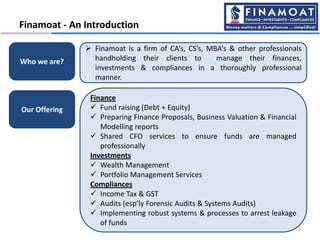

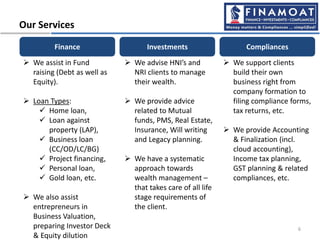

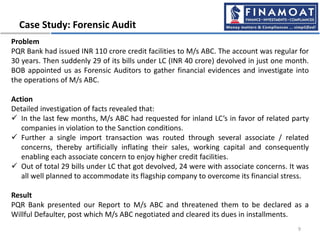

This document provides an introduction and overview of Finamoat, a firm that offers professional services related to finance, investments, and compliance for clients. It describes Finamoat's vision of adding value to over 500 clients by 2021 by professionally managing their finances, investments, and ensuring regulatory compliance. The document includes case studies demonstrating Finamoat's work in areas like equity fundraising, wealth management, forensic audits, and business structuring. It also provides brief profiles of the management team and services offered.