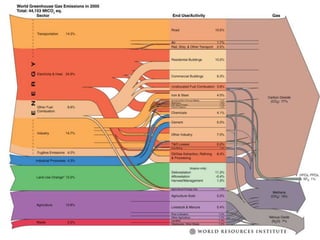

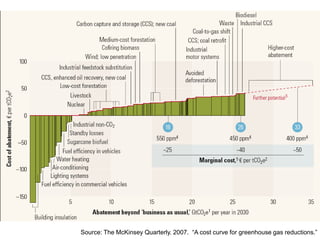

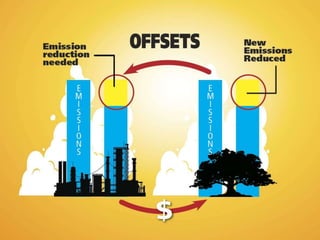

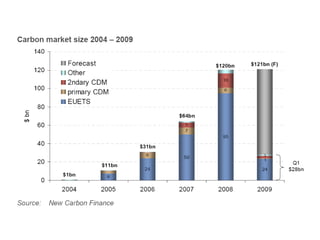

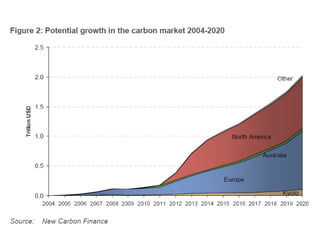

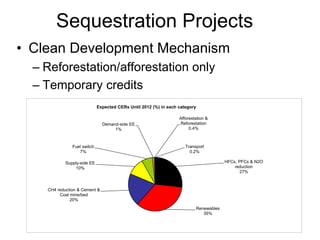

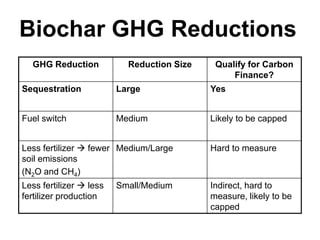

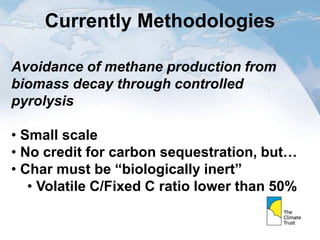

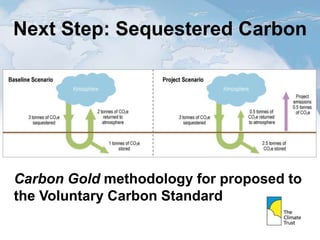

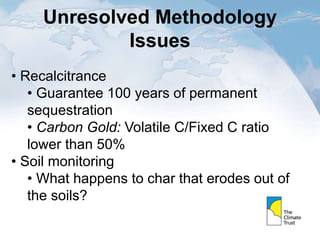

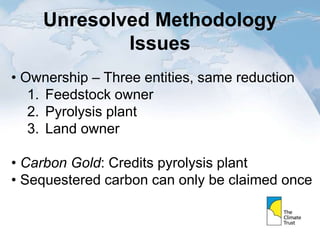

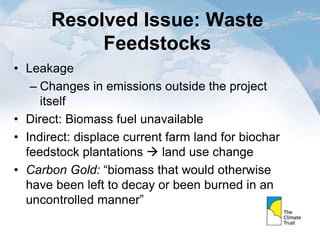

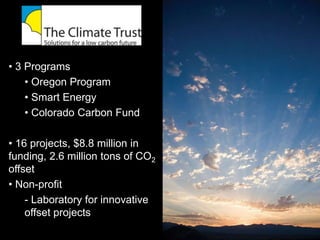

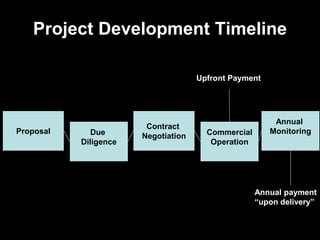

This document discusses how carbon offsets could support biochar projects and some of the methodology issues involved. It outlines the theory behind offsets and trends in the US offset market favoring domestic projects that destroy methane emissions or involve sequestration through forestry or soil management. The document discusses potential greenhouse gas reductions from biochar projects and issues with developing methodologies around ensuring permanent sequestration, ownership, and environmental impacts. It also covers how The Climate Trust currently funds offset projects and the development process involved.