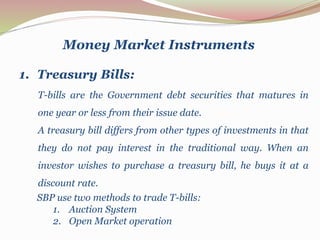

This document presents information about money market instruments. It begins with an introduction defining the money market as a financial market for short-term, highly liquid instruments. It then lists some key characteristics of money market instruments. The document proceeds to describe several types of popular money market instruments: Treasury bills, commercial paper, repurchase agreements, and banker's acceptances. It provides details on how Treasury bills are traded and the typical maturities of commercial paper, repurchase agreements, and banker's acceptances. The document concludes with a definition of the money market as a short-term market where liquidity and borrowing/lending occurs frequently, requiring constant awareness of changes.