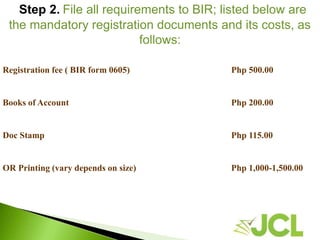

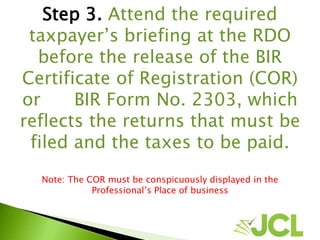

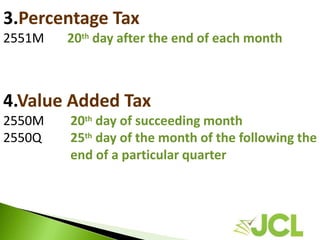

The document provides steps for professionals to properly register their business with the Bureau of Internal Revenue (BIR) in the Philippines. It outlines 6 steps for registration including securing requirements, filing documents, attending a briefing, applying for receipts, registering books of accounts, and updating information if needed. It also discusses bookkeeping, invoicing, and tax payment requirements for self-employed professionals.