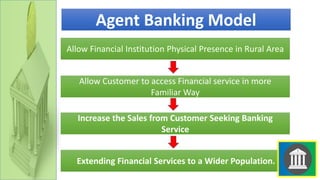

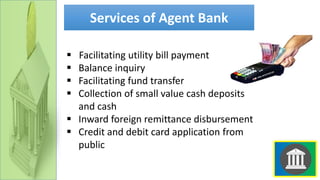

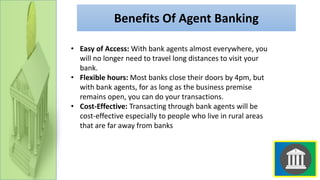

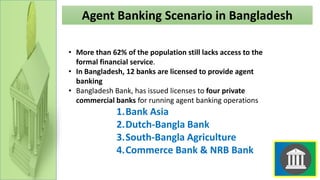

Agent banking allows banks to provide limited financial services through engaged agents to underserved populations under an agency agreement. It allows banks a physical presence in rural areas and lets customers access services in a familiar way, while increasing sales from new customers. Agent banking facilitates utility payments, balance inquiries, funds transfers, small deposits and cash withdrawals, remittances, and credit/debit card applications. It provides benefits like easy access, flexible hours, and lower costs compared to traveling long distances to visit a bank branch. In Bangladesh, 12 banks are licensed for agent banking and 4 private commercial banks have started operations, helping to provide over 62% of the population without formal access to financial services.