The document provides information about the Reserve Bank of India (RBI):

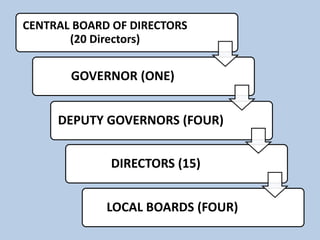

1. It establishes that RBI is the central bank of India, founded in 1934 and headquartered in Mumbai. Its governor is the executive head.

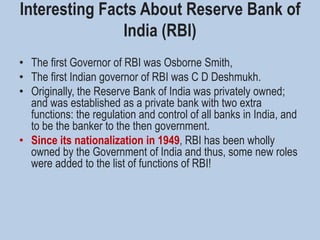

2. RBI was originally privately owned but was nationalized in 1949. It has since been wholly owned by the Government of India.

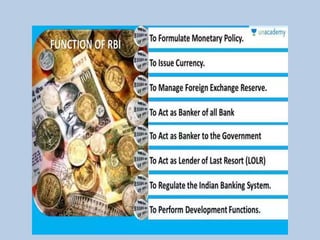

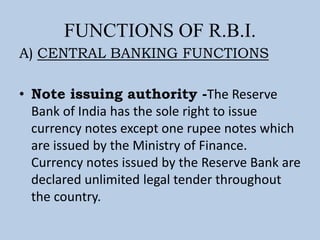

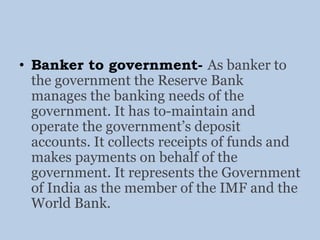

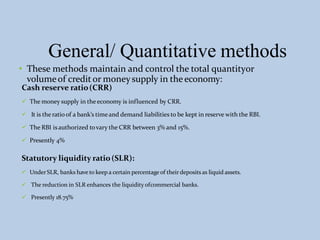

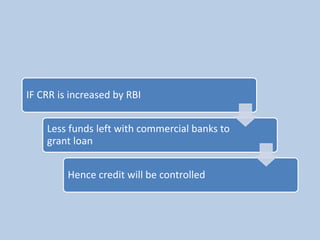

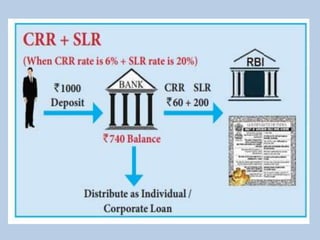

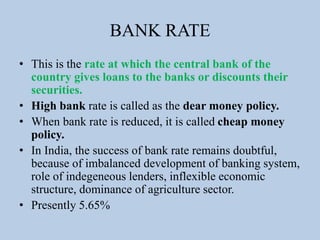

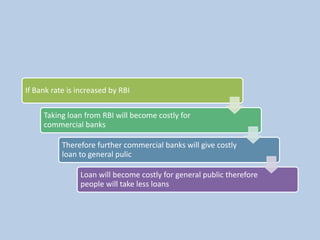

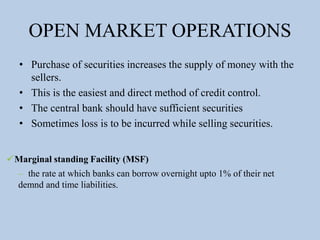

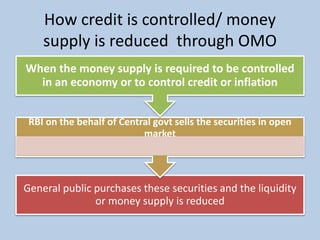

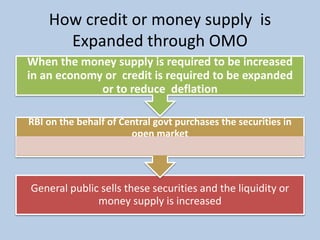

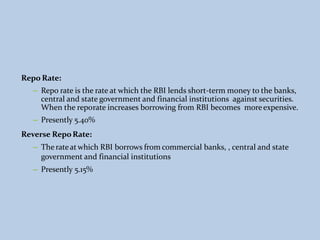

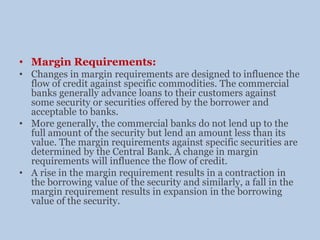

3. RBI's functions include acting as the banker to the government, regulating money supply and credit in the economy through various monetary policy tools, and supervising other banks in India.

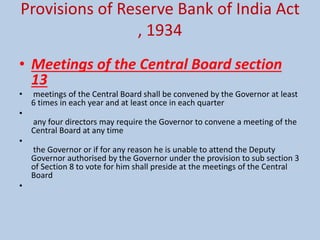

![Provisions of Reserve Bank of India Act

, 1934

• Section 6 in The Reserve Bank of India Act,

1934

• . Offices, branches and agencies.—The Bank

shall, as soon as may be, establish offices in

MUMBAI, KOLKATA, Delhi and chennai and

may establish branches or agencies in any

other place in India or, with the previous

sanction of the [Central Government]

elsewhere,](https://image.slidesharecdn.com/1rbiautosaved-230111172953-6cf28559/85/1-RBI-related-pptx-49-320.jpg)