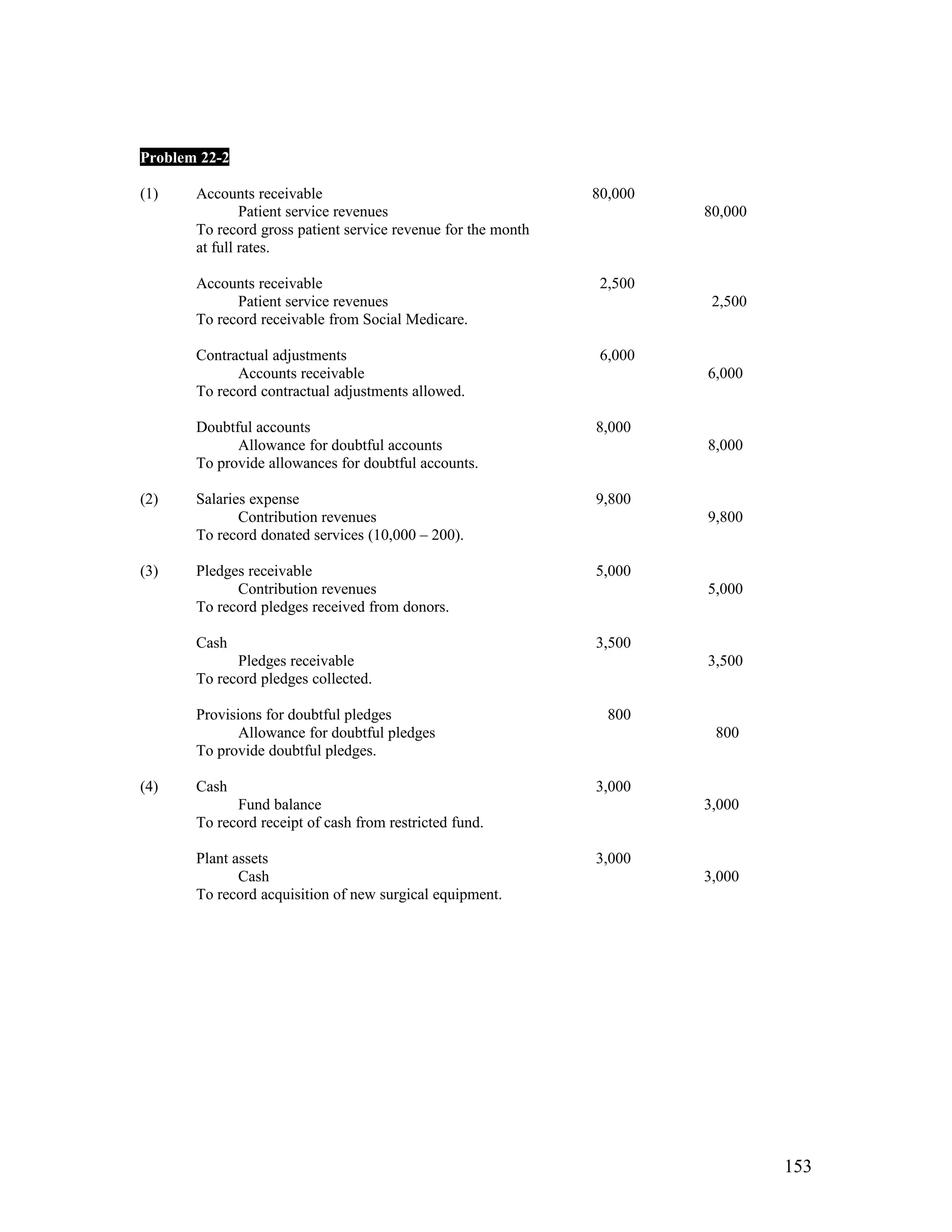

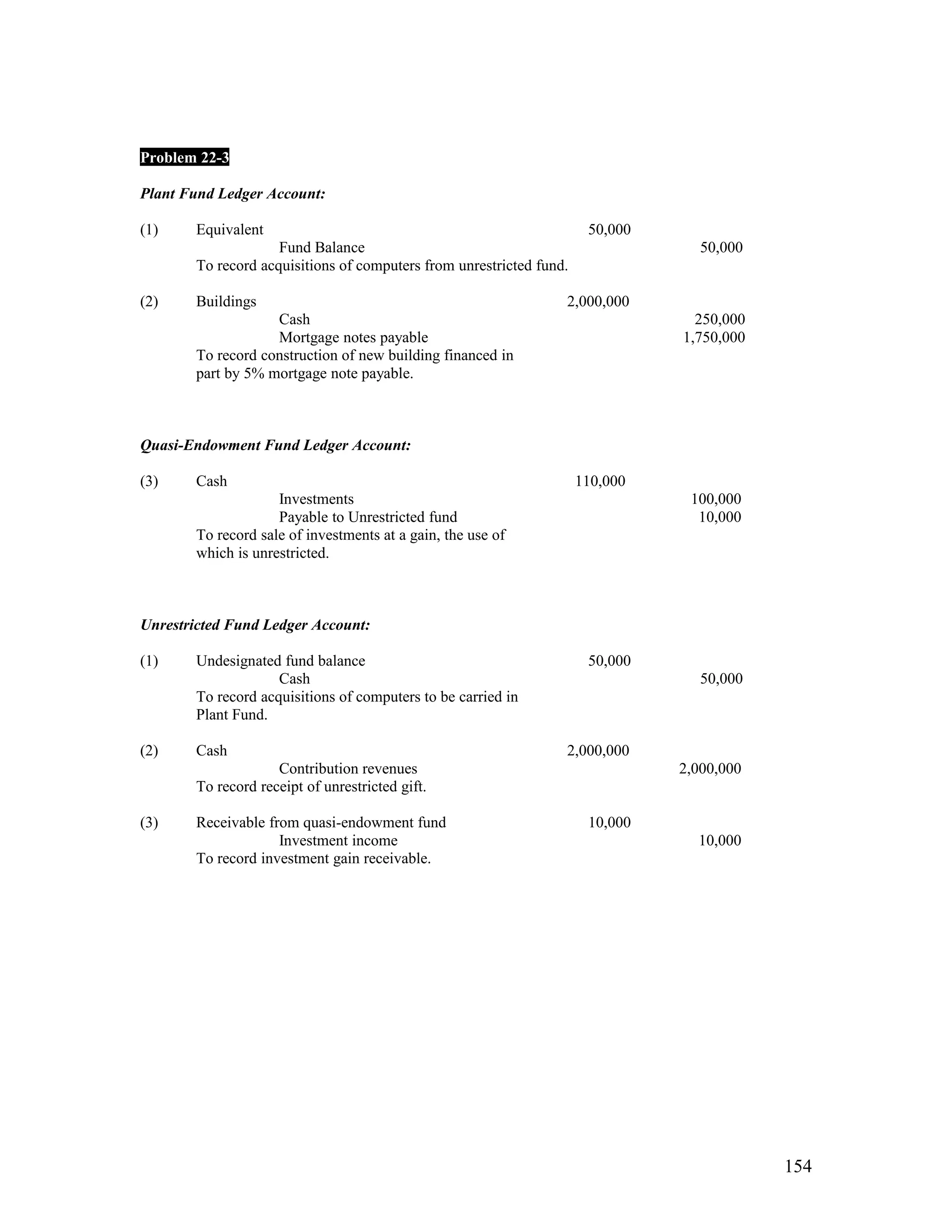

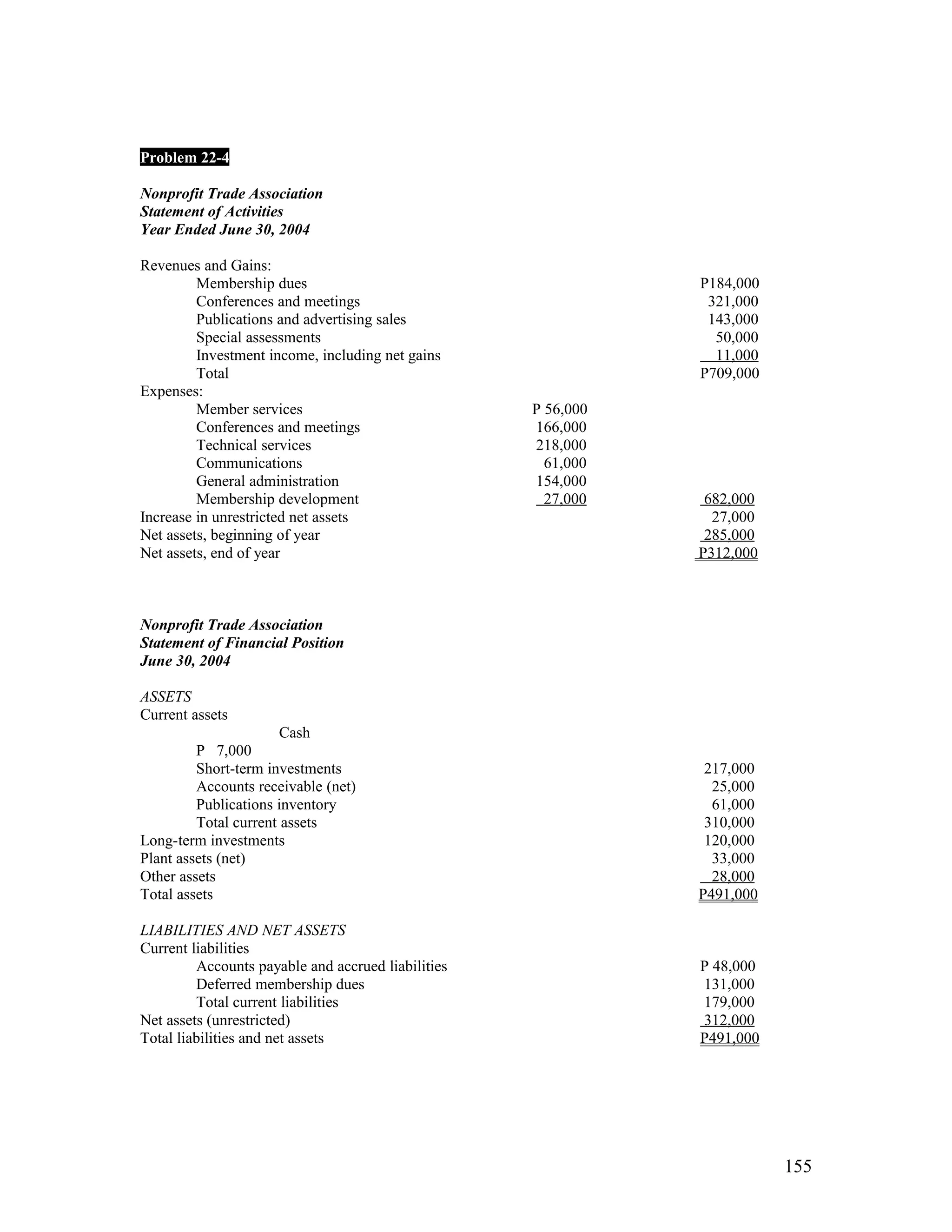

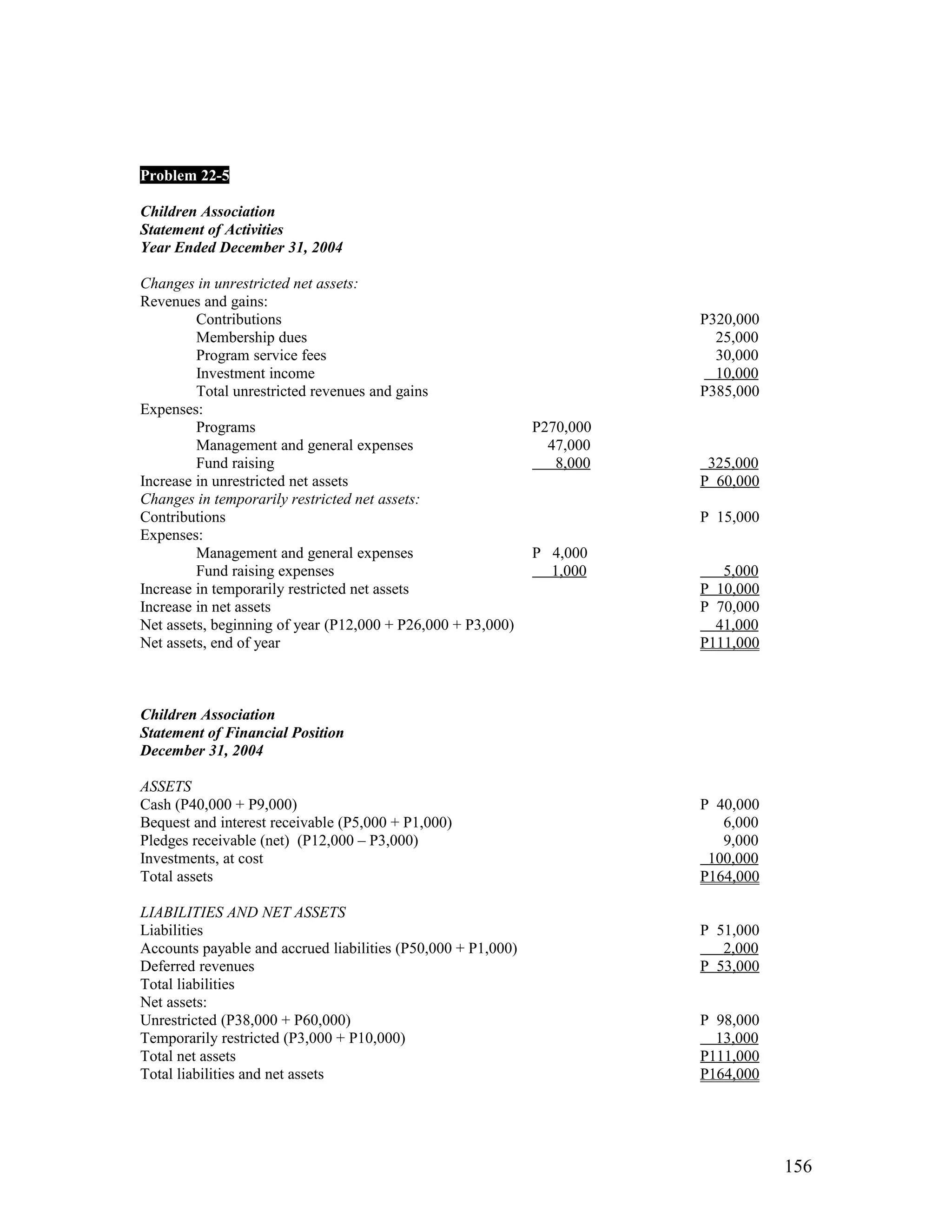

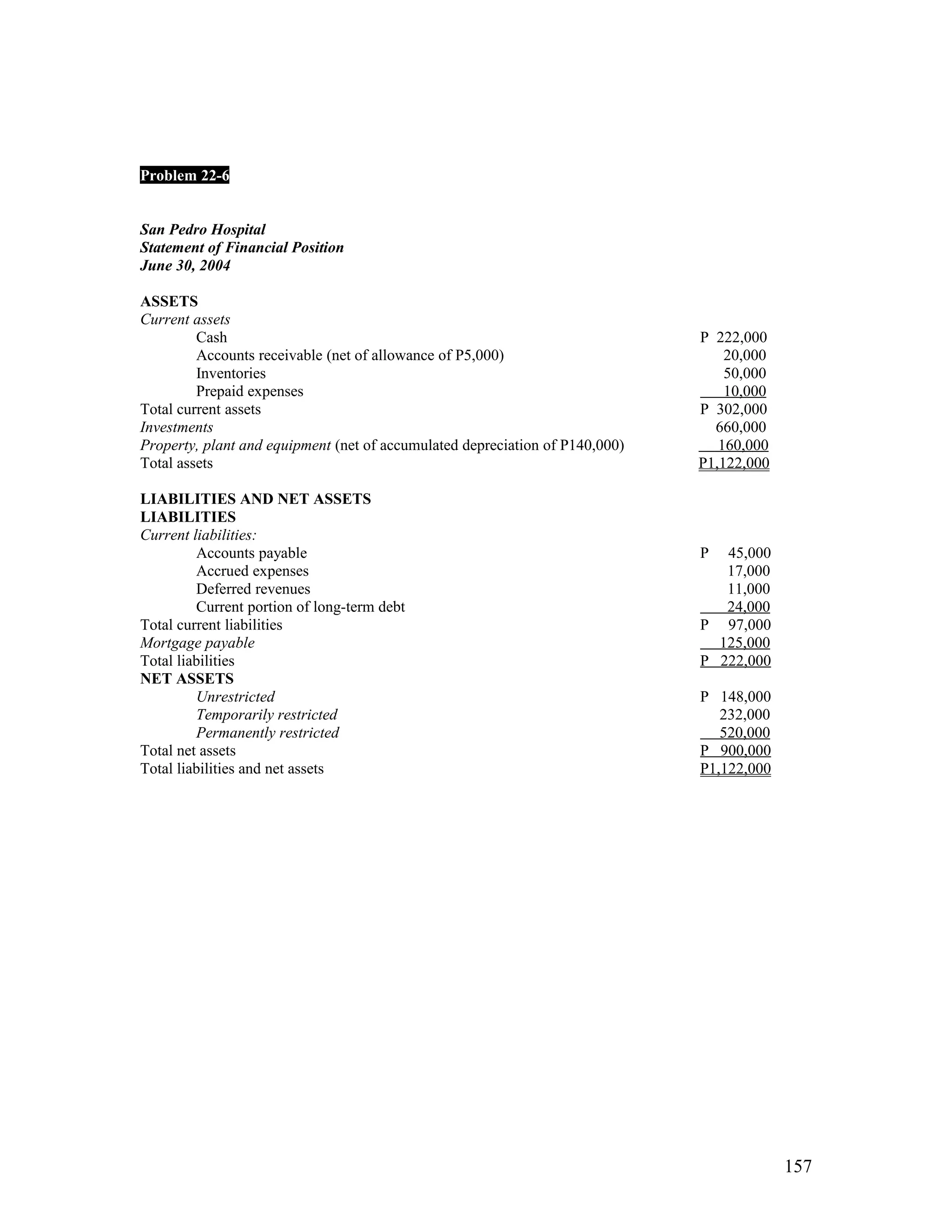

The document contains multiple choice questions and problems related to accounting for not-for-profit organizations. It includes questions about proper accounting treatments for revenues, expenses, contributions and donations. It also includes practice problems demonstrating journal entries for various not-for-profit transactions such as recording patient revenues, donations, and transfers between funds.