This document provides an overview of bookkeeping concepts including:

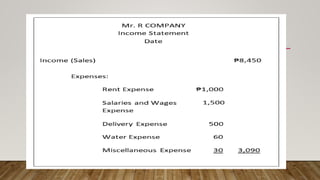

- Chart of accounts which lists account names for recording transactions. Common sections include assets, liabilities, equity, income and expenses.

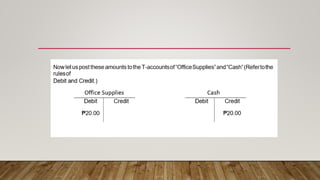

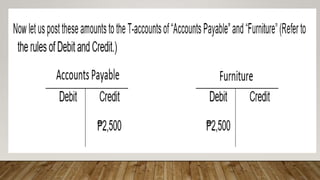

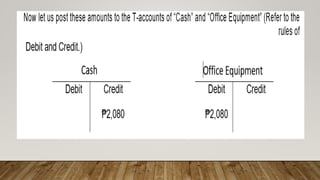

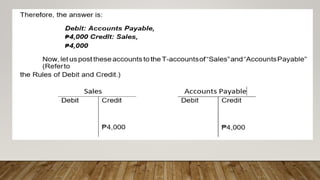

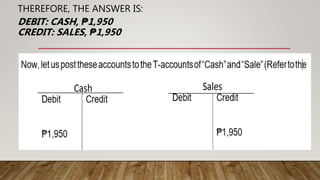

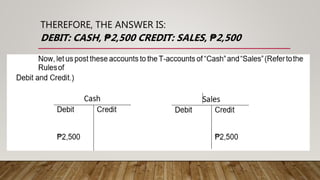

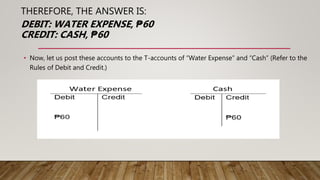

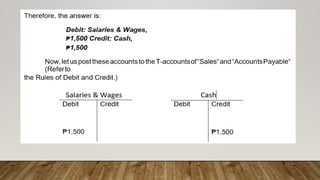

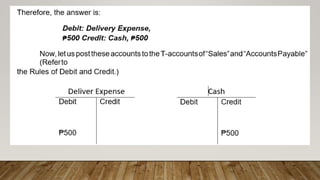

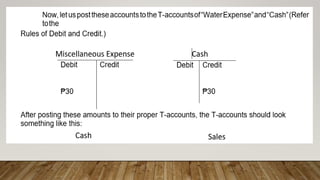

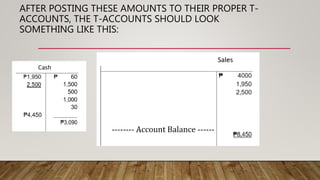

- T-accounts which are used to record changes to account balances, with debits on the left and credits on the right.

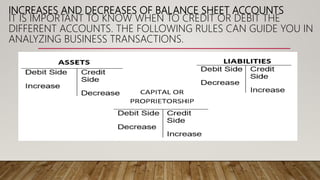

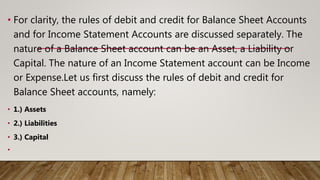

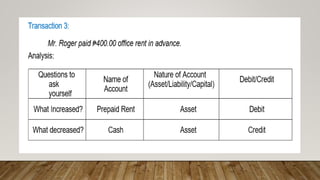

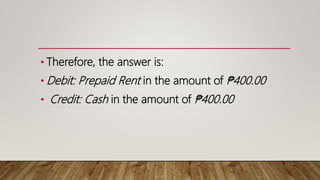

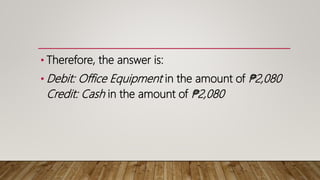

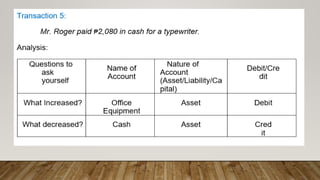

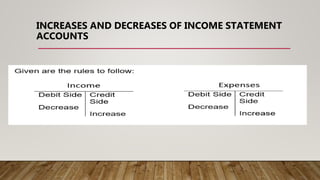

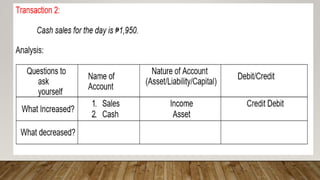

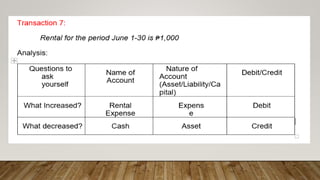

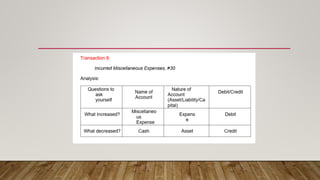

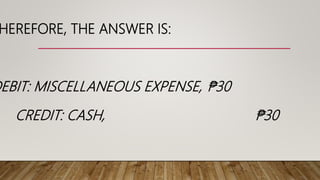

- Rules of debit and credit which specify whether increases and decreases to different types of accounts are recorded as debits or credits. For assets, increases are debits and decreases are credits.

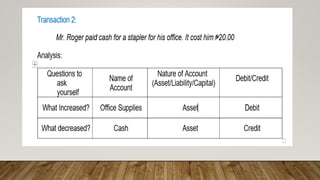

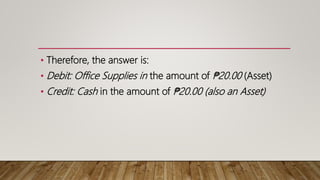

Several examples then demonstrate how to analyze transactions and apply debits and credits to the appropriate T-accounts.