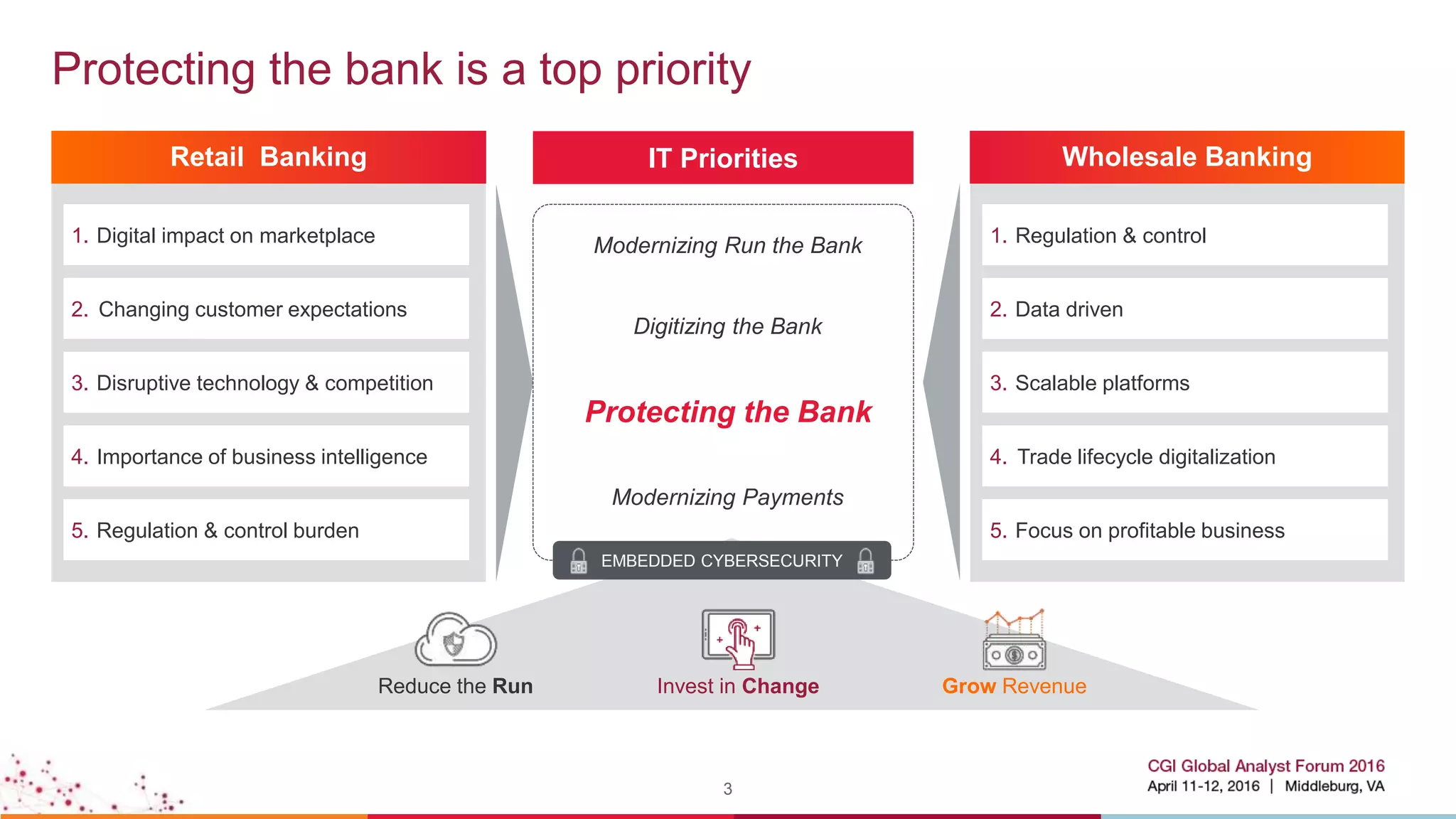

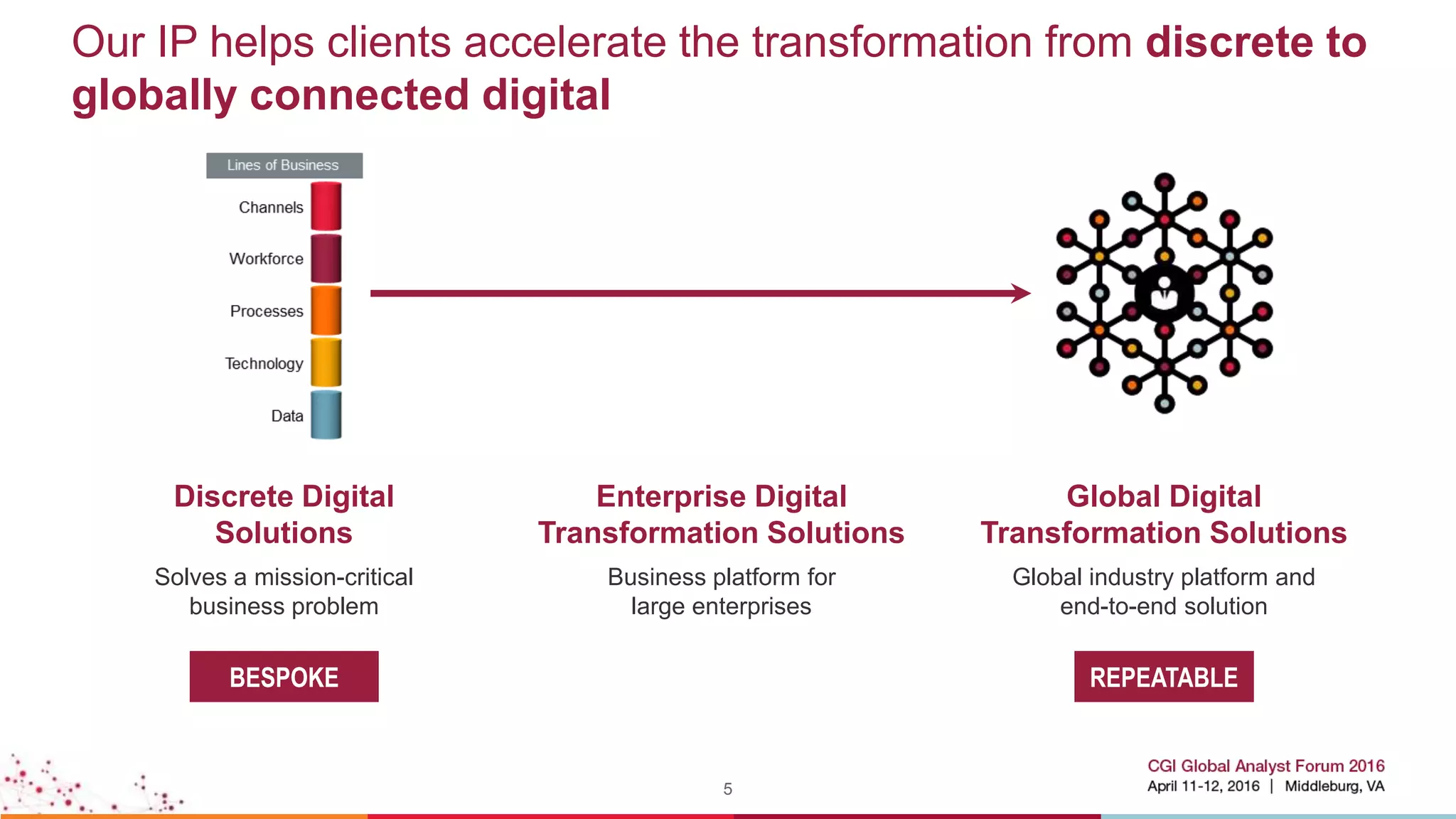

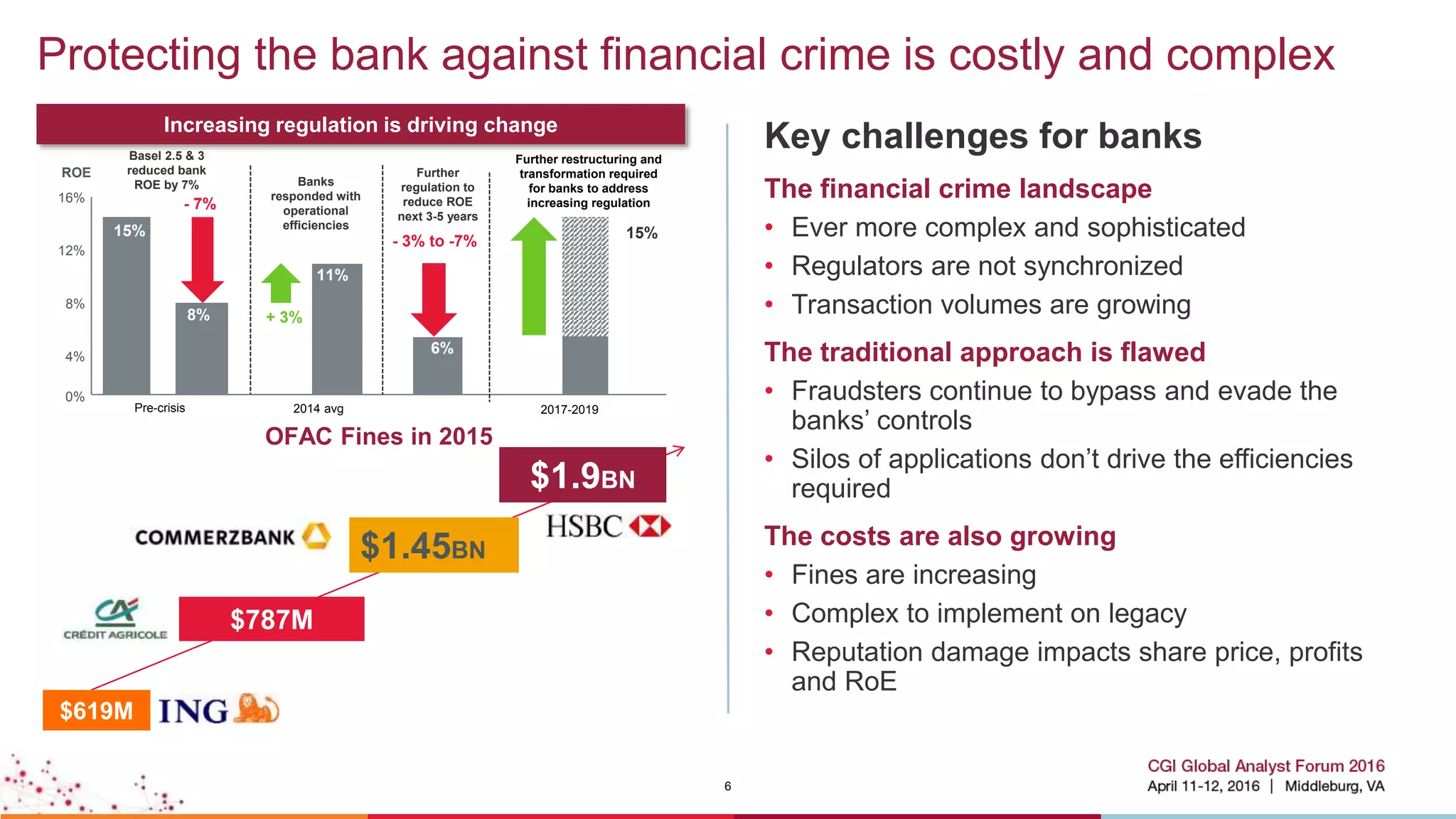

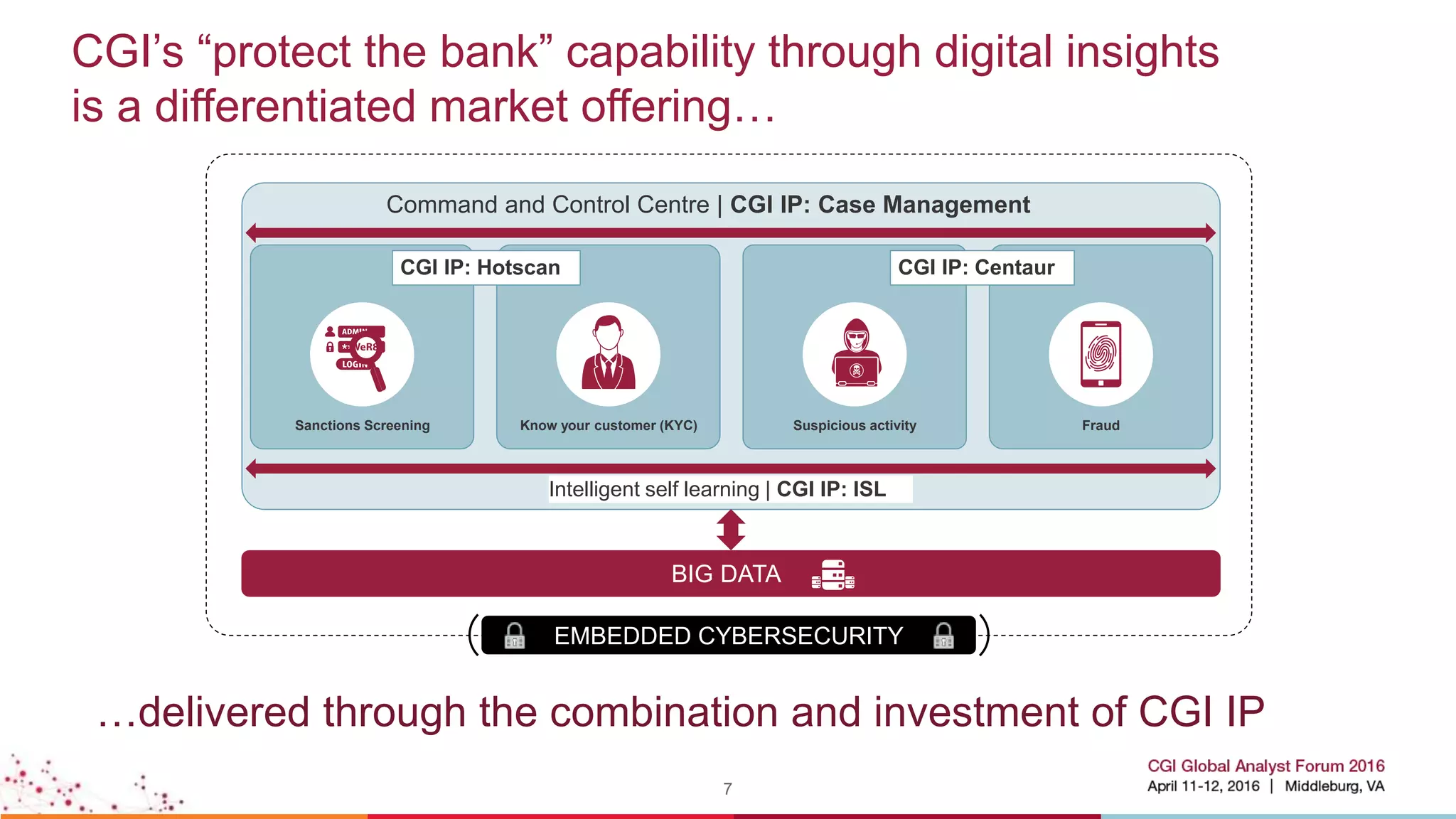

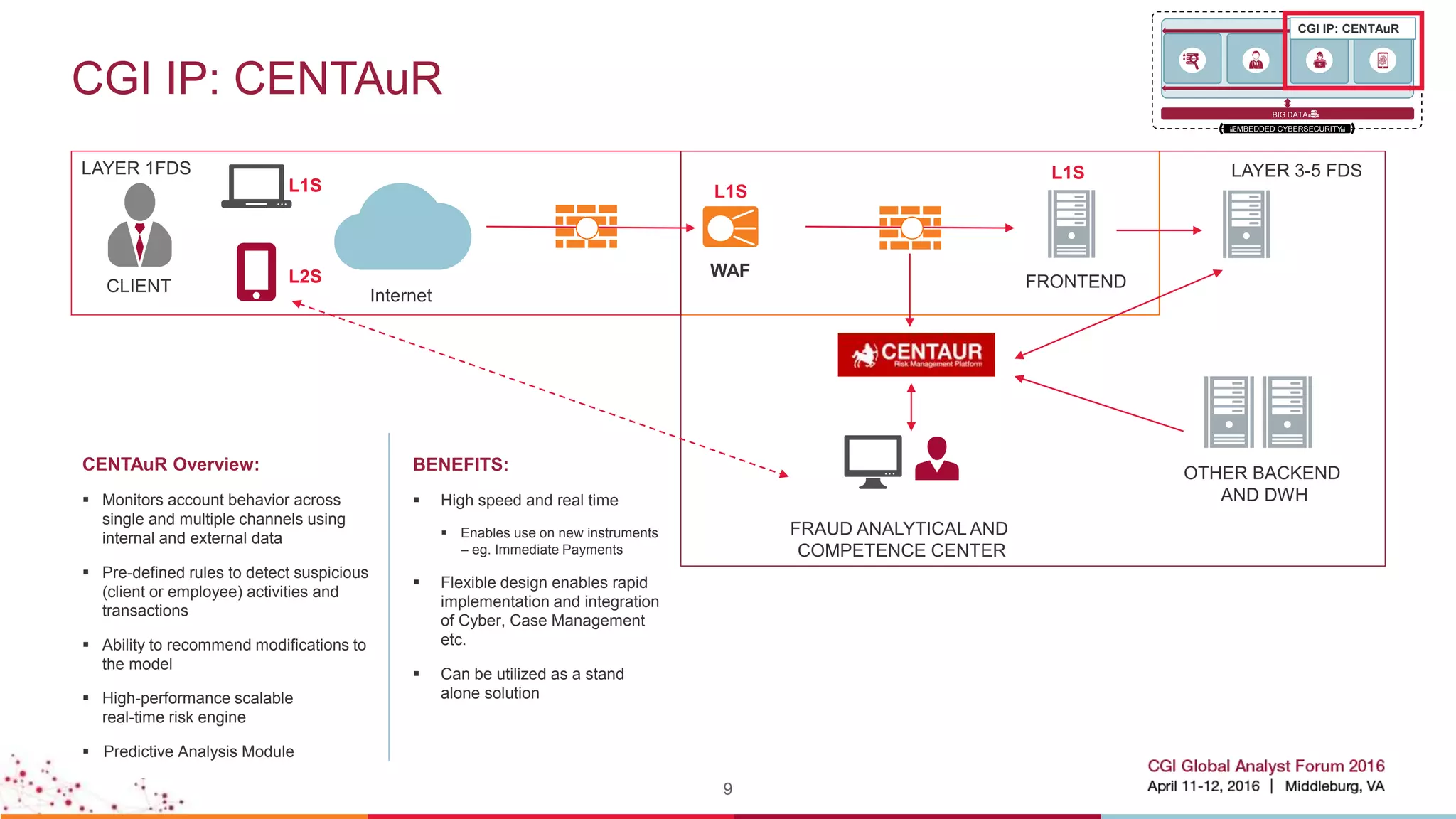

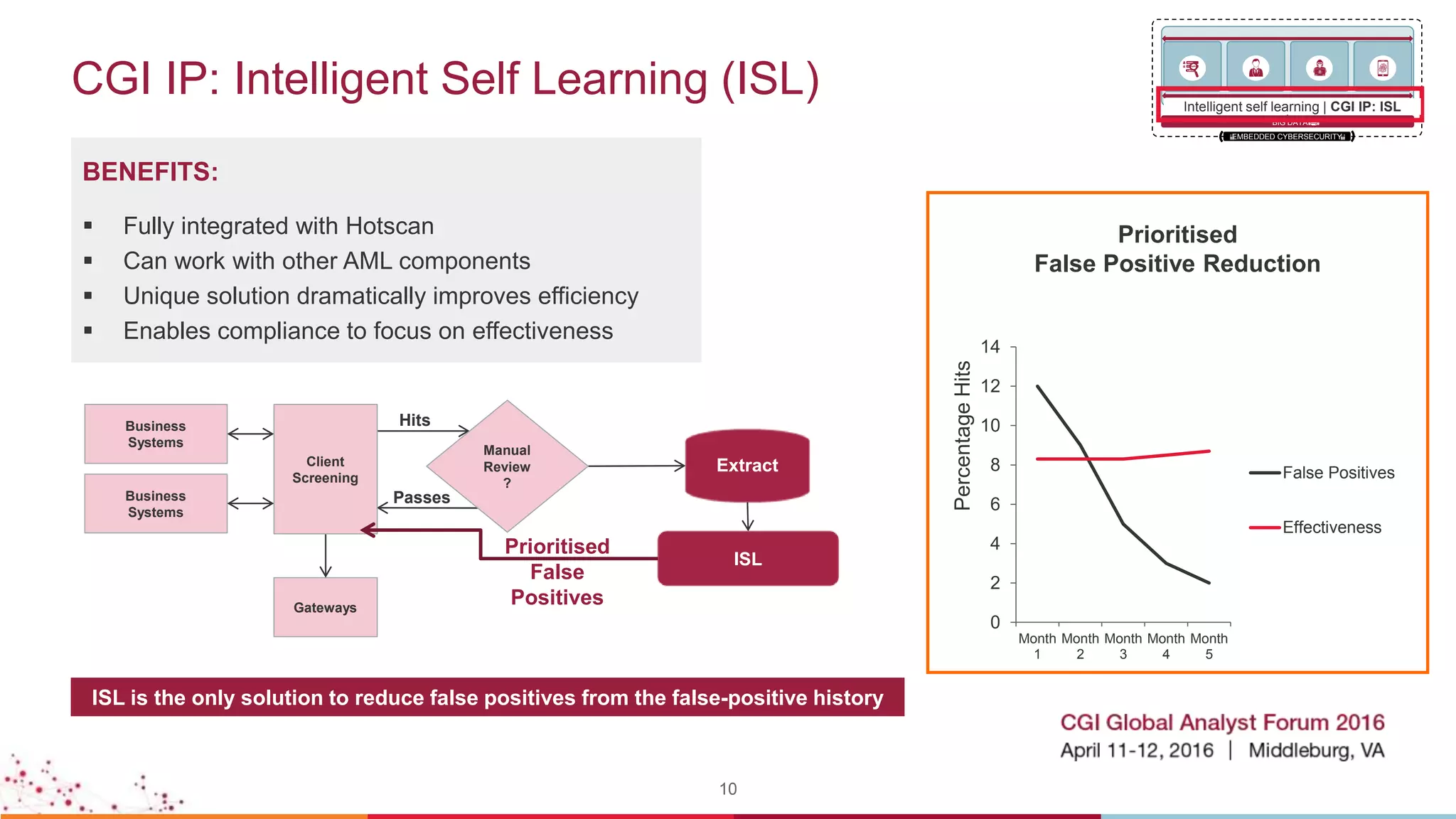

The document discusses key priorities and challenges in the banking industry, focusing on the importance of protecting banks from financial crime and regulatory pressures through digital transformation and advanced cybersecurity measures. It highlights CGI's solutions, such as intelligent self-learning systems and integrated cybersecurity, designed to enhance compliance, reduce false positives, and enable efficient transaction monitoring. The need for modernization and adaptability in response to disruptive technologies and changing customer expectations is emphasized as critical for future banking success.