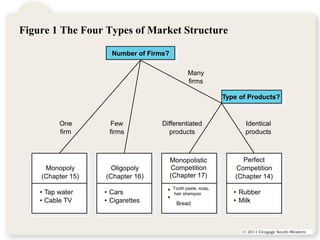

- Imperfect competition refers to market structures between perfect competition and pure monopoly, including oligopoly and monopolistic competition.

- Oligopoly is characterized by a few sellers offering similar products, with firms monitoring each other's actions. Monopolistic competition has many firms selling differentiated products.

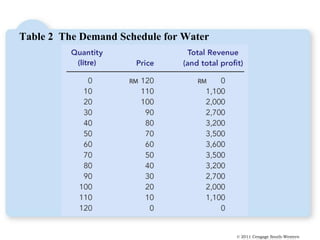

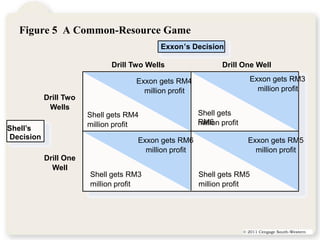

- In oligopoly, firms would benefit most by cooperating like a monopoly but competition makes this difficult to sustain, resulting in an equilibrium with higher output and price than a monopoly.