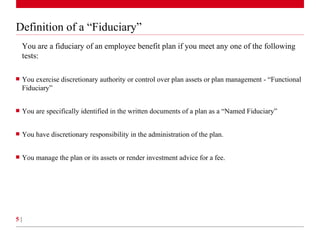

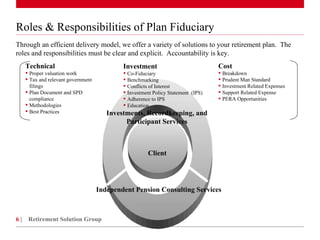

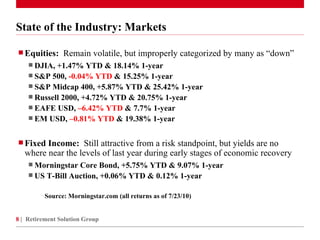

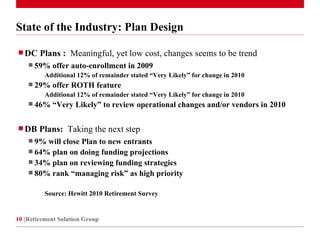

The document summarizes the state of the qualified retirement plan space in mid-2010. It discusses that markets have been volatile but not truly down for the year. Legislative changes have increased oversight and fee disclosure requirements. Plan designs are seeing more automatic enrollment and Roth options. The remainder provides case studies on situations involving a participant's market timing, the impact of suspending safe harbor contributions, and implementing a carve-out plan design. It encourages analyzing plans for customization and fiduciary support.