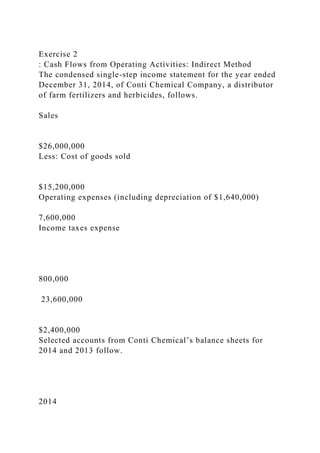

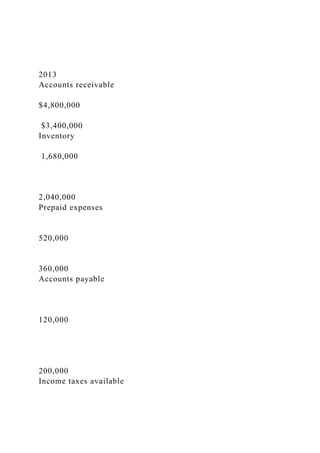

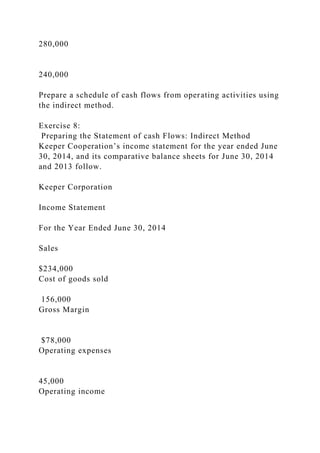

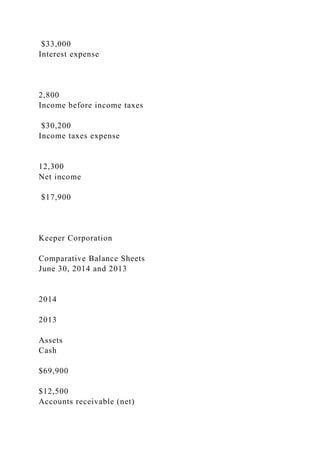

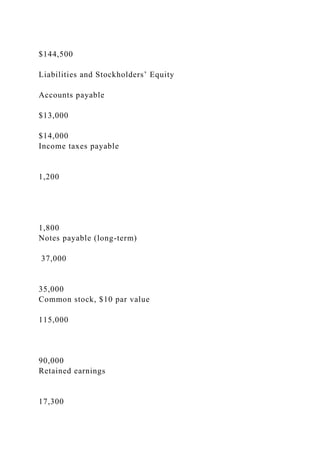

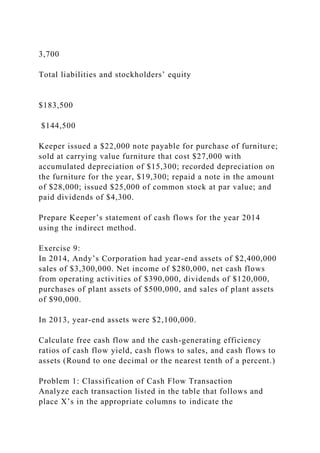

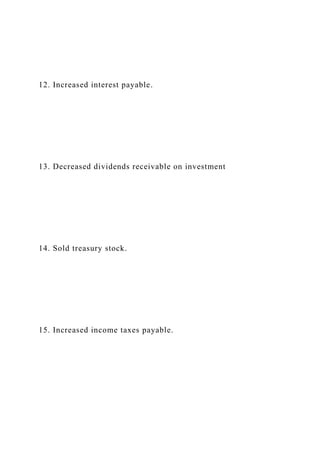

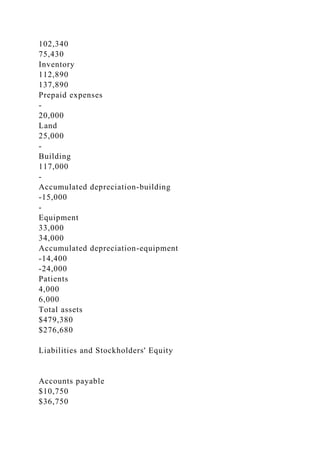

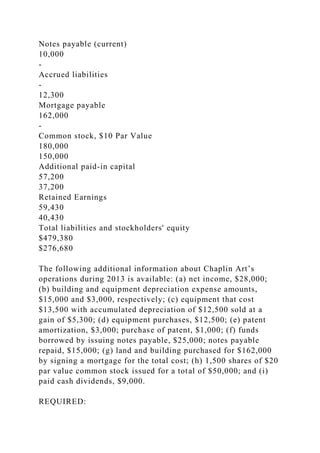

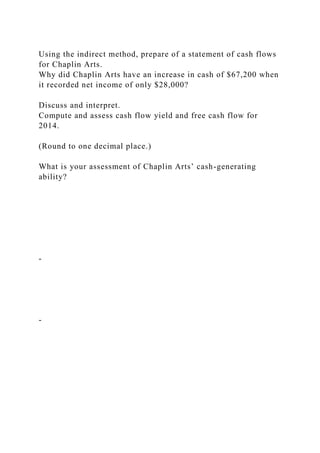

The document outlines exercises for calculating cash flows using the indirect method, focusing on the financial data from various companies for specified periods. It includes income statements, balance sheets, and additional information necessary to prepare statements of cash flows and analyze related metrics. Topics covered include free cash flow calculations, classifications of cash flow transactions, and assessments of cash-generating efficiency.