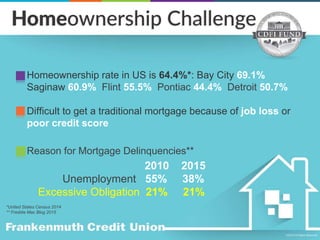

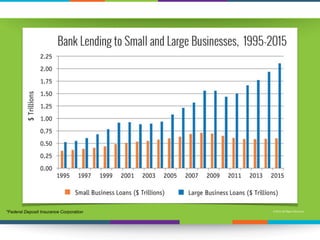

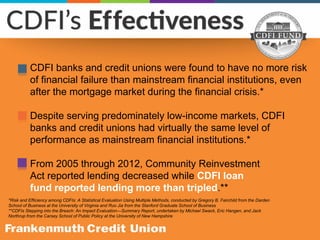

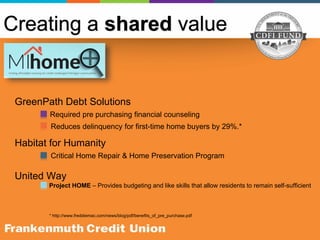

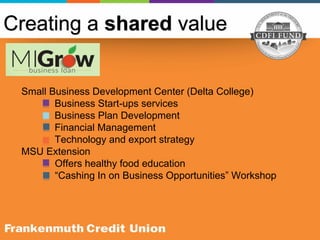

Community Development Financial Institutions (CDFIs) such as banks, credit unions, and loan funds strive to foster economic opportunity and revitalize low-income neighborhoods by providing financing to support families' first homes, small businesses, and community centers. The US Treasury Department manages the CDFI Fund, which provides targeted funds to help low-income areas and certified CDFIs. Frankenmuth Credit Union uses these funds to offer innovative financing programs like their MIhome Mortgage program that provides flexible home loans in underserved areas and their MIGrow Business Loan program for startups and expansions of farmers markets and groceries in food deserts.