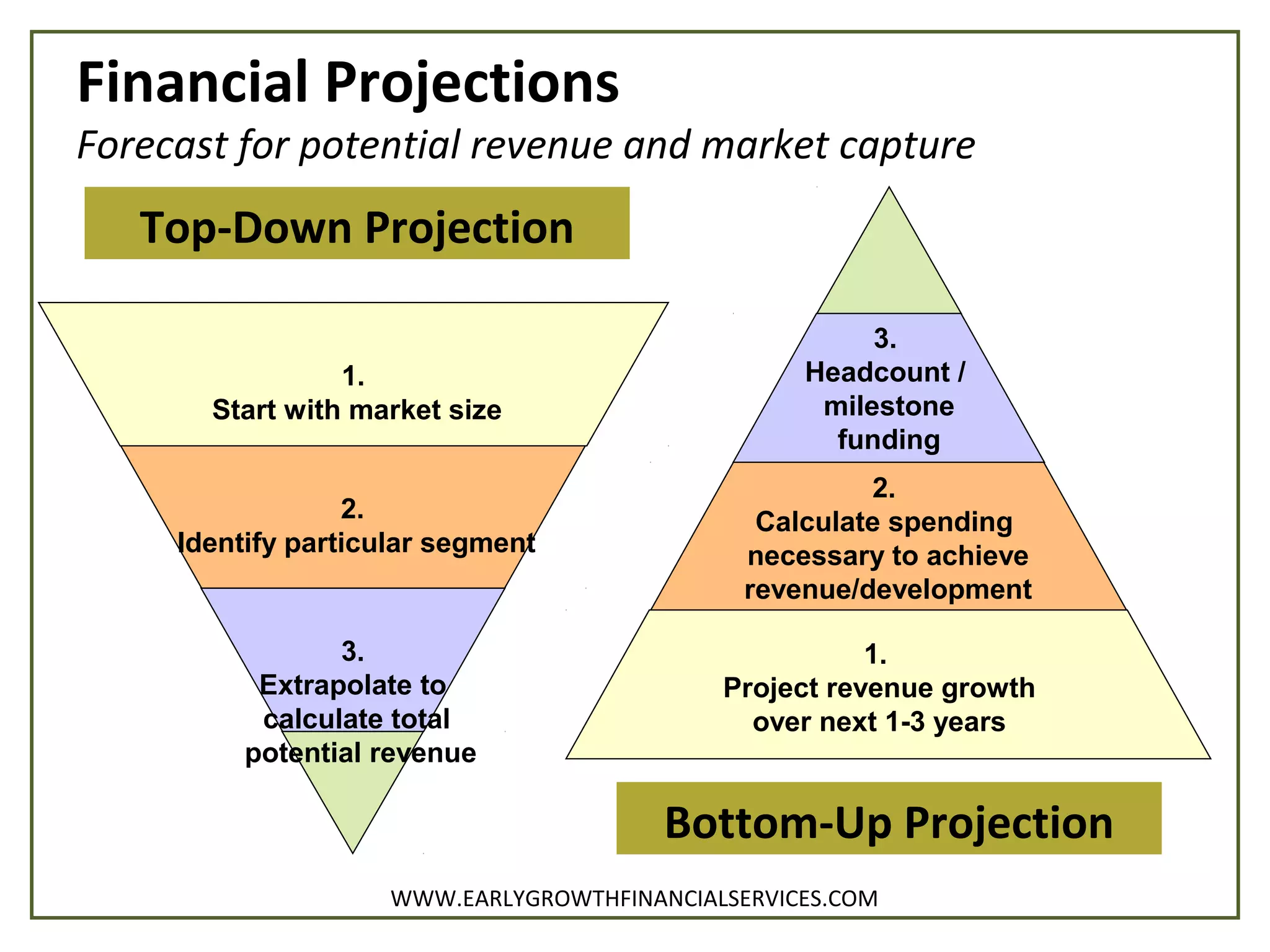

The document provides guidance on setting up accounting for startups, emphasizing the importance of establishing an early, simple, and scalable accounting system. It covers pre-funding and post-funding financial strategies, highlighting aspects like expense tracking, cash flow management, and tax obligations. The document also discusses the significance of financial projections and reporting to aid in business growth and investor relations.