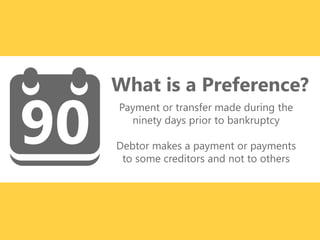

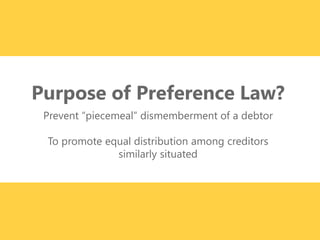

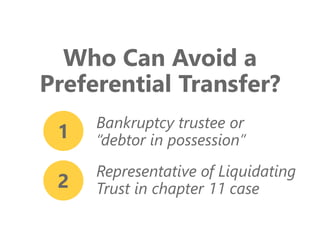

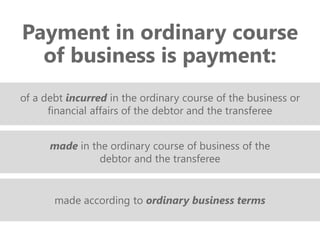

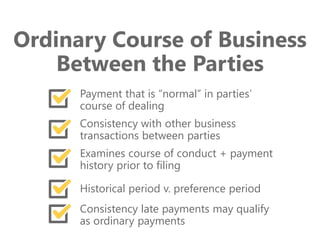

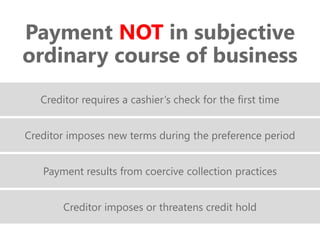

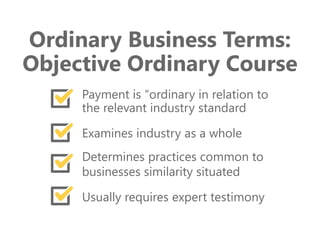

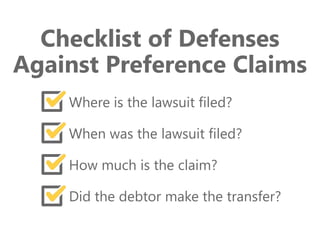

The document outlines the legal concept of preferential transfers in bankruptcy, explaining why they are regulated and how they can be challenged. It details the elements required to establish a preference, the defenses available to creditors, and the importance of maintaining consistent collection practices. Additionally, it provides practical tips for creditors on managing potential preference claims.