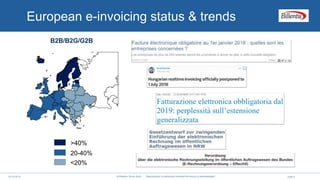

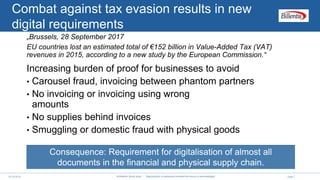

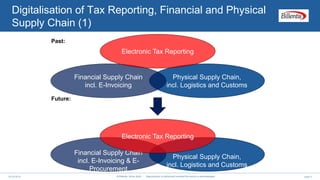

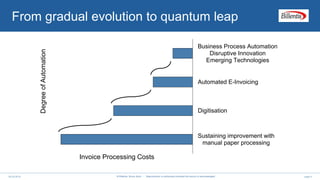

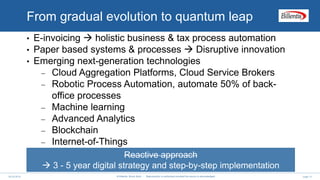

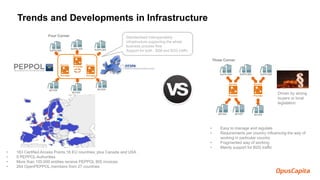

The document discusses the current trends and standards in e-invoicing, highlighting the need for digitalization due to increased taxation compliance requirements in the EU. It emphasizes the transformation from manual to automated systems and introduces new technologies like blockchain and machine learning to enhance efficiency. Additionally, it covers the influence of legislation and local standards on e-invoicing practices across different regions.