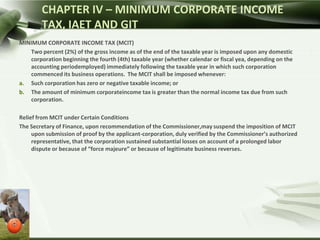

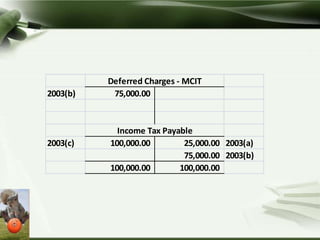

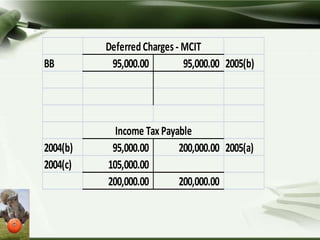

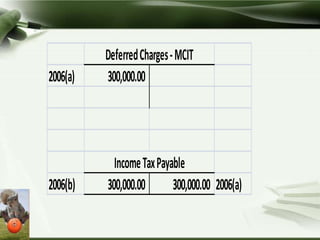

The document summarizes key aspects of minimum corporate income tax (MCIT), improperly accumulated earnings tax (IAET), and general information tax (GIT) in the Philippines. It explains that MCIT is 2% of gross income imposed on domestic corporations starting in their 4th tax year of operations if their taxable income is zero or negative, or if MCIT is greater than normal income tax. Any excess MCIT paid can be credited against normal income tax over the next 3 years. It provides examples of journal entries recording MCIT payments and credits over multiple years for a sample corporation.