The document discusses various topics related to borrowing money, including:

- Things to consider before borrowing, such as whether an item is needed, if the money could be saved up or raised in other ways, and if repayments can be afforded.

- Where people can borrow money from such as banks, building societies, credit unions, and moneylenders.

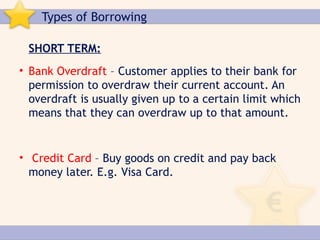

- Different types of borrowing including short, medium, and long term options.

- Rights and responsibilities of borrowers in the loan process.

- Information required by lenders when applying for a loan.

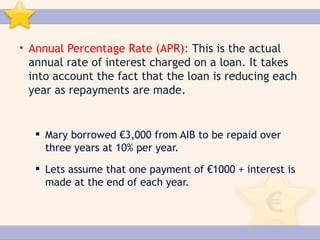

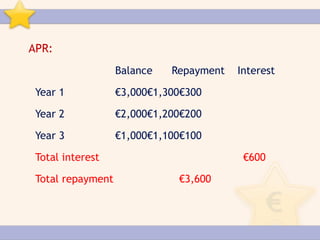

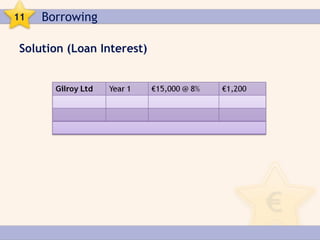

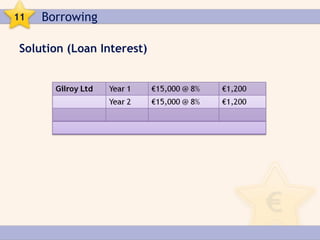

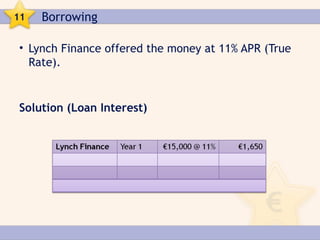

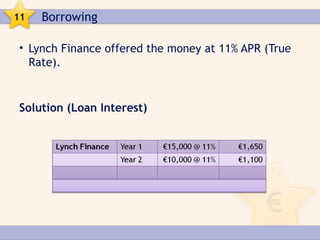

- How interest works on loans including flat rate interest and annual percentage rate calculations.