The document provides an overview of time series econometrics concepts including:

1) Time series econometrics analyzes the dynamic structure and interrelationships over time in economic data. It examines stationary and non-stationary stochastic processes.

2) A time series is stationary if its mean, variance, and autocovariance remain constant over time. A random walk process is a type of non-stationary process where the variable fluctuates around a stochastic trend.

3) The document discusses key time series econometrics models and techniques including unit root tests, vector autoregressive models, causality tests, cointegration, and error correction models.

![(b) has a finite variance that is time-invariant;

and

(c) has a theoretical correlogram that diminishes

as the lag length increases.

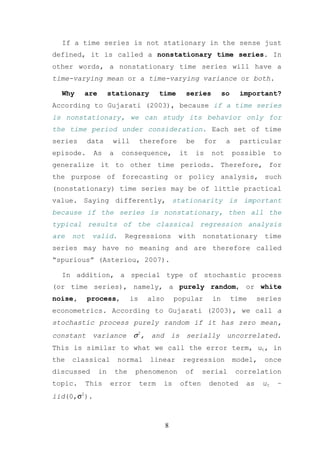

In its simplest terms a time series Yt is said to be

weakly stationary (hereafter refer to stationary) if:

(a) Mean: E(Yt) = µ (constant for all t);

(b) Variance: Var(Yt) = E(Yt-µ)2 = σ2 (constant for

all t); and

(c) Covariance: Cov(Yt,Yt+k) = γk = E[(Yt-µ)(Yt+k-µ)]

where γk, covariance (or autocovariance) at lag k,is

the covariance between the values of Yt and Yt+k, that

is, between two Y values k periods apart. If k = 0, we

obtain γ0, which is simply the variance of Y (=σ2); if

k = 1, γ1 is the covariance between two adjacent values

of Y.

Suppose we shift the origin of Y from Yt to Yt+m

(say, from the first quarter of 1970 to the first

quarter of 1975 for our GDP data). Now, if Yt is to be

stationary, the mean, variance, and autocovariance of

Yt+m must be the same as those of Yt. In short, if a

time series is stationary, its mean, variance, and

autocovariance (at various lags) remain the same no

matter at what point we measure them; that is, they

are time invariant. According to Gujarati (2003), such

time series will tend to return to its mean (called

mean reversion) and fluctuations around this mean

(measured by its variance) will have a broadly

constant amplitude.

7](https://image.slidesharecdn.com/causalitymodels-121015014433-phpapp01/85/Causality-models-7-320.jpg)

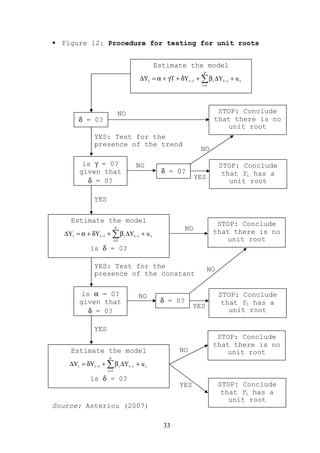

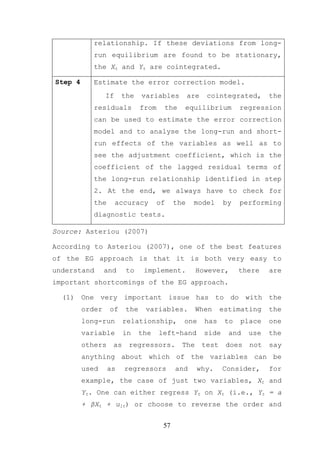

![model and moving to the next model. This procedure is

illustrated in Figure 12. It needs to be stressed here

that, although useful, this procedure is not designed

to be applied in a mechanical fashion. Plotting the

data and observing the graph is sometimes very useful

because it can clearly indicate the presence or not of

deterministic regressors. However, this procedure is

the most sensible way to test for unit roots when the

form of the data-generating process is unknown.

In practical studies, researchers use both the ADF

and the Phillips-Perron (PP) tests21. Because the

distribution theory that supporting the Dickey-Fuller

tests is based on the assumption of random error terms

[iid(0,σ2)], when using the ADF methodology we have to

make sure that the error terms are uncorrelated and

they really have a constant variance. Phillips and

Perron (1988) developed a generalization of the ADF

test procedure that allows for fairly mild assumptions

concerning the distribution of errors. The regression

for the PP test is similar to equation (15).

∆Yt = α + δYt-1 + et (20)

While the ADF test corrects for higher order serial

correlation by adding lagged differenced terms on the

right-hand side of the test equation, the PP test

makes a correction to the t statistic of the

coefficient δ from the AR(1) regression to account for

the serial correlation in et.

21

Eviews has a specific command for these tests.

32](https://image.slidesharecdn.com/causalitymodels-121015014433-phpapp01/85/Causality-models-32-320.jpg)

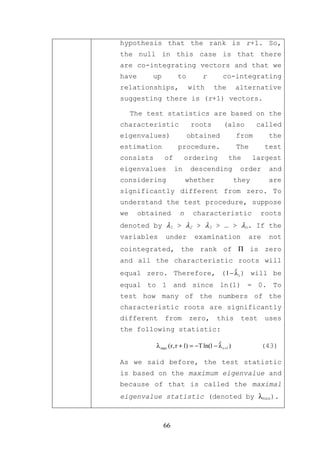

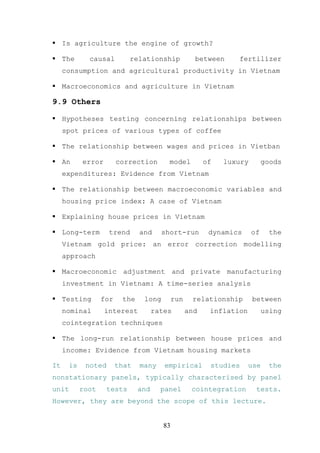

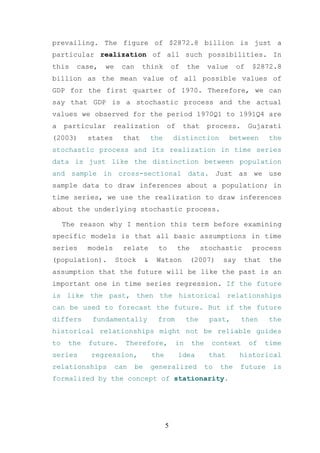

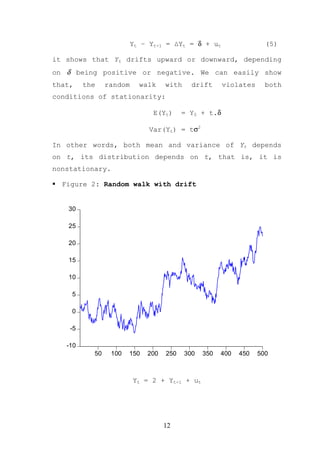

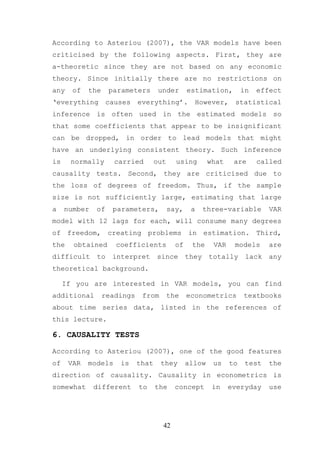

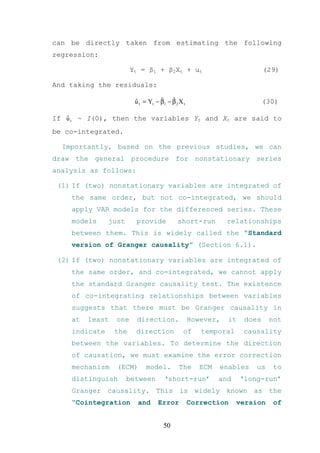

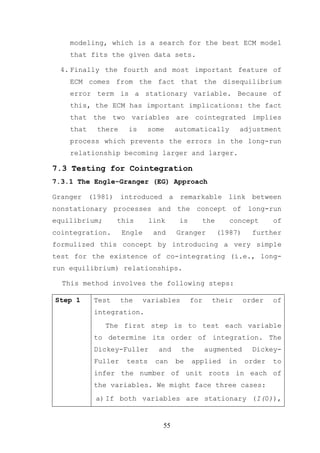

![where we assume that both Yt and Xt are stationary and

uyt and uxt are uncorrelated white-noise error terms.

These equations are not reduced-form equations since

Yt has a contemporaneous impact on Xt, and Xt has a

contemporaneous impact on Yt. The illustrative example

is presented in Figure 15 (open the file VAR.wf1).

Figure 15: An illustration of VAR in Eviews

Vector Autoregression Estimates

Date: 02/20/10 Time: 15:46

Sample (adjusted): 1975Q3 1997Q4

Included observations: 90 after adjustments

Standard errors in ( ) & t-statistics in [ ]

GDP M2

GDP(-1) 1.230362 -0.071108

(0.10485) (0.09919)

[11.7342] [-0.71691]

GDP(-2) -0.248704 0.069167

(0.10283) (0.09728)

[-2.41850] [0.71103]

M2(-1) 0.142726 1.208942

(0.11304) (0.10693)

40](https://image.slidesharecdn.com/causalitymodels-121015014433-phpapp01/85/Causality-models-40-320.jpg)

![[1.26267] [11.3063]

M2(-2) -0.087270 -0.206244

(0.11599) (0.10972)

[-0.75237] [-1.87964]

C 4.339620 8.659425

(3.02420) (2.86077)

[1.43497] [3.02696]

R-squared 0.999797 0.998967

Adj. R-squared 0.999787 0.998918

Sum sq. resids 6000.811 5369.752

S.E. equation 8.402248 7.948179

F-statistic 104555.2 20543.89

Log likelihood -316.6973 -311.6972

Akaike AIC 7.148828 7.037716

Schwarz SC 7.287707 7.176594

Mean dependent 967.0556 509.1067

S.D. dependent 576.0331 241.6398

Determinant resid covariance 4459.738

Determinant resid covariance 3977.976

Log likelihood -628.3927

Akaike information criterion 14.18650

Schwarz criterion 14.46426

According to Asteriou (2007), the VAR model has some

good characteristics. First, it is very simple because

we do not have to worry about which variables are

endogenous or exogenous. Second, estimation is very

simple as well, in the sense that each equation can be

estimated with the usual OLS method separately. Third,

forecasts obtained from VAR models are in most cases

better than those obtained from the far more complex

simultaneous equation models (see Mahmoud, 1984;

McNees, 1986). Besides forecasting purposes, VAR

models also provide framework for causality tests,

which will be presented shortly in the next section.

However, on the other hand the VAR models have faced

severe criticism on various different points.

41](https://image.slidesharecdn.com/causalitymodels-121015014433-phpapp01/85/Causality-models-41-320.jpg)

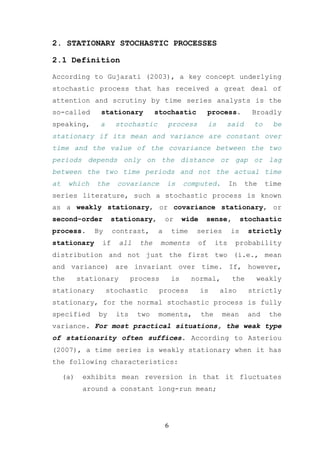

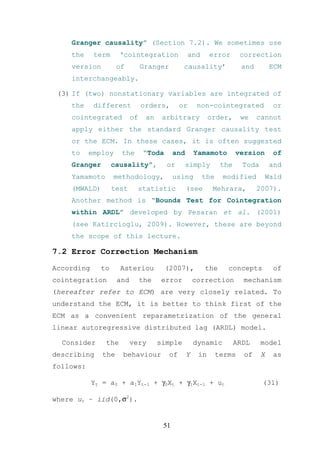

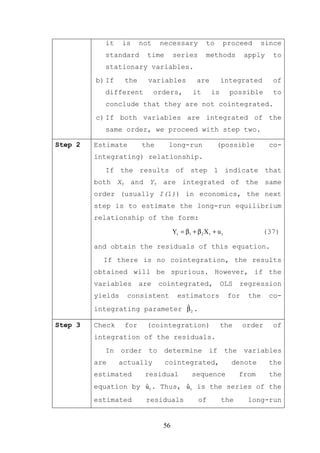

![In this model24, the parameter γ0 denotes the short-

run reaction of Yt after a change in Xt. The long-run

effect is given when the model is in equilibrium

where:

Yt* = β 0 + β1 X *

t (32)

and for simplicity, we assume that:

X * = X t = X t −1 = ... = X t − p

t (33)

From (31), (32), and (33), we have:

Yt* = a 0 + a 1Yt* + γ 0 X * + γ 1X * + u t

t t

Yt* (1 − a 1 ) = a 0 + ( γ 0 + γ 1 )X * + u t

t

a0 γ + γ1 *

Yt* = + 0 Xt + u t

1 − a1 1 − a1

Yt* = β 0 + β1 X * + u t

t (34)

Therefore, the long-run elasticity between Y and X is

captured by β1=(γ0+γ1)/(1-a1). It is noted that, we need

to make the assumption that a1 < 1 (why?) in order

that the short-run model (31) converges to a long-run

solution.

The ECM can be rewritten as follows:

∆Yt = γ0∆Xt – (1-a)[Yt-1 – β0 – β1Xt-1] + ut (35)

∆Yt = γ0∆Xt – π[Yt-1 – β0 – β1Xt-1] + ut (36)

(please show that the ECM model (35) is the same as

the original model (31)?)

24

We can easily expand this model to a more general case for large numbers of lagged terms.

52](https://image.slidesharecdn.com/causalitymodels-121015014433-phpapp01/85/Causality-models-52-320.jpg)

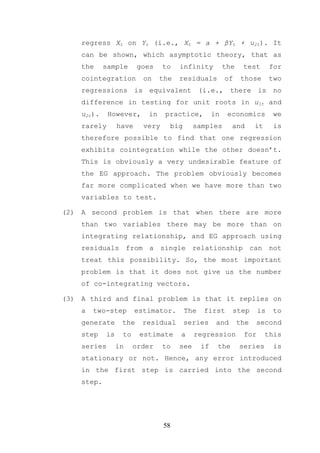

![mean that the variables in the model might form

several equilibrium relationships. In general, for n

number of variables, we can have only up to n-1 co-

integrating vectors.

Having n > 2 and assuming that only one co-

integrating relationship exists, where there are

actually more than one, is a very serious problem that

cannot be resolved by the EG single-equation approach.

Therefore, an alternative to the EG approach is needed

and this is the Johansen approach26 for multiple

equations.

In order to present this approach, it is useful to

extend the single-equation error correction model to a

multivariate one. Let’s assume that we have three

variables, Yt, Xt and Wt, which can all be endogenous,

i.e., we have that (using matrix notation for Zt =

[Yt,Xt,Wt])

Zt = A1Zt-1 + A2Zt-2 + … + AkZt-k + ut (37)

which is comparable to the single-equation dynamic

model for two variables Yt and Xt given in (31). Thus,

it can be reformulated in a vector error correction

model (VECM) as follows:

∆Zt = Γ1∆Zt-1 + Γ2∆Zt-2 + … + Γk-1∆Zt-k-1 + ΠZt-1 + ut (38)

where the matrix Π contains information regarding the

long-run relationships. We can decompose Π = αβ’ where

α will include the speed of adjustment to equilibrium

26

For clearer, please read Li, X. (2001) ‘Government Revenue, Government Expenditure, and Temporal

Causality: Evidence from China’, Applied Economics, Vol.33, pp.485-497.

60](https://image.slidesharecdn.com/causalitymodels-121015014433-phpapp01/85/Causality-models-60-320.jpg)

![coefficients, while β’ will be the long-run matrix of

coefficients.

Therefore, the β’Zt-1 term is equivalent to the error

correction term (Yt-1 – β0 – β1Xt-1) in the single-

equation case, except that now β’Zt-1 contains up to (n

– 1) vectors in a multivariate framework.

For simplicity, we assume that k = 2, so that we

have only two lagged terms, and the model is then the

following:

∆Yt ∆Yt −1 Yt −1

∆X t = Γ1 ∆X t −1 + Π X t −1 + e t (38)

∆W W

∆Wt t −1 t −1

or

∆Yt ∆Yt −1 α11 α 12 Y

β11 β 21 β 31 t −1

∆X t = Γ1 ∆X t −1 + α 21 α 22

X t −1 + e t

(39)

∆W ∆W α α β12 β 22 β 32 W

t t −1 31 32 t −1

Let us now analyse only the error correction part of

the first equation (i.e., for ∆Yt on the left-hand

side) which gives:

Π1Zt-1 = ([α11β11 + α12β12][α11β21 + α12β22]

Yt −1

[α11β31 + α12β32]) X t −1 (40)

W

t −1

Equation (40) can be rewritten as:

Π1Zt-1 = α11(β11Yt-1 + β21Xt-1 + β31Wt-1) +

α12(β12Yt-1 + β22Xt-1 + β32Wt-1) (41)

61](https://image.slidesharecdn.com/causalitymodels-121015014433-phpapp01/85/Causality-models-61-320.jpg)