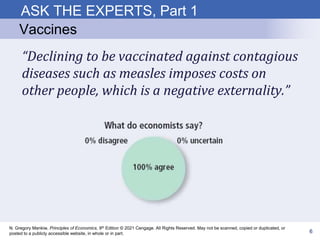

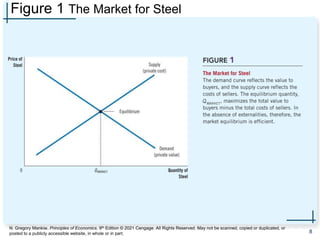

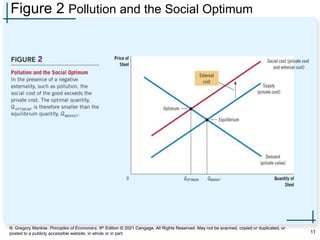

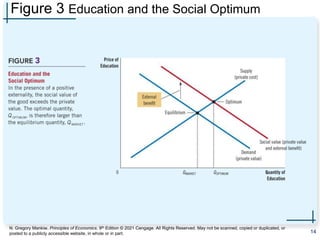

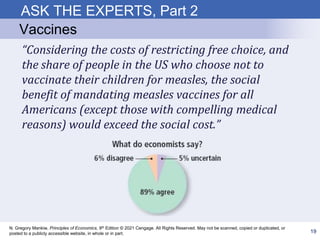

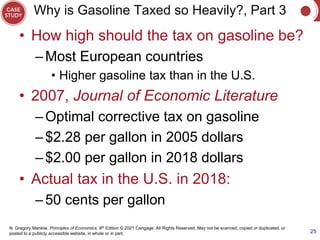

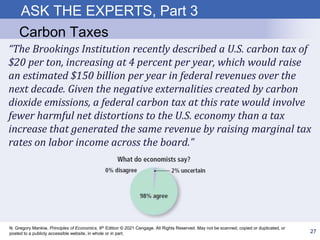

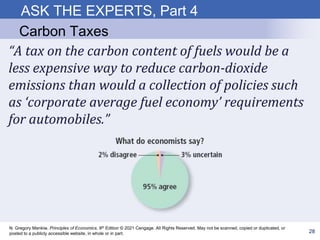

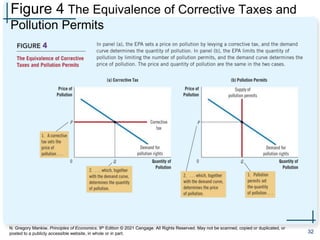

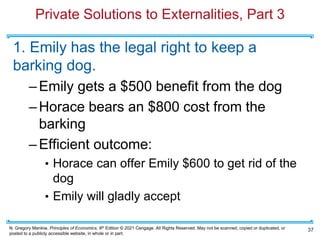

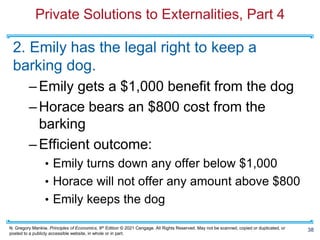

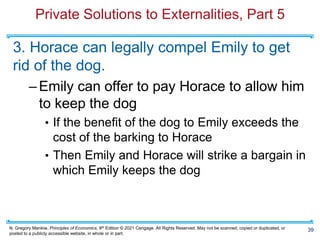

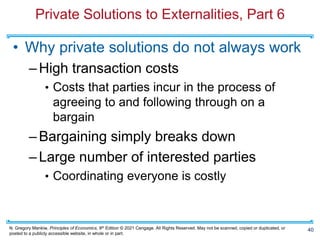

The document discusses externalities, which are the uncompensated impacts of one person's actions on others, and how government policies can improve market failures related to these externalities. It outlines the different types of externalities, their effects on society, and approaches for government intervention, such as corrective taxes and subsidies. The importance of finding efficient allocations of resources to maximize social welfare while addressing both negative and positive externalities is emphasized.