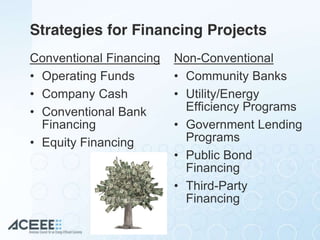

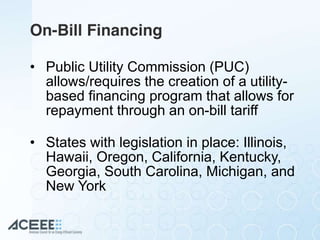

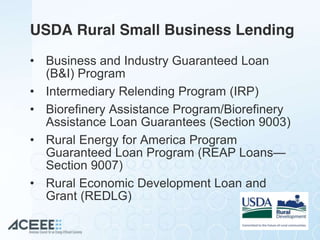

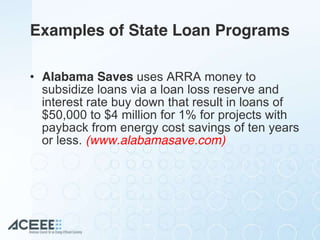

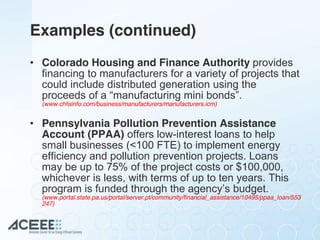

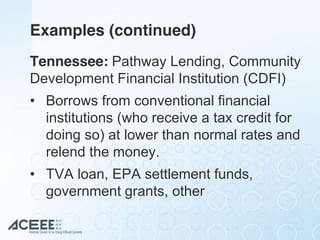

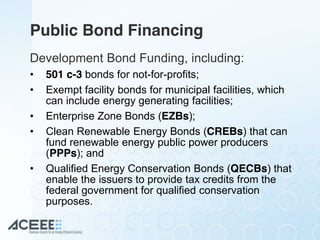

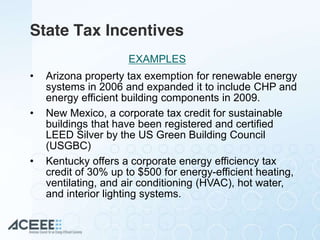

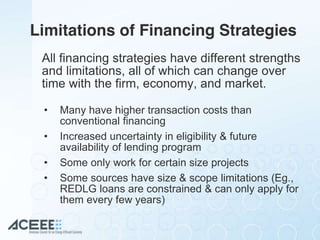

This document discusses various strategies for financing industrial energy efficiency and combined heat and power projects. It outlines conventional financing options like operating funds, company cash, and bank loans. It also describes non-conventional options such as loans from community banks and utilities, government lending programs, public bonds, and third-party financing like performance contracting. Specific programs are highlighted from the USDA, state governments, and other sources. Challenges with different financing strategies are also noted.