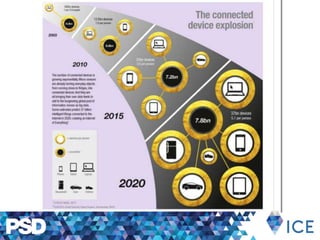

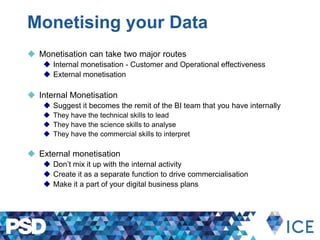

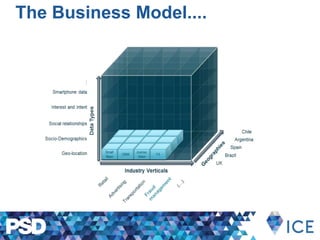

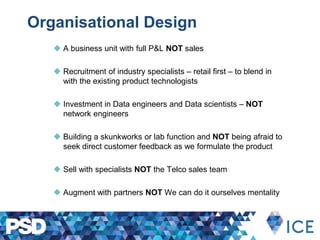

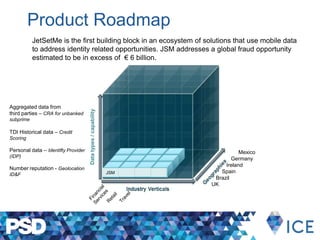

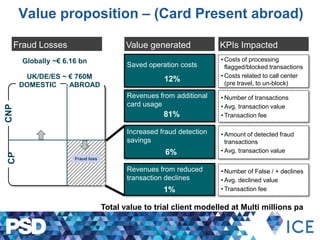

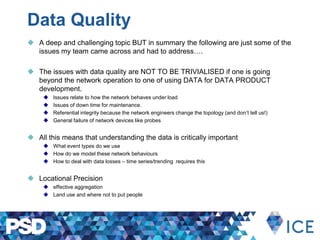

The document outlines the agenda and key discussions from a 2013 big data event held at the Royal Horseguards Hotel, led by Chris Eldridge and featuring guest speaker Mike Fishwick from Telefonica Digital. Key topics included monetizing big data, the transformation of Telefonica into an information company, and challenges related to data quality and privacy. The event emphasized the importance of internal and external monetization strategies and the role of specialized teams in driving data-related initiatives.