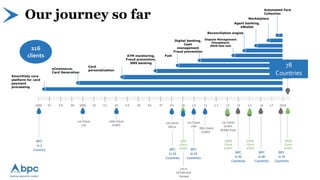

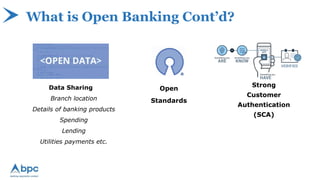

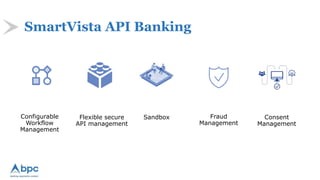

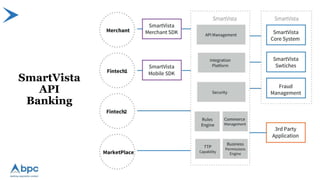

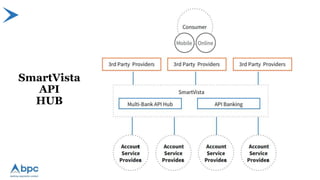

BPC is a global fintech company that provides payments infrastructure and solutions to over 200 clients in 78 countries. Their flagship platform, SmartVista, offers digital banking, payments processing, fraud management, and other solutions powered by APIs, artificial intelligence, and open banking. Open banking is enabling new levels of collaboration in fintech by allowing customers to securely share their financial data with third parties to access improved services. BPC helps banks and other organizations implement open banking through their SmartVista API Banking platform, which includes tools for API management, workflows, consent management, and more.