Embed presentation

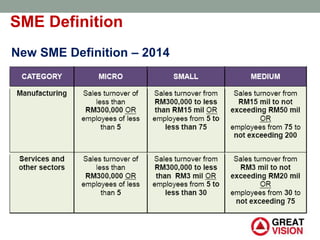

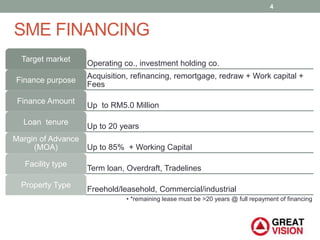

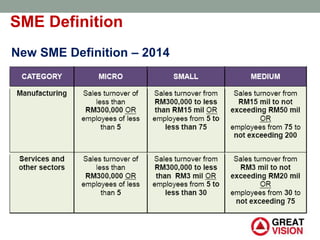

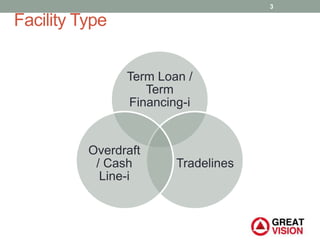

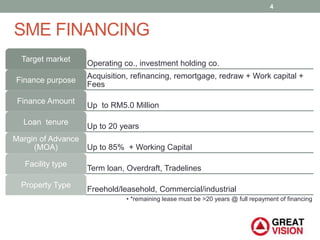

The document defines SME financing as loans provided to small and medium enterprises for working capital and asset acquisition purposes. Eligible SMEs include operating companies and investment holding companies. SME financing provides term loans, overdraft facilities, and tradelines up to RM5 million for purposes such as acquisitions, refinancing, working capital, with loan tenures up to 20 years and advance margins up to 85% of property value plus working capital needs. Eligible property types are freehold or leasehold commercial or industrial properties with remaining lease periods over 20 years.