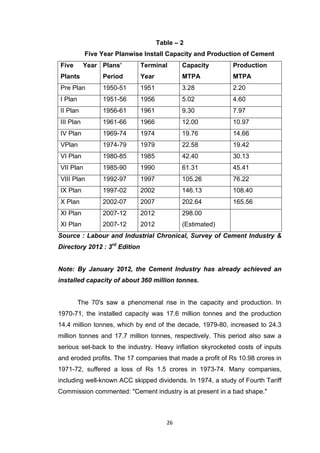

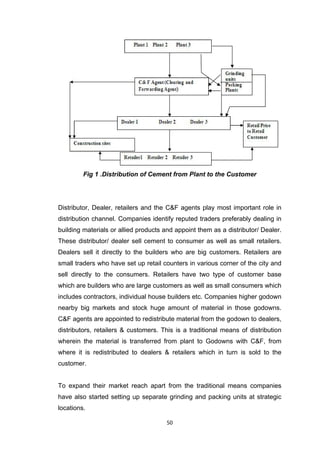

This document provides an overview of the cement industry in India. It discusses the history and development of the industry from its beginnings in 1914 with a single 1000 tonne plant. It traces the industry's growth over the decades as more plants were established and capacity increased. Key milestones and events discussed include the formation of the Indian Cement Manufacturers Association in 1925 and growth supported by Five Year Plans. Tables provide statistical data on leading cement companies, installed capacity and production over time, and the current distribution of major plants by state.