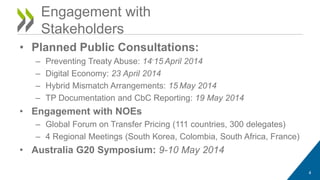

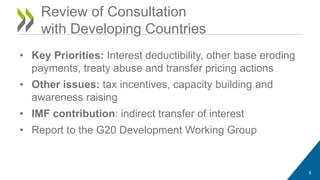

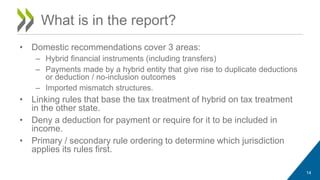

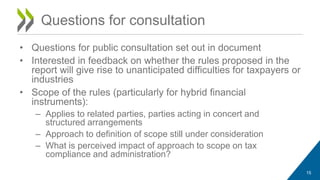

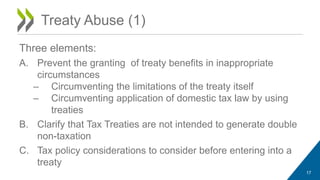

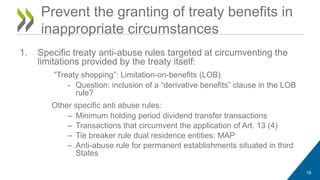

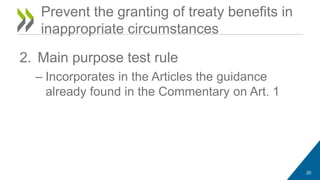

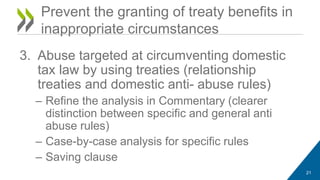

The BEPS project is progressing with several discussion drafts and deliverables planned for 2014, focusing on country-by-country reporting, tax treaty abuse, hybrid mismatches, and the digital economy. Public consultations are scheduled to gather stakeholder feedback on various aspects of the project, including tax challenges specific to the digital economy and anti-abuse rules in tax treaties. Key priorities identified include interest deductibility, treaty abuse, and capacity building for developing countries.