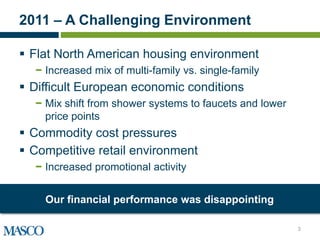

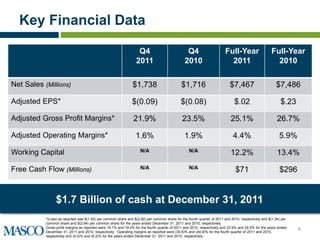

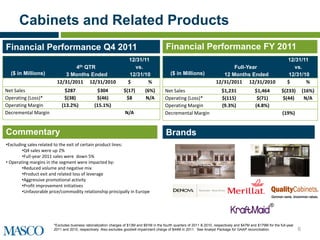

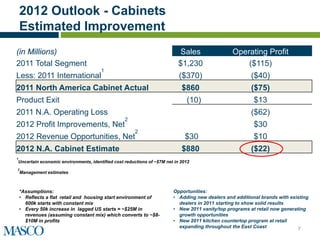

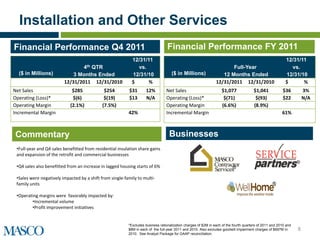

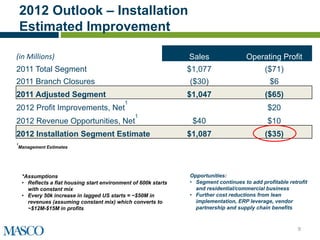

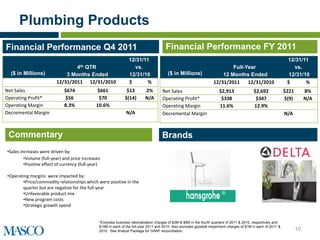

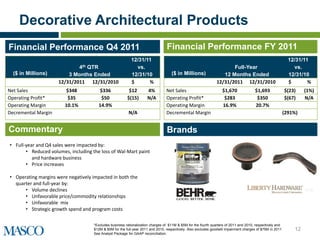

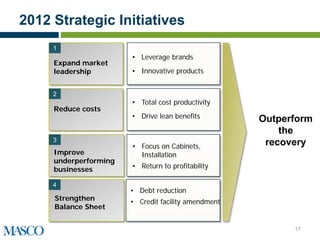

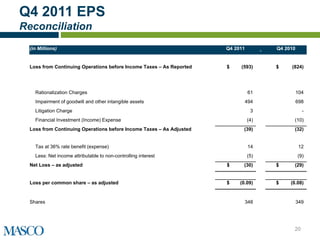

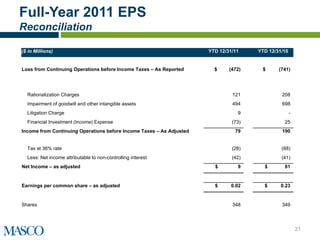

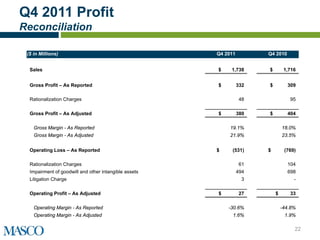

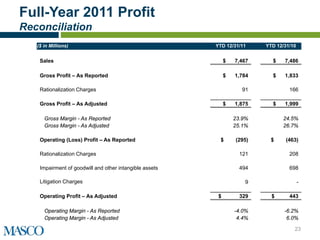

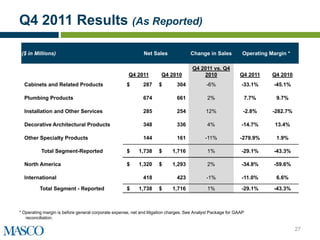

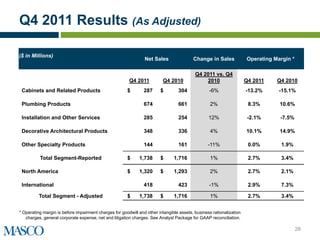

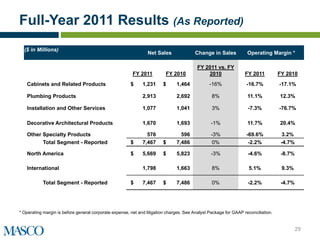

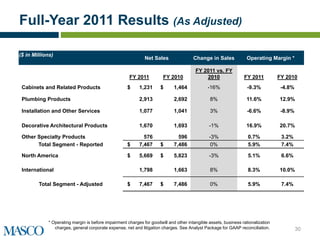

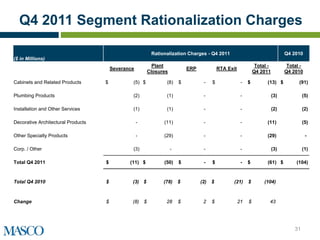

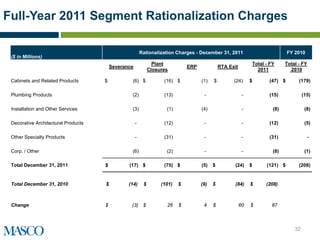

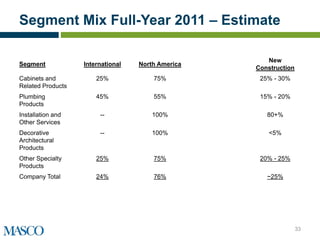

Masco's 2011 financial performance was disappointing due to a challenging environment including a flat housing market, difficult economic conditions in Europe, and commodity cost pressures. Key metrics such as adjusted EPS, margins, and free cash flow declined compared to 2010. Masco took actions in 2011 to reduce costs and rationalize underperforming businesses in order to better position the company for the current environment and future recovery.