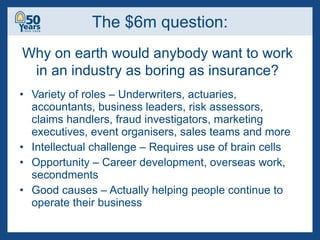

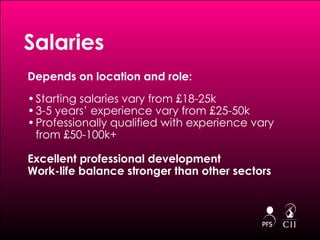

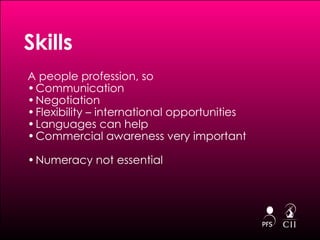

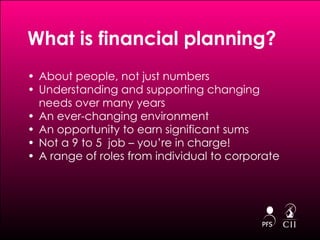

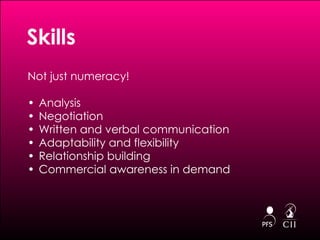

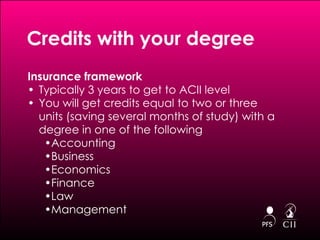

The document discusses careers in the risk and financial planning industries. It provides an overview of the industries, including that they involve assessing and mitigating risk, provide stability, and are growing sectors of the UK economy. It also shares the experiences of two professionals in commercial underwriting and financial planning and outlines the qualifications, skills, and career paths in these fields.

![Great professions with wide range of roles Great opportunities to progress quickly In summary www.insurancecareers.cii.co.uk www.cii.co.uk/www.thepfs.org [email_address]](https://image.slidesharecdn.com/gsharedemploymentandeventseventsemployerpresentationscareersinriskandplanning-100211043557-phpapp01/85/Careers-In-Risk-And-Planning-34-320.jpg)

![New risk-focused website Interactive career builder More case studies, news, blogs Coming up www.discoverrisk.co.uk [email_address] From early Feb](https://image.slidesharecdn.com/gsharedemploymentandeventseventsemployerpresentationscareersinriskandplanning-100211043557-phpapp01/85/Careers-In-Risk-And-Planning-35-320.jpg)