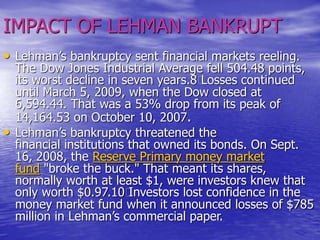

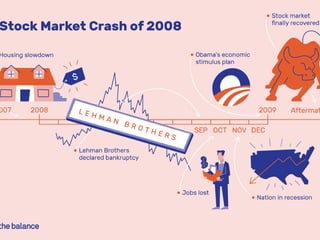

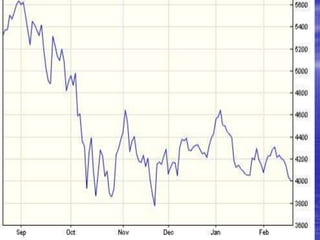

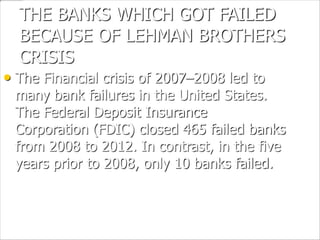

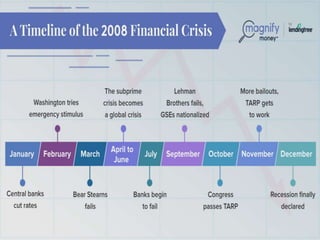

Lehman Brothers was a major global investment bank that filed for bankruptcy in September 2008, contributing to the onset of the late-2000s global financial crisis. Founded in Alabama in 1850, Lehman Brothers grew to become the fourth largest investment bank in the US. However, the bank became heavily involved in subprime mortgage lending and real estate investments, taking on too much risk without sufficient capital or ability to raise cash. When the US housing bubble burst in 2007-2008, Lehman Brothers suffered major losses and lost investor confidence, leading to its bankruptcy filing on September 15, 2008. The collapse sent global financial markets into a tailspin and further deepened the crisis.