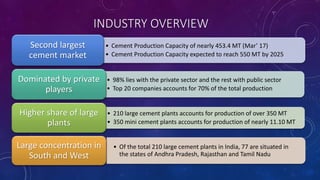

The Indian cement industry, with a production capacity of 453.4 million tons as of March 2017, is projected to reach 550 million tons by 2025, primarily dominated by private sector players. Top companies, including Ultratech and ACC, hold significant market shares amidst high competitive rivalry and moderate supplier bargaining power. Future growth is anticipated due to government initiatives in housing and infrastructure, despite current stagnation linked to economic policies.