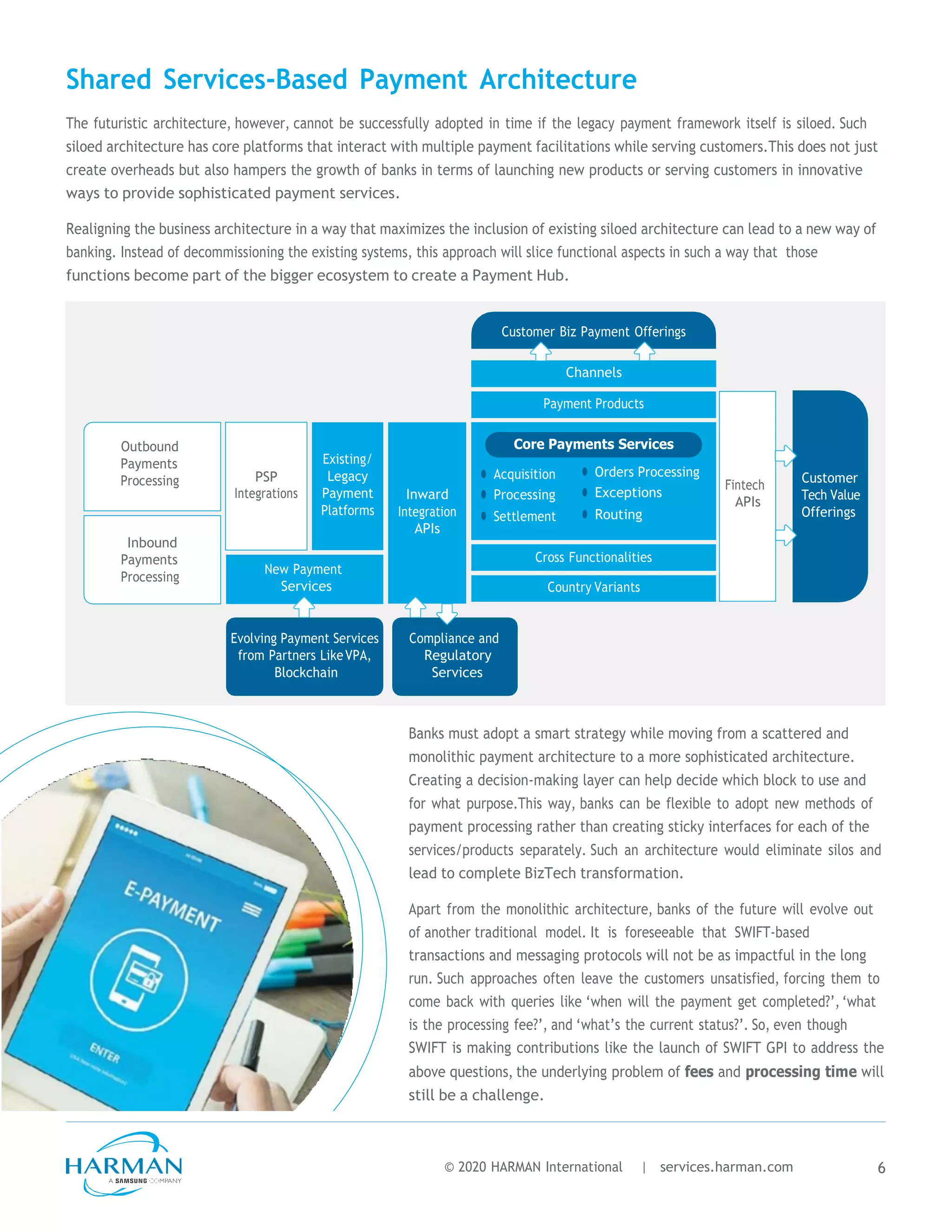

The document discusses the evolution of banks into 'biztech banks' to adapt to the complexities and demands of modern international payments, driven by technological advancements and changing customer expectations. It emphasizes the need for banks to transform their payment architectures by utilizing innovative technology solutions, such as blockchain, to enhance efficiency and customer satisfaction. Harman offers collaboration with financial institutions to streamline this transformation, aiming to create flexible, cost-effective payment solutions in an increasingly digital landscape.