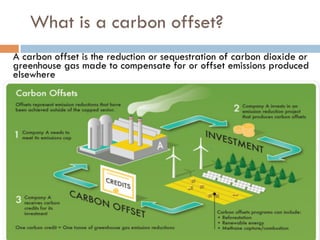

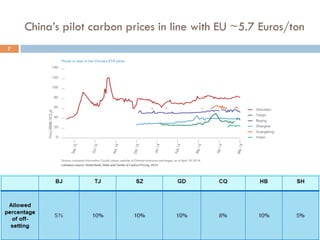

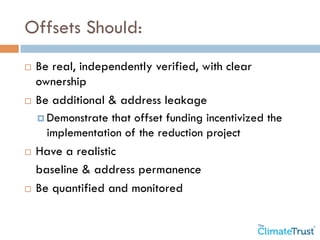

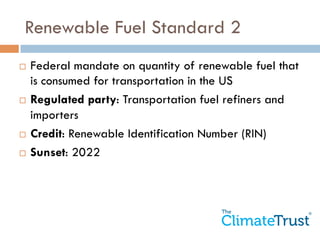

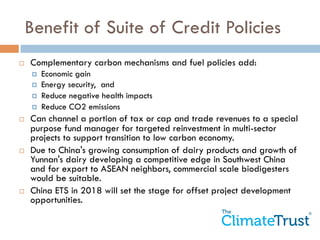

The document discusses carbon offset mechanisms and markets. It provides an overview of The Climate Trust, a carbon fund manager with expertise in developing climate solutions projects. It then summarizes several carbon pricing programs and markets including cap and trade systems in California and China, as well as offset standards and project types. Specific project examples discussed include livestock digesters, forestry, and nutrient management. Pricing data is provided for compliance and voluntary carbon markets.