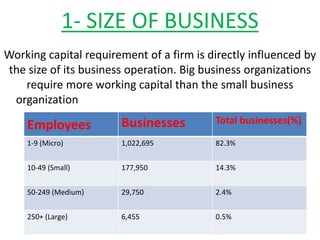

The key determinants of working capital requirements for a business include: the size of the business, with larger businesses needing more working capital; the nature of the business, with manufacturing and trading typically requiring more than services; seasonal requirements in some industries; credit terms given to customers and required for suppliers; potential for business growth; and changes in price levels that impact inventory needs. Operational efficiency and working capital cycles also influence how much capital is needed on hand for daily business operations.