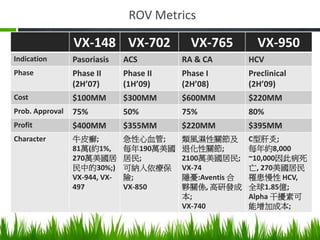

Vertex Pharmaceuticals is evaluating its R&D portfolio and must decide which projects to advance in development. The portfolio includes projects for pasoriasis (VX-148), acute coronary syndrome (VX-702), rheumatoid arthritis and osteoarthritis (VX-765), and hepatitis C (VX-950). The summary provides details on the development phase, estimated costs, probability of approval, and potential profits for each project.