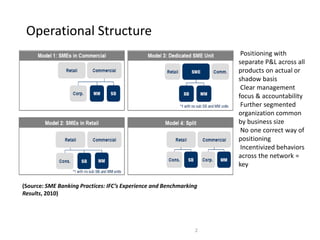

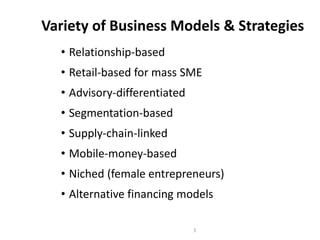

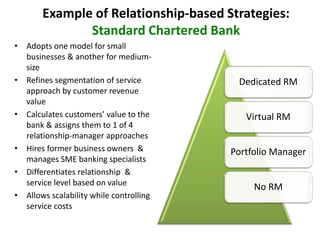

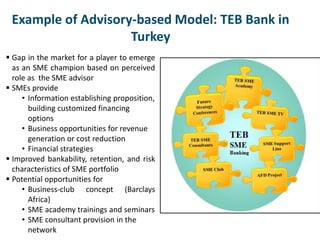

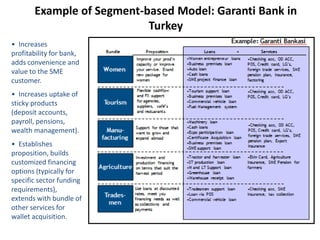

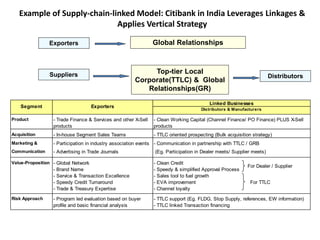

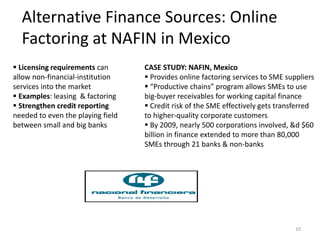

This document discusses various business models and strategies that banks use to effectively serve small and medium enterprises (SMEs). It provides examples of relationship-based strategies from Standard Chartered Bank and Wells Fargo, an advisory-based model from TEB Bank in Turkey, a segment-based model from Garanti Bank in Turkey, a niche model targeting women entrepreneurs, a supply-chain linked model from Citibank in India, and an alternative financing model using online factoring from NAFIN in Mexico. The models demonstrate different approaches to positioning, segmentation, products, and partnerships that banks employ to better meet the needs of SME customers.