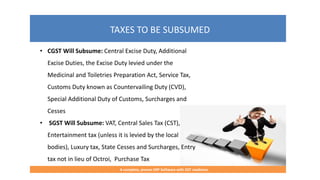

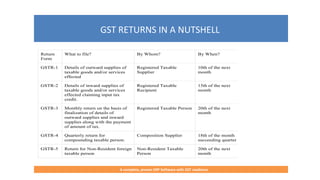

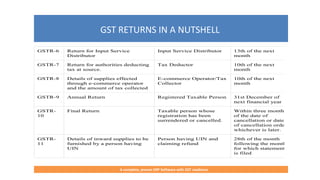

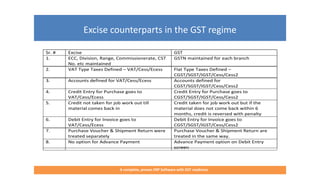

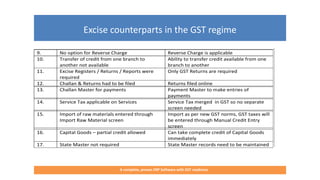

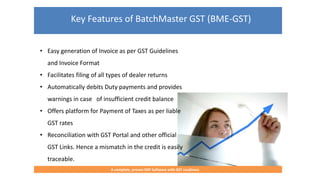

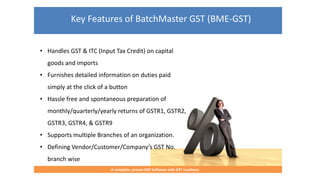

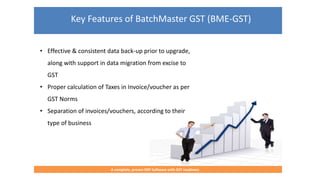

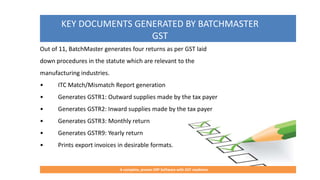

BatchMaster ERP is a comprehensive software for emerging formula-based manufacturers, featuring GST readiness and tools for managing complex taxation processes. It offers capabilities such as easy invoice generation, tax compliance, and support for multiple branches, aiding in transition to the GST system. The software streamlines GST returns and integrates with GST portals, ensuring accurate tax reporting and handling of input tax credits.