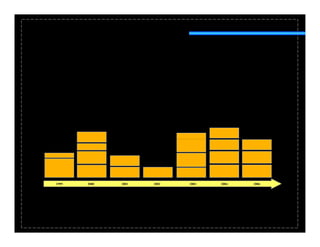

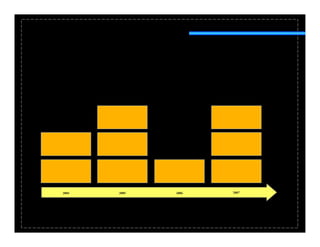

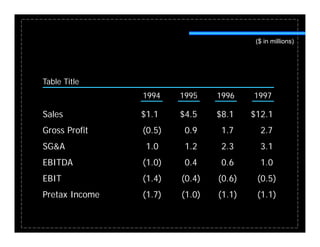

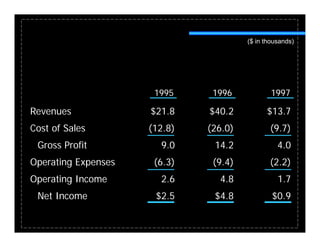

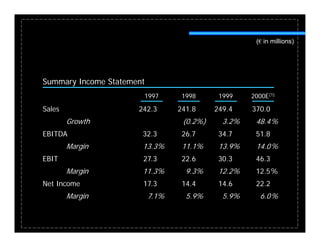

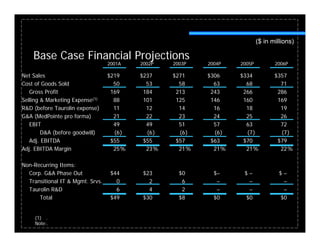

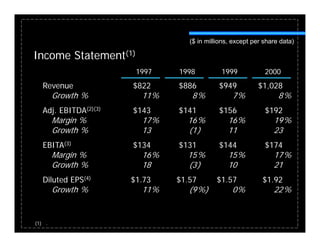

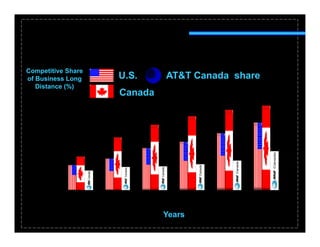

The document contains financial data and projections for several companies from 1994-2007 including income statements, EBITDA, revenues, costs and margins. It also includes diagrams, organizational charts and discusses topics like telecom equipment markets, potential strategic directions, infrastructure, convergence trends and opportunities in various industries.

![ [Text to Come.]](https://image.slidesharecdn.com/portfolioslides-090813223538-phpapp01/85/Portfolio-Slides-3-320.jpg)

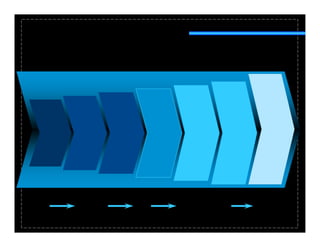

![ [Text to Come]

[ ]

Wide Area Network](https://image.slidesharecdn.com/portfolioslides-090813223538-phpapp01/85/Portfolio-Slides-20-320.jpg)

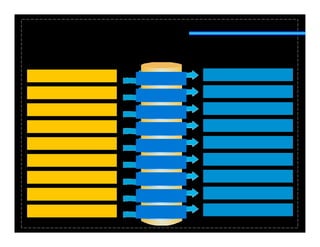

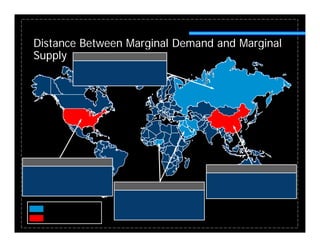

![Technology Investment Banking

Name

Title

Equity Research Strategic Advisory

Name

Title

Name Name

Title Name Title

Title

Name Name

Title Name Title

Title

Equity Capital Markets Equity Capital Markets Services

Name

Title [Logo or Name

Name

Title

Company Name] Title](https://image.slidesharecdn.com/portfolioslides-090813223538-phpapp01/85/Portfolio-Slides-23-320.jpg)

![Convergence Trends [Scott Wanted to Delete]](https://image.slidesharecdn.com/portfolioslides-090813223538-phpapp01/85/Portfolio-Slides-104-320.jpg)