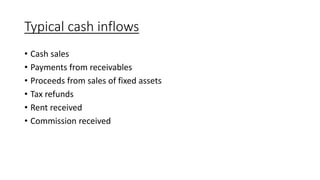

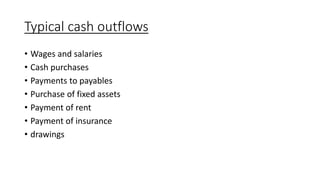

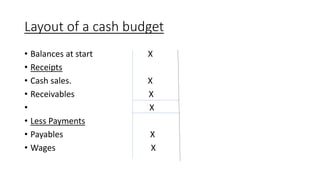

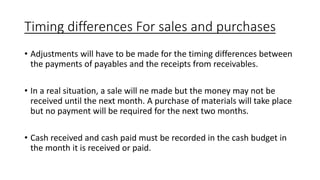

This document provides an overview of budgets and cash budgeting for a business. It defines what a budget is and lists important budgeting terms. It discusses factors to consider when preparing budgets, such as objectives and limiting factors. It describes the uses of budgets, including formalizing plans, coordination between departments, and improving management commitment. The document outlines the preparation of functional budgets for different departments and lists common types. It details the purpose and components of a cash budget, including typical cash inflows and outflows, and addresses timing differences between sales/purchases and associated cash flows.