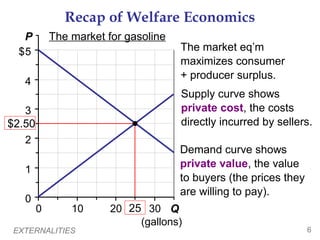

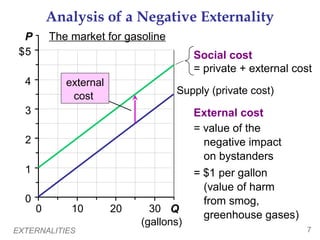

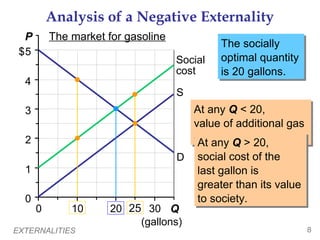

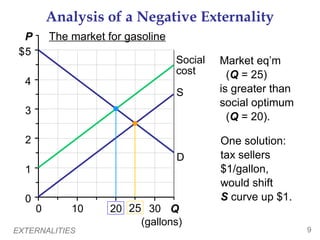

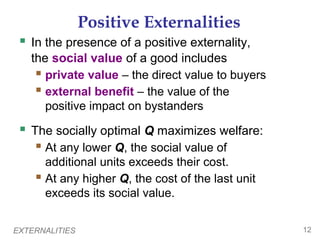

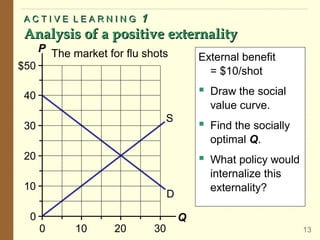

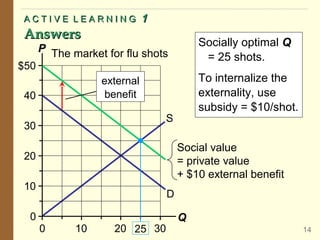

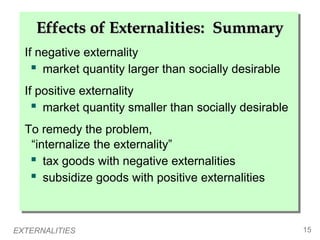

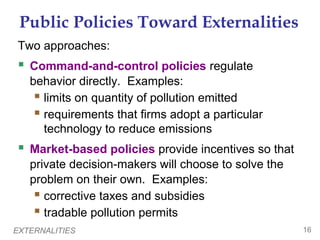

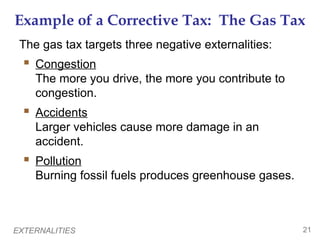

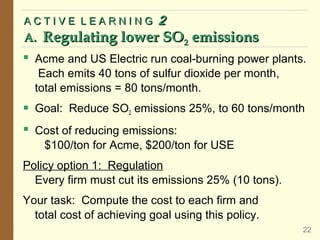

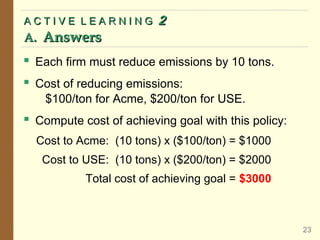

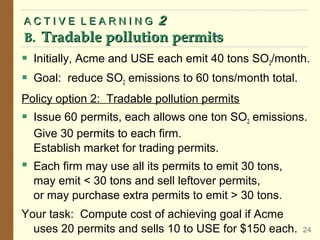

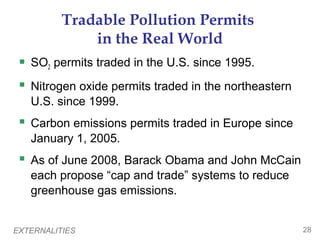

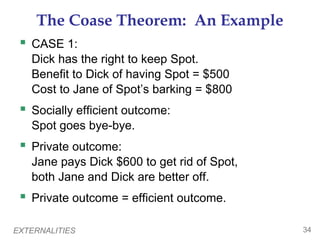

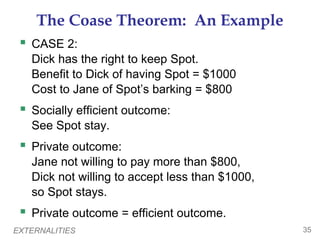

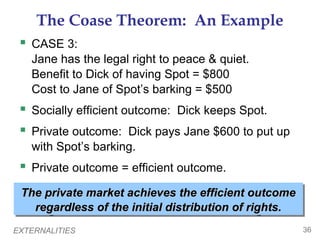

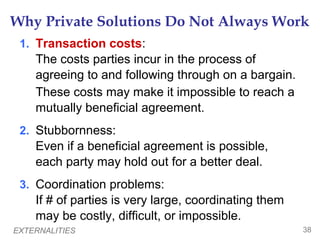

This document discusses externalities, which are uncompensated impacts of one person's actions on another person. It provides examples of negative externalities like pollution and positive externalities like education. It explains that markets fail to allocate resources efficiently when externalities are present. To remedy this, governments can implement corrective taxes on negative externalities and subsidies for positive externalities to align private incentives with social welfare. Alternatively, tradable pollution permits can achieve pollution reduction goals at lower cost than regulations. While private solutions may work in theory, in practice externalities are often best addressed through public policy.