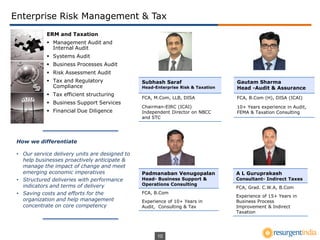

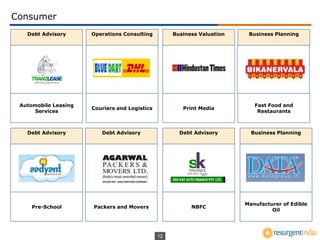

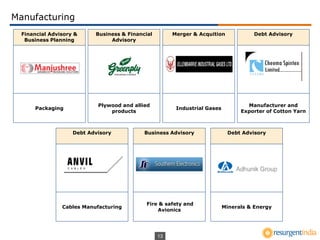

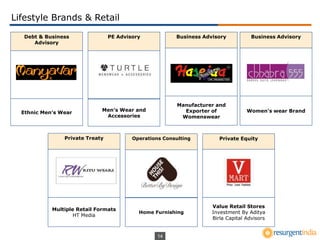

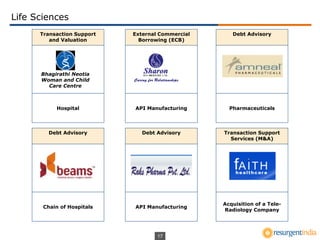

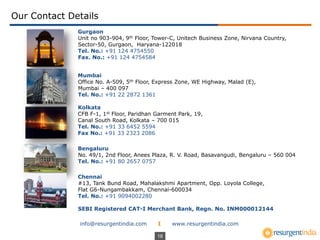

This document provides an overview of an investment bank and SEBI registered merchant bank called Resurgent. It offers various services including mergers and acquisitions, private equity, debt solutions, and enterprise risk management. The document highlights that Resurgent has over 100 professionals, has closed over 120 transactions totaling over $500 million, and has offices across multiple cities in India. It also provides details on its various service offerings and teams as well as examples of select transactions it has completed in sectors such as consumer, manufacturing, infrastructure, and life sciences.